EUR flows: EUR gains on Ukraine look optimistic

EUR gains on the back of rising expectations of an end to the Ukraine war look optimistic

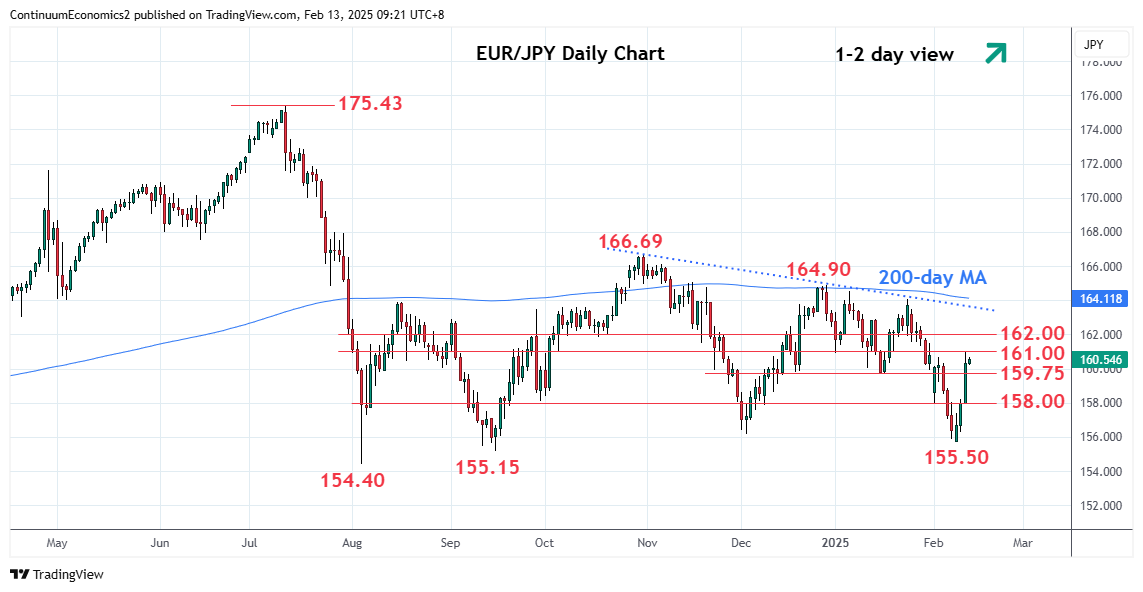

Most European currencies have gained across the board over the last 24 hours from the reports that Trump and Putin are negotiating an end to the Ukraine war. EUR/JPY and EUR/CHF have made particular gains, and European equity markets have generally benefited. The negotiations are at an early stage, so the precise character of any end to the war is unclear, but at this stage it looks as if any deal will be broadly Russia friendly with Ukrainian NATO membership ruled out and Russia keeping large chunks of territory. From a European perspective, it also looks like Trump is increasing the requirement for Europe to pay for security.

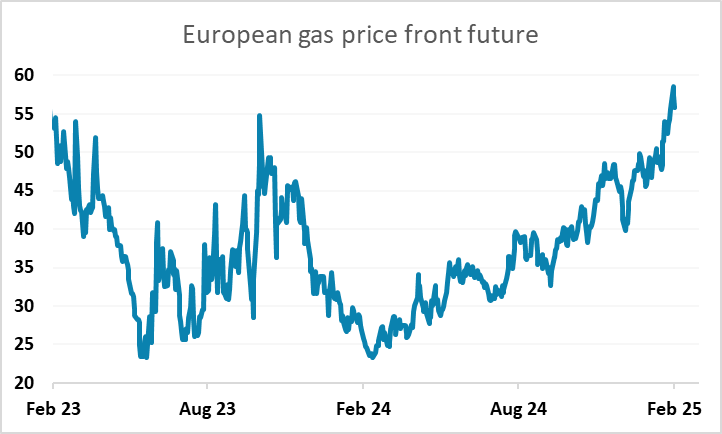

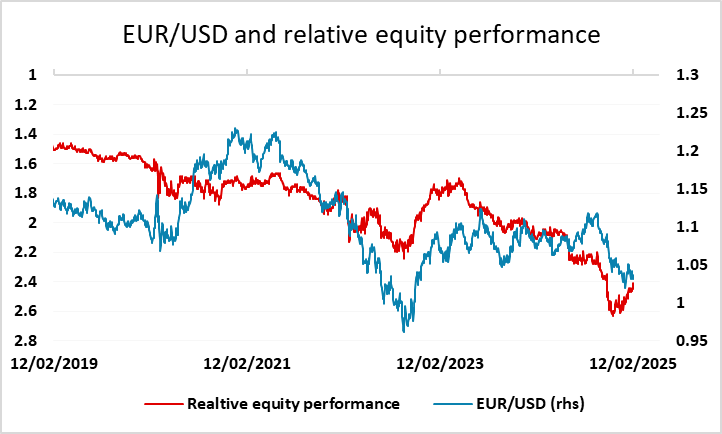

Even so, the European markets are seeing the news as positive, in part because of the hope of lower gas prices. Gas prices did drop around 5% yesterday, but are still high, even by the standards of the last two years, with the front future having reached a 2 year high on Monday. The gains in European equities yesterday were in part a response to Ukraine, but may also have been related to some switching from the US after the stronger than expected US CPI data and the rise in US yields. The resilience of equity markets in the face of rising yields is impressive, but valuations in the US are very high and there still looks to be very little upside for the US. European valuations are much more reasonable, but upside depends on European growth improving, which is far from a done deal.

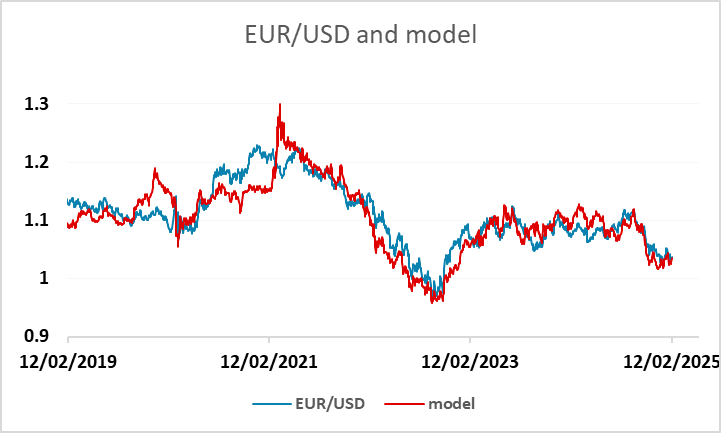

We are therefore a little sceptical of the EUR’s strength, at least in the short run. Equity gains might be hard to extend, and European yields could move lower if gas prices do fall. At this stage, gas prices haven’t fallen significantly at all and any Ukraine growth premium is unlikely to be felt for many months if not years. While the EUR may hold above 1.04 in the short term, progress to 1.05 and beyond is likely to require some clearer positive news on the Eurozone economy.