FX Daily Strategy: Europe, July 25th

Focus on US Q2 GDP

Growth to stay sub-trend, but limited impact seen

European surveys may weigh on EUR

SEK weakness starting to look stretched

Focus on US Q2 GDP

Growth to stay sub-trend, but limited impact seen

European surveys may weigh on EUR

SEK weakness starting to look stretched

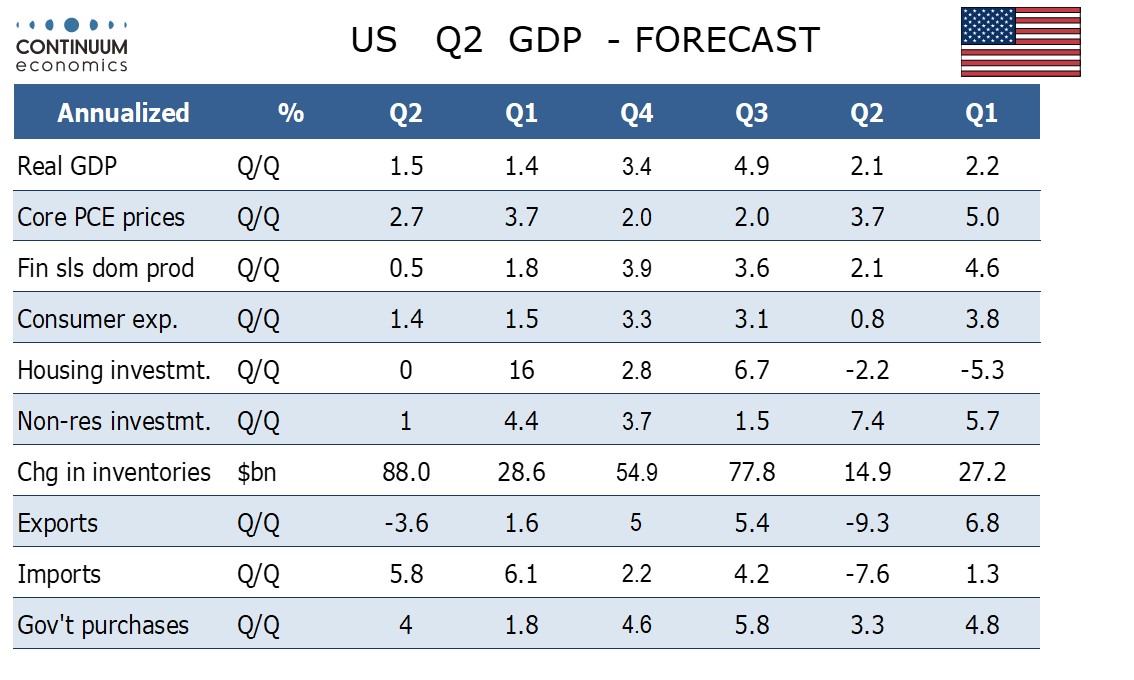

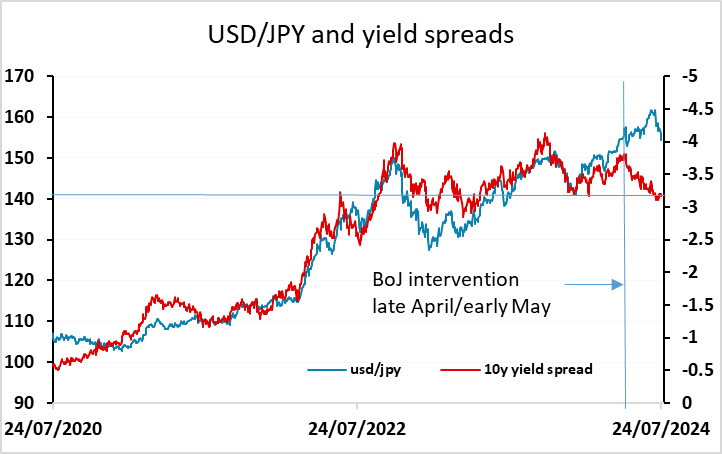

US Q2 GDP will be the main focus on Thursday. Our forecast is slightly below market consensus at 1.8% q/q annualised (consensus 2.0%), but in line with the consensus for the core PCE deflator at 2.7% annualised. The first two quarters of 2024 are set to be the weakest since the first two quarters of 2022 recorded modest declines. Q1’s weaker growth was downplayed due to the slowdown coming mostly from inventories and net exports, with final sales to domestic buyers (GDP less inventories and net exports) rising by a respectable 2.4%. In Q2 we expect a modest slowing in final sales to domestic buyers, to 2.0%. All in all, our forecast is similar enough to consensus to suggest there won’t be much of a USD reaction. The softer USD tone on Wednesday against the European currencies looks a little overdone given the relative strength of the US S&P PMIs, so there may be scope for a USD recovery in those pairs. There is less reason to expect a USD recovery against the JPY with yield spreads still pointing substantially lower and USD/JPY valuation still extremely high.

