Published: 2024-11-27T15:15:16.000Z

U.S. October Personal Income stronger, Spending and Core PCE Prices as expected

5

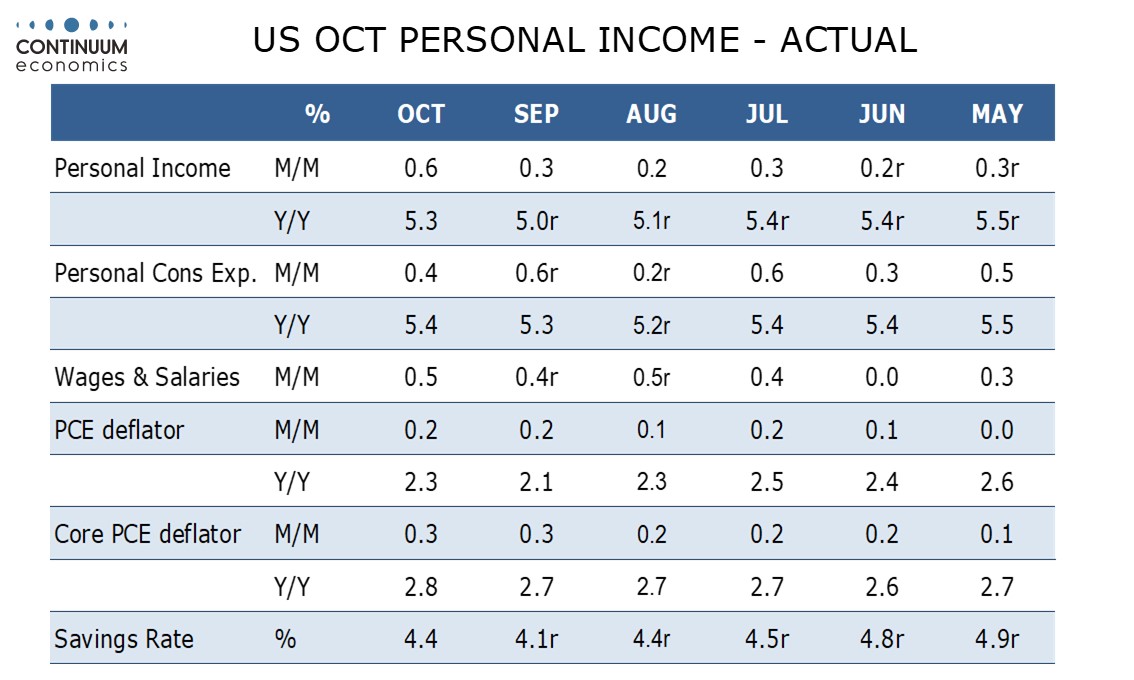

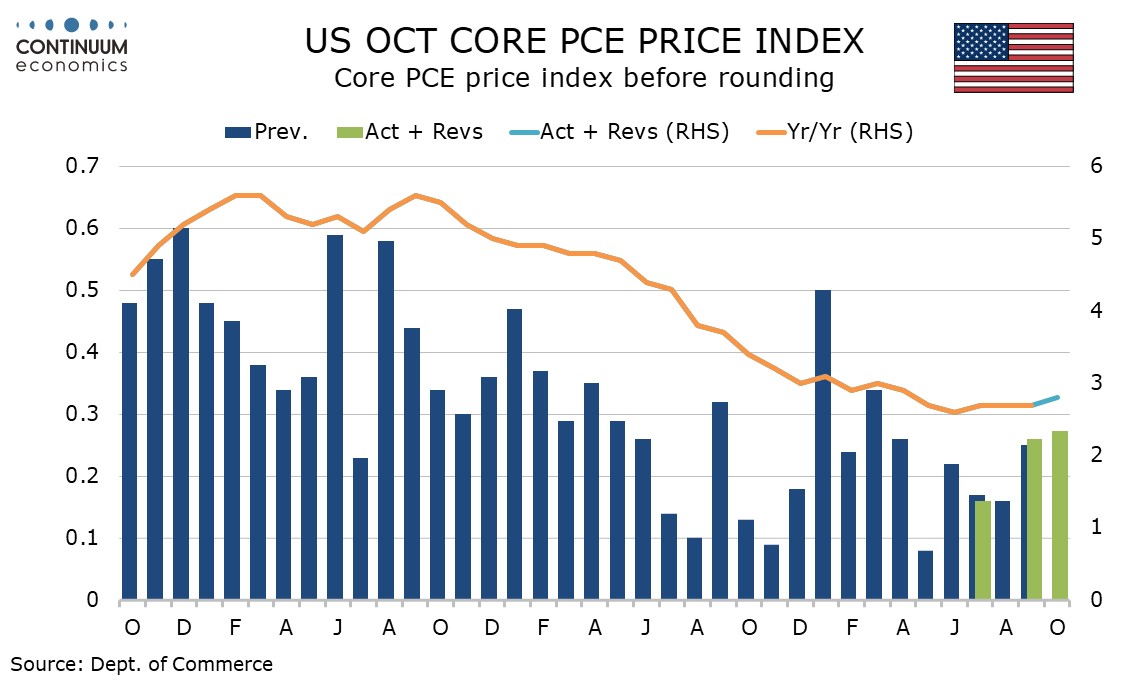

October PCE prices at 0.2% overall, 0.3% core, with yr/yr rates slightly firmer at 2.3% and 2.8% respectively are as expected and predicted by Fed’s Powell on November 14. The core rate at 0.27% before rounding is not quite as strong as the core CPI. The pace is a little higher than desirable, but will probably not generate any extra worries at the FOMC.

Personal income with a 0.6% increase is well above expectations. A 0.5% rise in wages and salaries was a little stronger than the non-farm payroll had implied but the main surprise was that the other components of personal income outperformed, with dividend and social security income particularly strong. Personal income saw negative revisions in Q2, as already seen in the GDP release.

A 0.4% increase in personal spending was in line with consensus, retail slightly underperforming the signals of retail sales data but services solid with a rise of 0.5%.