Canada July Employment - Anther subdued headline, mixed detail

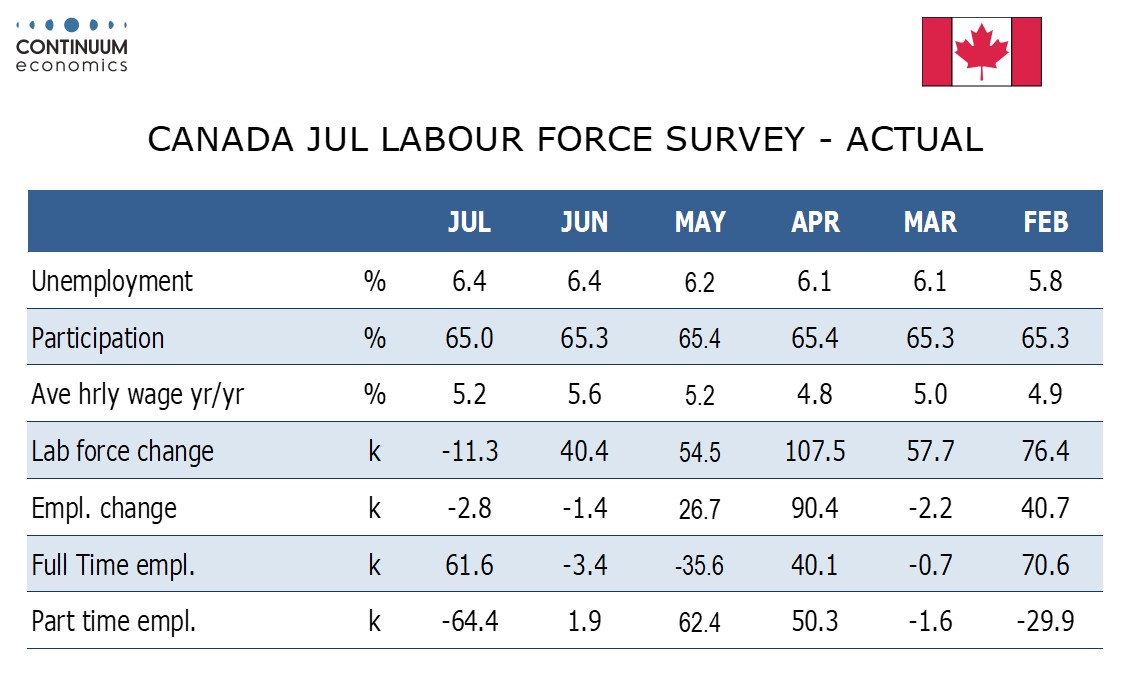

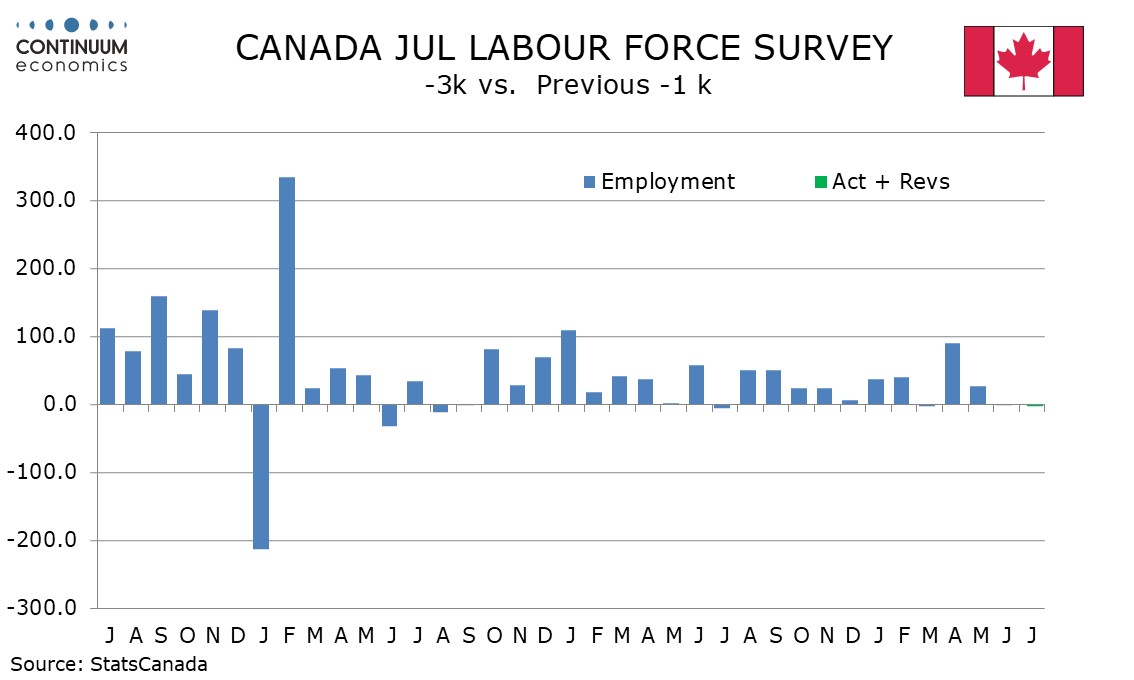

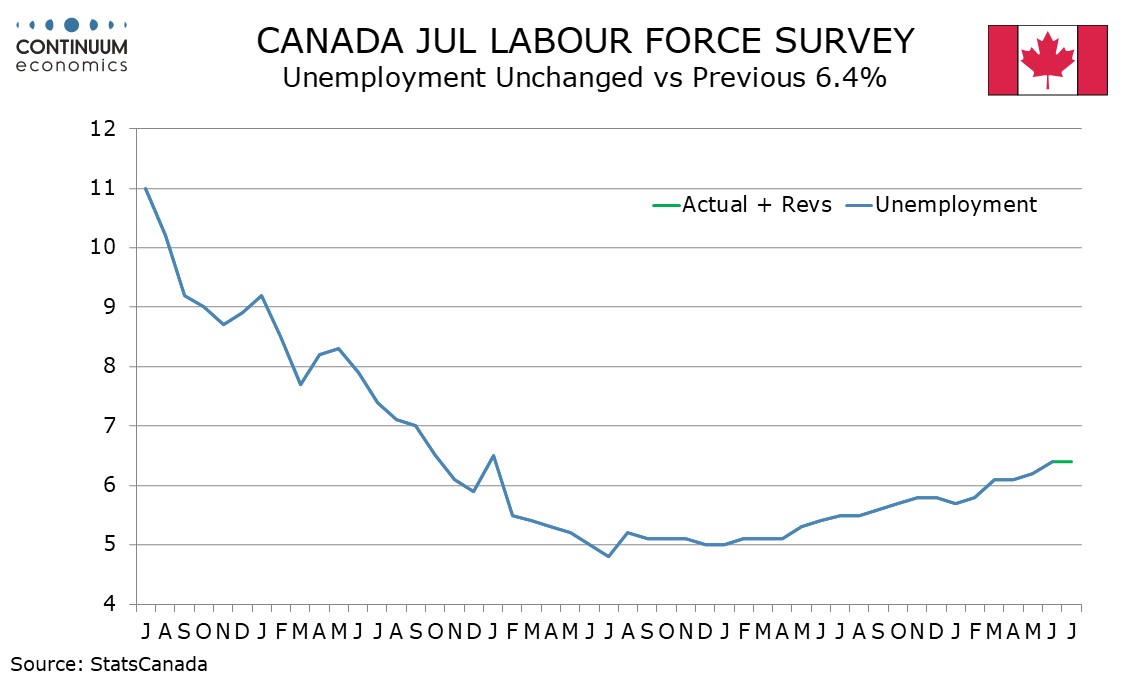

Canada’s July employment data is weak on the headline with a 2.8k decline but mixed in the detail with strong job growth from full time and public sector work, and unemployment unchanged at 6.4%. Wage growth slowed from an above trend June but remains quite strong. The data does not appear to be a major obstacle to a September BoC easing provided July CPI due on August 20 does not surprise on the upside.

The almost unchanged headline employment number looks similar to a 1.4k decline in June but the details are different. June also saw full time and part time employment little changed. July saw a strong 61.6k increase in full time employment offset by a 64.4k plunge in part time employment. Less positive in the July detail however is that the bulk of the job growth (40.8k) came in public sector work, with private sector employment weak with a 41.9k decline. Self-employment saw a strong month, up by 23k. Goods producing work was firm with a 12.1k rise despite a fall of 8.6k in manufacturing. Service producing fell by 18.8k, fully on a 44.1k drop in wholesale and retail. Public administration rose by 20k.

The unchanged unemployment rate of 6.4% was due to a fall of 11.3k in the labor force, its first decline since September 2022, and follows a rise in June in the rate from 6.2% in May. Unemployment has been trending higher since starting 2023 around 5.0% and continues to do so.

The average hourly wage rate of permanent employees rose by 5.2% yr/yr, returning to trend after a stronger 5.6% rise in June though trend remains quite high, and inconsistent with inflation returning to the 2.0% target. June’s above trend data appears to be inflated by June 2023 being below trend at 3.9% and July’s pace is back level with May’s 5.2%. Still 5.2% is stronger than seen in February, March or April, so there is no sign of slowing in trend, despite the rising trend in unemployment. This will be a concern for the BoC, but as long as unemployment is rising and inflation is falling, we would expect easing to continue.