Before the US data there are the second round of European surveys in the form of the French INSEE survey and the German IFO survey. These have been more consistent with the PMI surveys than the US ISM has with the US PMIs, so it is unlikely there will be any major surprises. However, after the weaker than expected German PMI, the published consensus of a small recovery in the IFO business climate index is likely too optimistic. The market is no doubt aware of this, but the firmness of EUR/USD through the European afternoon on Tuesday looked overdone and may suffer a correction if the IFO survey is on the soft side. However, there is also Eurozone money data due and this looks likely to show a slightly stronger tone, so we wouldn’t see too much EUR downside.

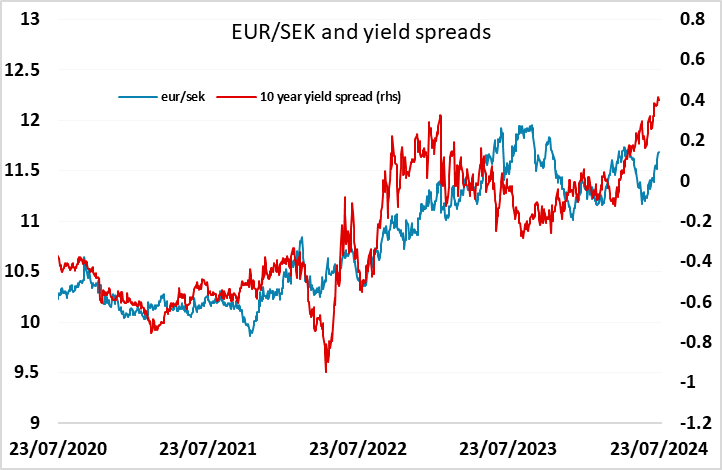

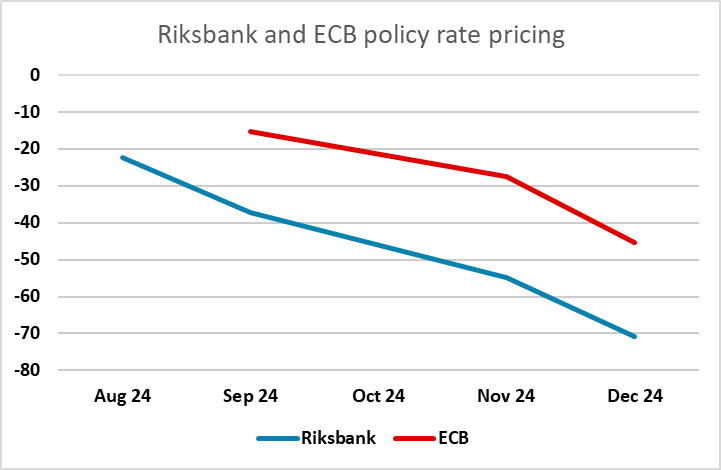

There may also be interest in the Swedish data given the steady rise of EUR/SEK through the last month, with PPI and money data both out. The rise in EUR/SEK is in line with the move in yield spreads in favour of the EUR over the period, so is hard to oppose, but the market looks to be pricing in too much Riksbank easing relative to ECB easing, so we would be wary of assuming further significant SEK losses.