USD flows: USD up slightly after GDP

Market focusing on higher PCE deflator and solid domestic growth so US yields and the USD modestly higher

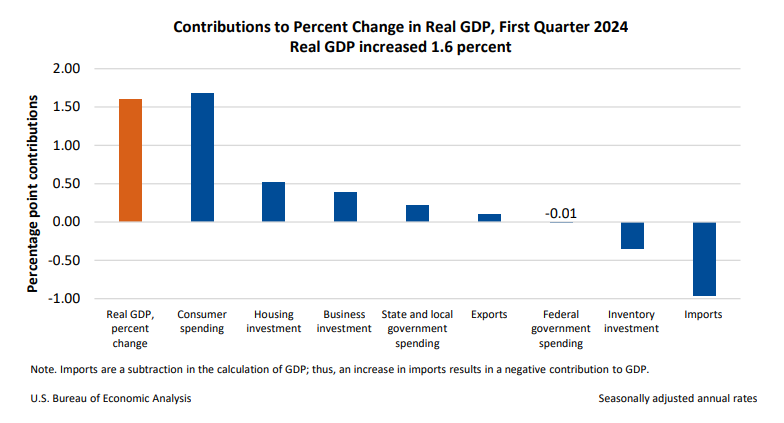

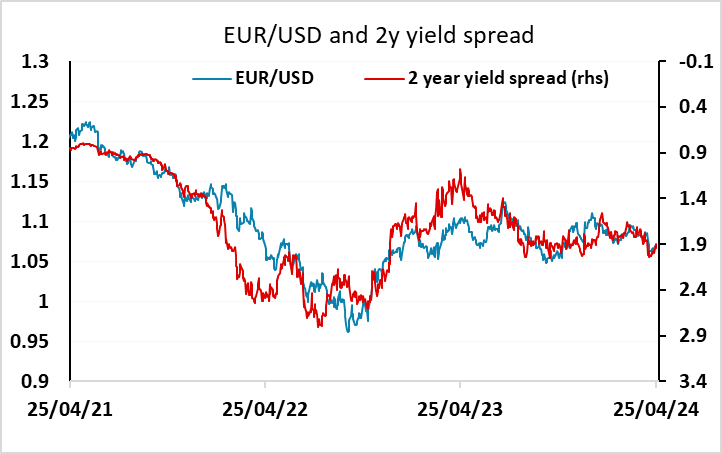

Although US Q1 GDP has come out on the weak side of expectations at 1.6% annualised against the 2.5% expected, the market is paying more attention to the strength of the PCE deflator at 3.7% against 3.4% expected. The fact that the downside miss was due to net exports and inventories with consumption and investment still strong also prevents the market from seeing the data as a reason for the Fed to ease. So US yields are slightly higher, but the USD is also net slightly higher, with the riskier currencies falling back as equities have fallen on the data. Certainly the higher PCE deflator makes it hard to see the Fed seeing the data as a reason to ease.

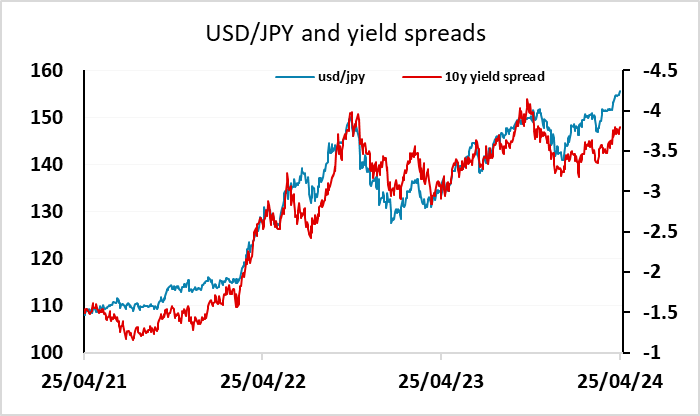

However, the weakness of net exports cannot be completely disregarded. The strong USD may be starting to take its toll, in which case this might become a factor arguing for a lower USD, particularly against the surplus countries. However, it’s a bit early to be making this conclusion, but if the USD’s strength does start to be seen as a growth problem, it could become an election issue, in which case the case for USD declines against the JPY in particular will become clearer. For now, though, the USD/JPY reaction is likely to be modest and the JPY will be more focused on tomorrow’s BoJ meeting, while the USD gains elsewhere are also unlikely to go too far as the rise in US yields on the data is quite small and shouldn’t have a big impact on equities.