USD flows: USD a little softer after housing starts

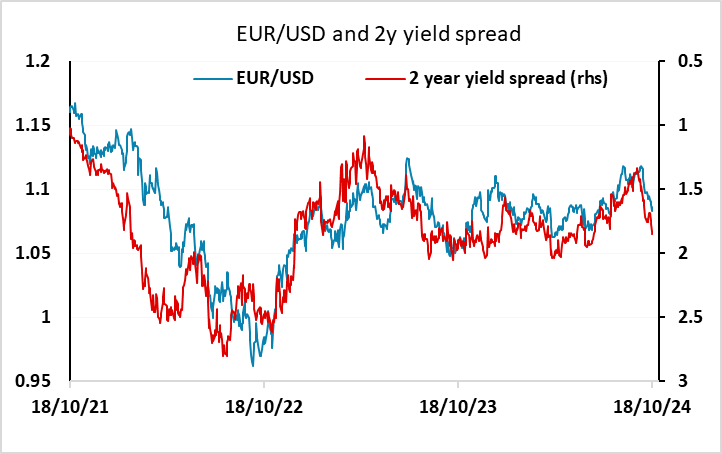

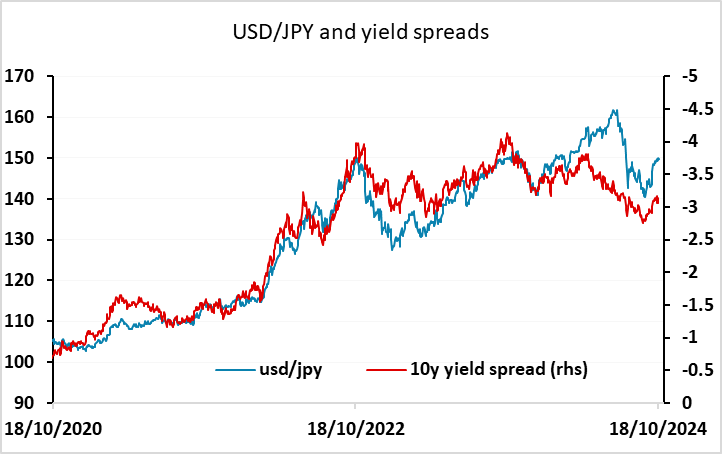

USD dips slightly after housing starts. EUR/USD still looks biased lower but USD/JPY stretched near 150.

The USD has edged a little lower after the housing starts data, even though starts were slightly stronger than consensus, perhaps because permits were weaker than expected, and starts were expected to be somewhat impacted by weather. There isn’t a lot on the calendar for the rest of the day, although there are speeches from FOMC members Bostic and Kashkari which might impact market expectations for the next couple of meetings.

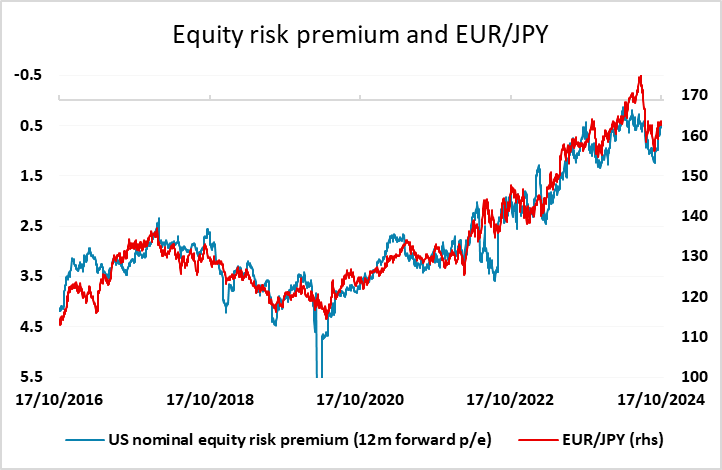

EUR/USD still looks biased lower given the recent move in short term yield spreads, but USD/JPY continues to looks stretched near 150. This suggests downside risks for EUR/JPY, but EUR/JPY continues to be supported by the strength of the equity market and the low level of equity risk premia. Even so, sooner or later we would expect an equity market correction which will push EUR/JPY lower.