U.S. Initial Claims low, Philly Fed and Empire State surveys stronger at the start of 2026

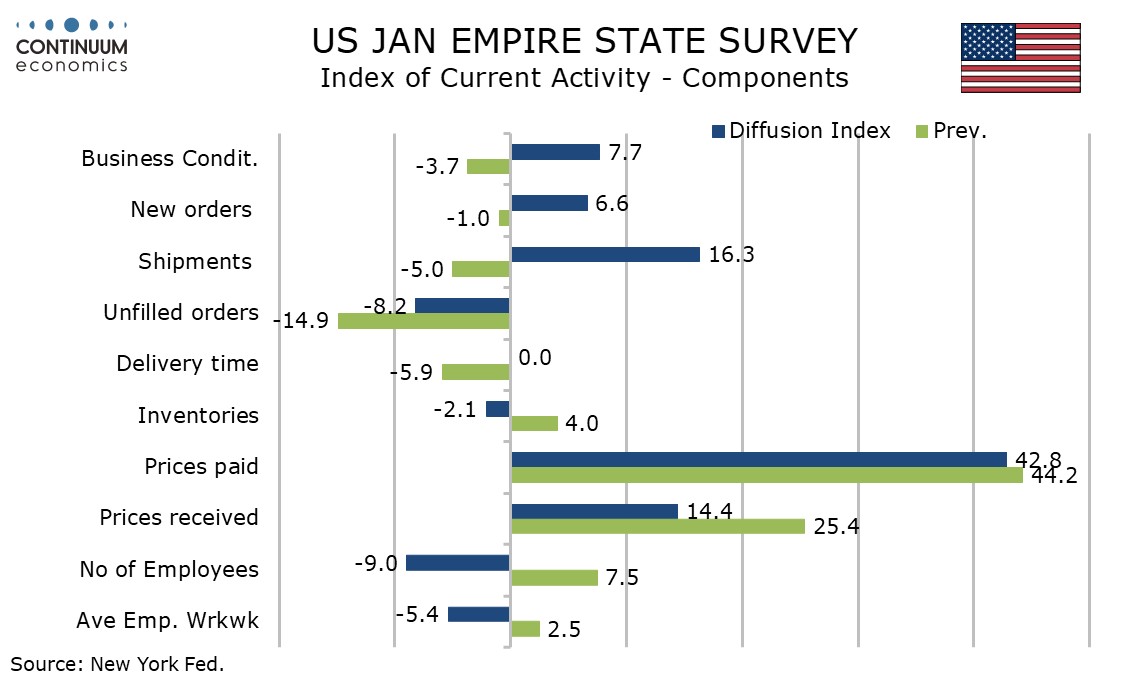

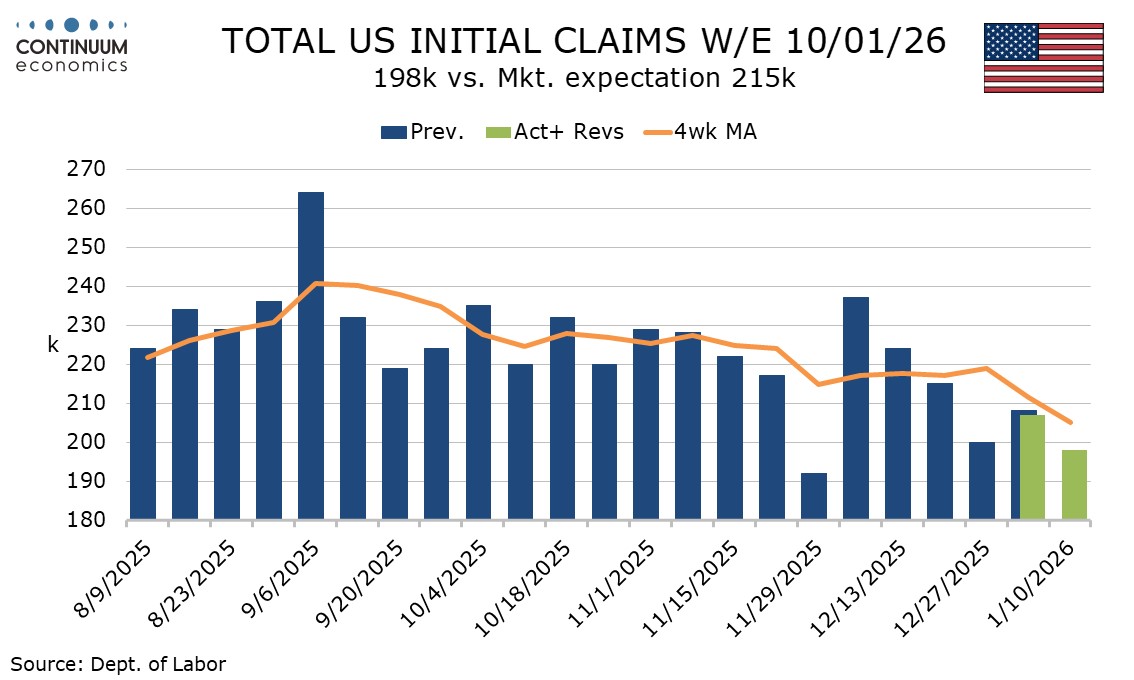

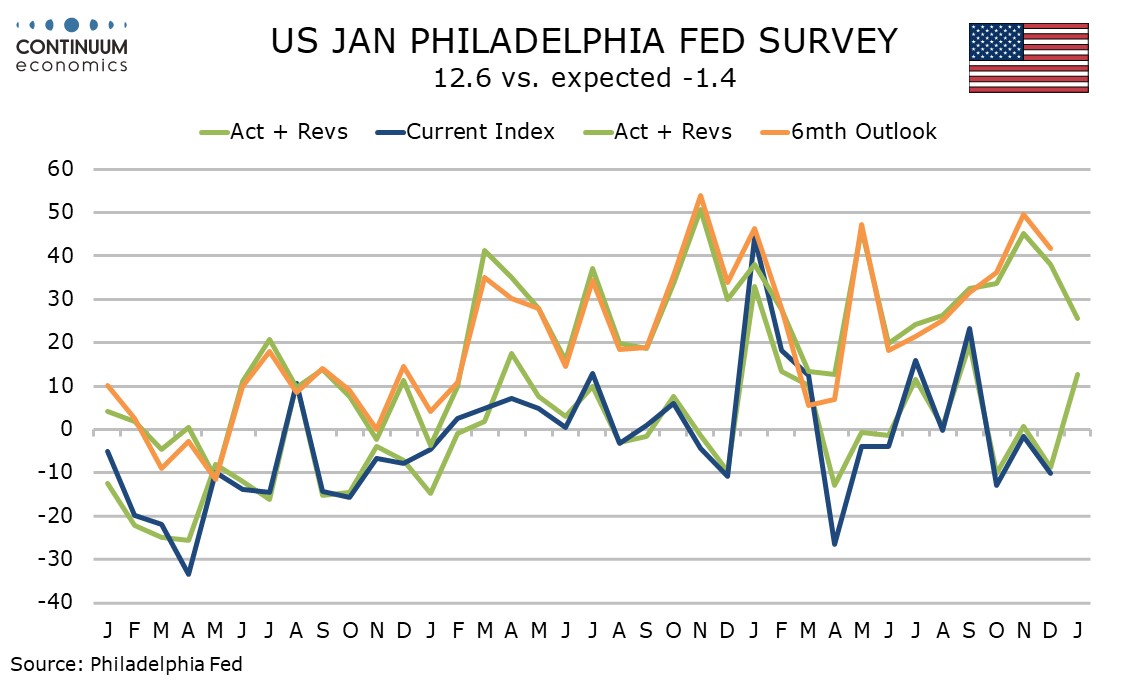

