JPY, EUR flows: JPY up on BoJ talk, EUR may gain support from German trade data

A Jiji press report that some BoJ members will support the case for an exit from NIRP in March has booisted the JPY in early trade. EUR may get some benefit from record German trade surplus.

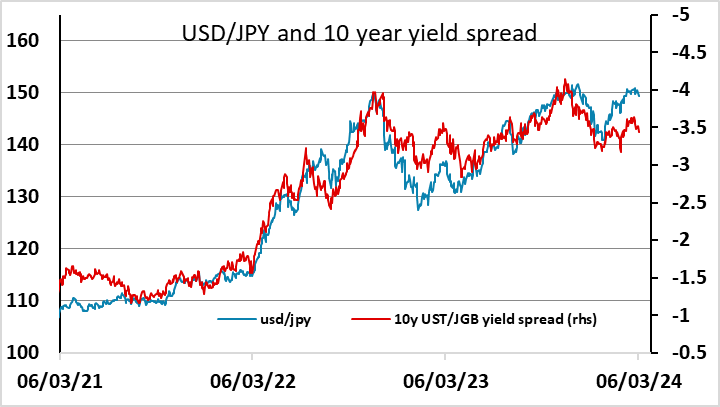

The JPY has opened the European session strong on a Jiji press report that some BoJ members will say exiting the NIRP at the March meeting is “reasonable”. This doesn’t mean it will happen; Ueda’s recent comments suggests he will want to wait for more evidence form the spring wage negotiations. But the JPY was already stronger overnight, and yield spreads already suggest scope for JPY gains, so this report is pushing on an open door for a stronger JPY. It is still a struggle for the JPY to make gains on the crosses in a risk positive environment, but there should be scope for USD/JPY to test below 149.

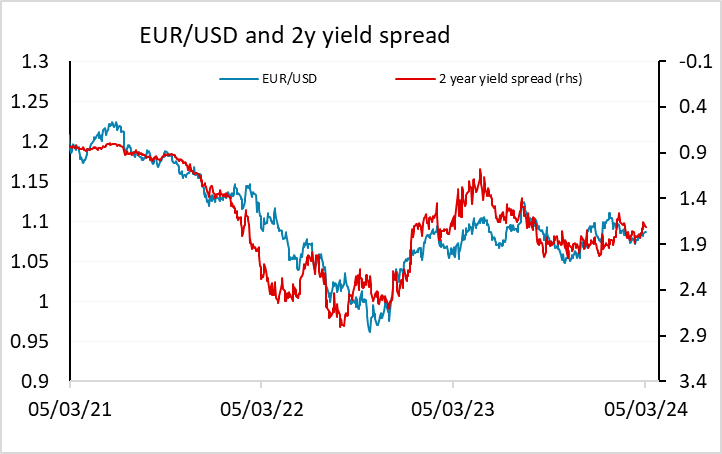

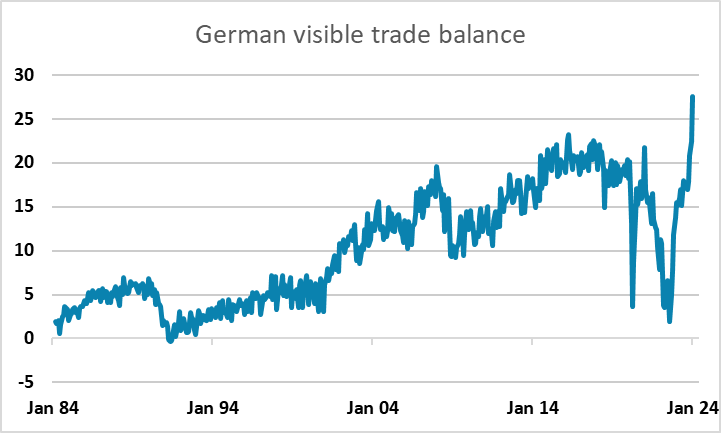

Elsewhere, this morning saw some unusually positive, albeit minor, German data with the January trade numbers showing strong rises in both exports and imports, with exports outperforming, and the trade surplus hitting a record high. While trade balances are not seen as a big factor for FX in the short run, part of the USD strength in recent years has been related to the rise in energy prices and the consequent deterioration in energy importers trade positions. This has now largely reversed, and provides a supportive case for the EUR and the JPY. Scope for EUR/USD to edge up towards the range top at 1.09.