FX Daily Strategy: APAC, July 12th

US PPI watched in follow up to CPI

JPY has the most potential for volatility

SEK at risk on CPI

US PPI watched in follow up to CPI

JPY has the most potential for volatility

SEK at risk on CPI

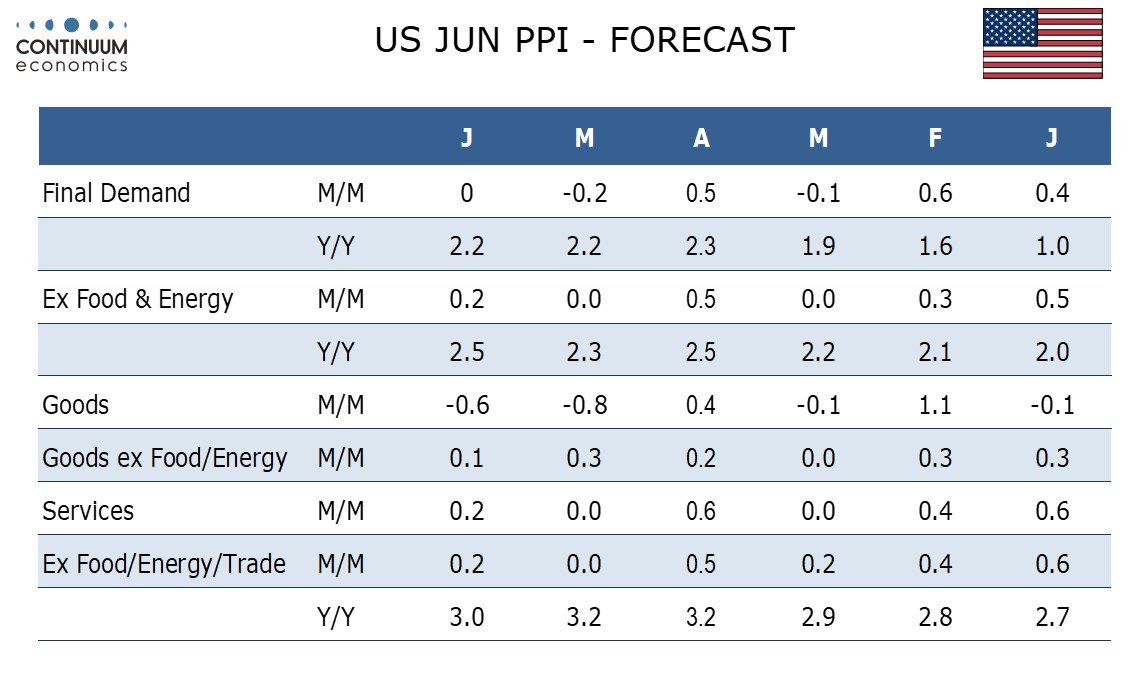

Friday sees US PPI to follow up on the CPI on Thursday, and before that we have Swedish CPI, which could be important given the sharp decline in the NOK that we have seen this week after the weaker than expected Norwegian June CPI. We expect a subdued June PPI, unchanged overall with a 0.2% increase in the core rates ex food and energy and ex food, energy and trade. However the data will be not quite as soft as seen in May, which corrected from a stronger April.

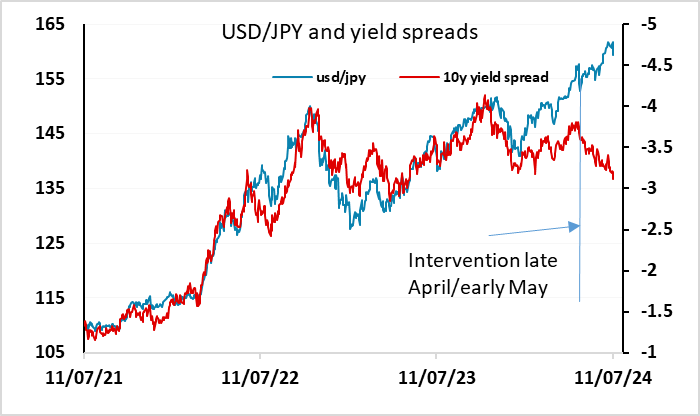

The biggest focus will be on the JPY after the big rise on Thursday following the US data. USD/JPY fell more than 3 figures from high to low, wiping out most of the gains of the last month, while EUR/JPY also lost around 3 figures, returning it to the levels seen at the beginning of July. There is no evidence of intervention, and the JPY move looks more likely to have been driven by stop losses being hit than by official action. It is still very much in the balance where it gores from here. Some may see this as a JPY buying opportunity, as we have had several sharp corrections in the long JPY downtrend we have seen in the last few years without any of them resulting in a proper trend reversal. Others may point to the fact that the fundamental drivers of JPY weakness in the last few years are no longer supporting the JPY bears, with yield spreads moving in the JPY’s favour and USD/JPY and EUR/JPY already a long way above the levels suggested by current yield spreads. We favour the latter case, but some weakening in risk appetite may be necessary to secure any longer term JPY gains.

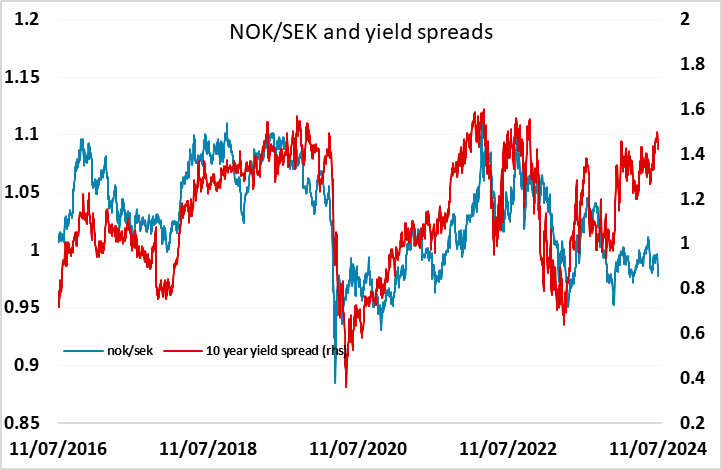

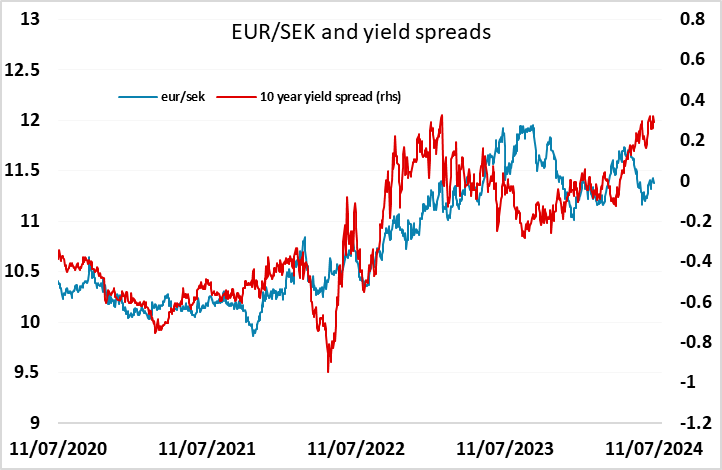

The SEK looks vulnerable to weaker CPI data, after the sharp decline in the NOK seen this week following the weaker than expected Norwegian CPI. Yield spreads are already pointing higher for both EUR/SEK and NOK/SEK, and the risks of a weaker CPI number have increased after the weaker Norwegina data.