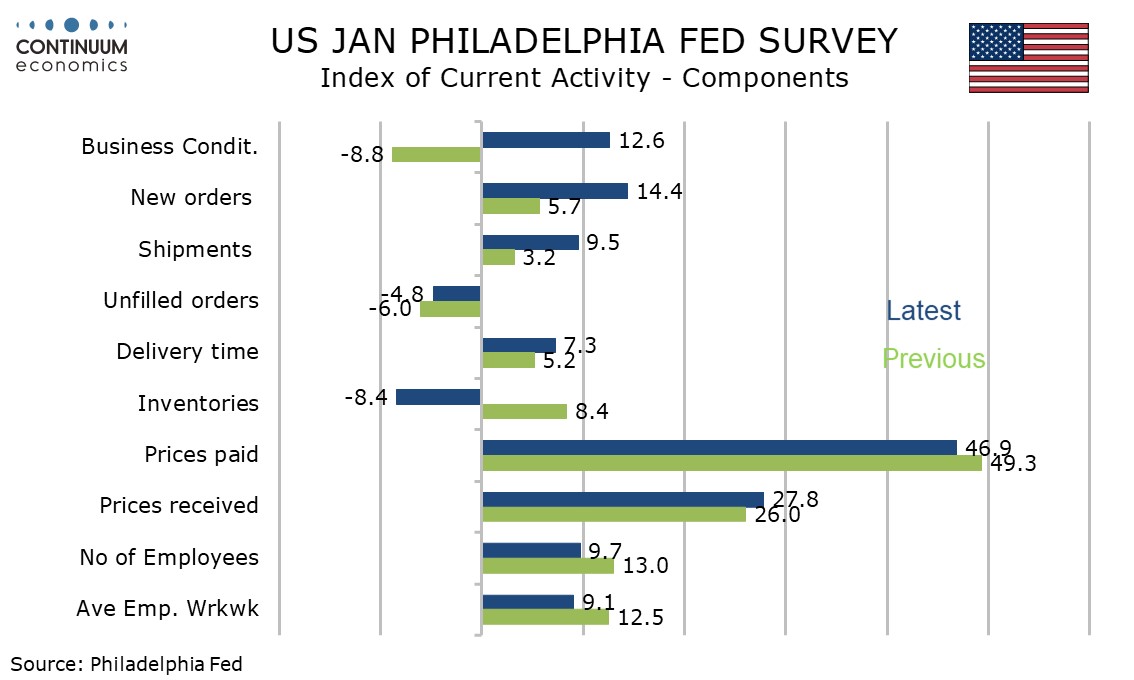

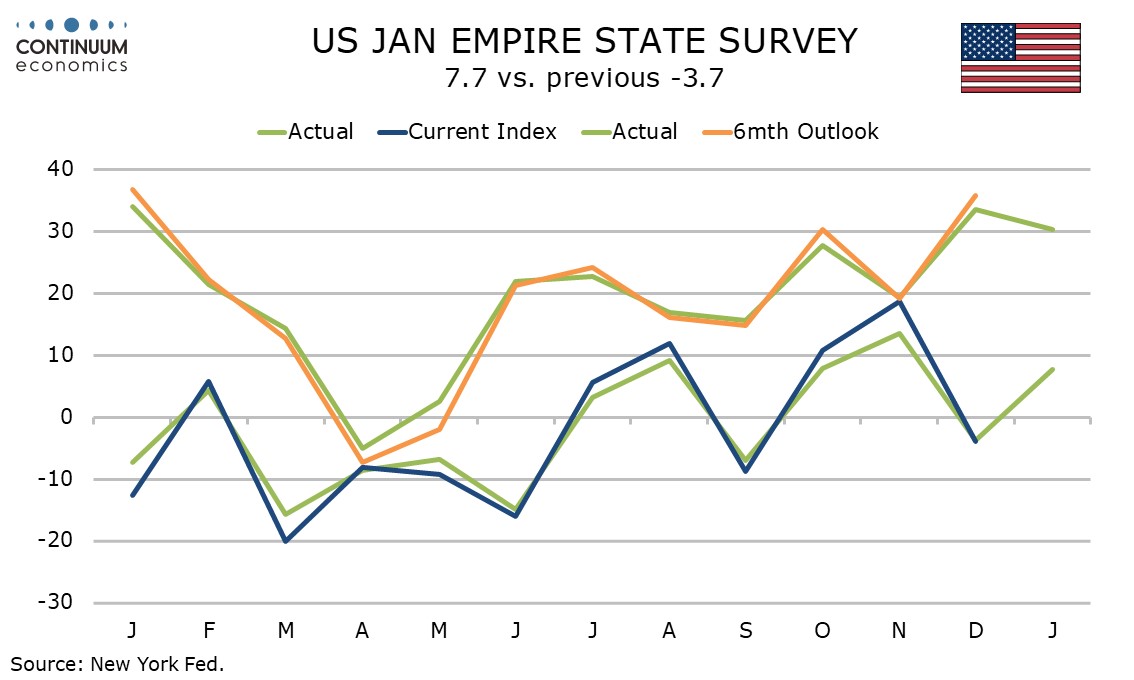

The latest US data suggests a stronger start to 2026, with initial jobless claims very low at 198k from 207k in a week not including a holiday and is thus less prone to a surprise, and also positive manufacturing surveys from the Empire State at 7.7 and the Philly Fed at 12.6, both contrasting negative outcomes of -3.7 and -8.8 respectively in December.

Initial claims at 198k are down from 207k in the preceding week that included the New Year holiday. Holiday weeks have been prone to volatility with Christmas week low at 200k, Thanksgiving week lower still at 192k, but Labor Day week sharply above trend at 264k. Non-seasonally adjusted initial claims are however quite high, up by 32k to 331k, so some may still argue seasonal adjustment issues, but the 4-week average is the lowest since January 2024.

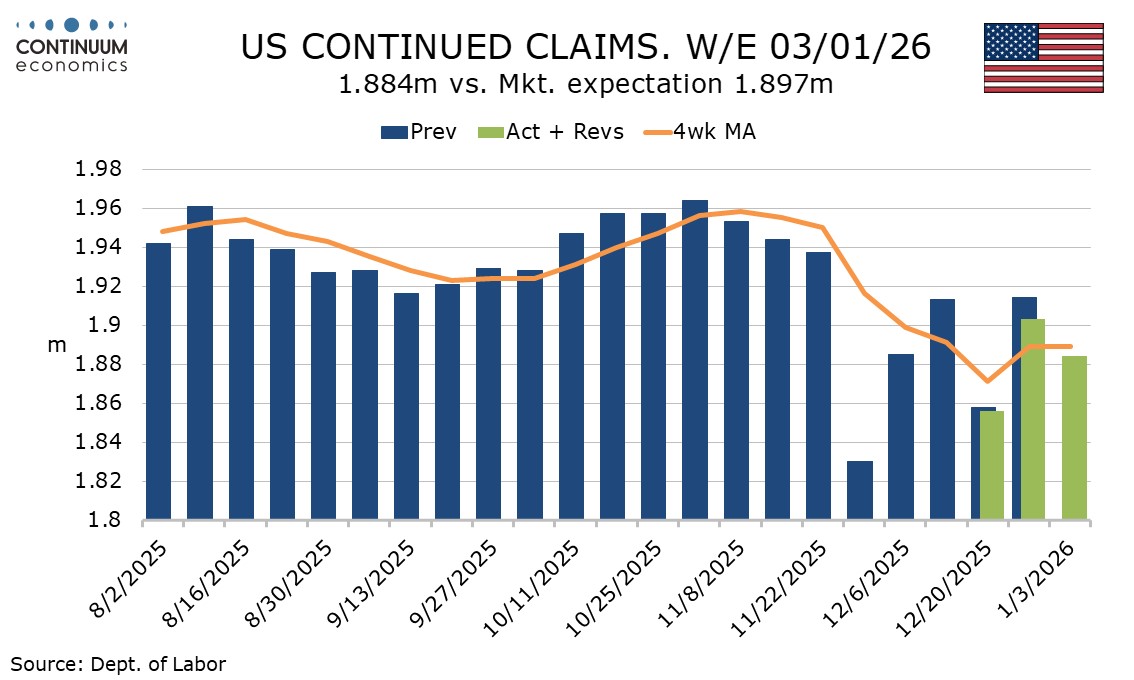

Continued claims cover the week before initial claims, and thus the latest fall, by a modest 19k to 1.884m covers the New Year week. The fall does not fully reverse last week’s 47k rise.

Both the Philly Fed and Empire Sate surveys are volatile and should be treated with some caution, though both moving in the same direction adds credibility to the data. The Philly Fed breakdown shows a bounce in new orders but slightly less positive employment and workweek indices, while 6-month expectations for activity at 28.5 from 38.1 are the slowest since July.

Price indices are little changed on a one month view and for 6-month prices paid, but 6-month prices received expectations at 61.8 from 57.2 are at their highest since September.

In the Empire State breakdown new orders also turned positive but employment and the workweek actually turned negative. 6-month expectations did slip, but at 30.3 from 33.5 are still stronger than every month from February through November.

All four price indices in the Empire State breakdown slipped, but prices paid at 42.8 are the slowest since March and prices received at 11.4 from 25.4 and are the lowest since January. 6-month prices paid at 52.6 and prices received at 36.5 are both at their lowest since December 2024.