Mexico: FDI Increases 21% in 2023

UNCTAD's preliminary estimates show a 9% decline in global Foreign Direct Investments to developing countries in 2023, contrasting with Mexico's exceptional 21% increase, likely due to nearshoring. Greenfield projects and expansion in the Mexico Industrial Park signal growth. While 2023's overall FDI seems weaker, UNCTAD's advanced figures suggest a fourth-quarter surge. Mexico's potential to reduce Chinese imports could boost U.S. exports, yet challenges in labor qualification and infrastructure persist. Geopolitical shifts, especially influenced by the U.S. election outcome, will shape Mexico's nearshoring success.

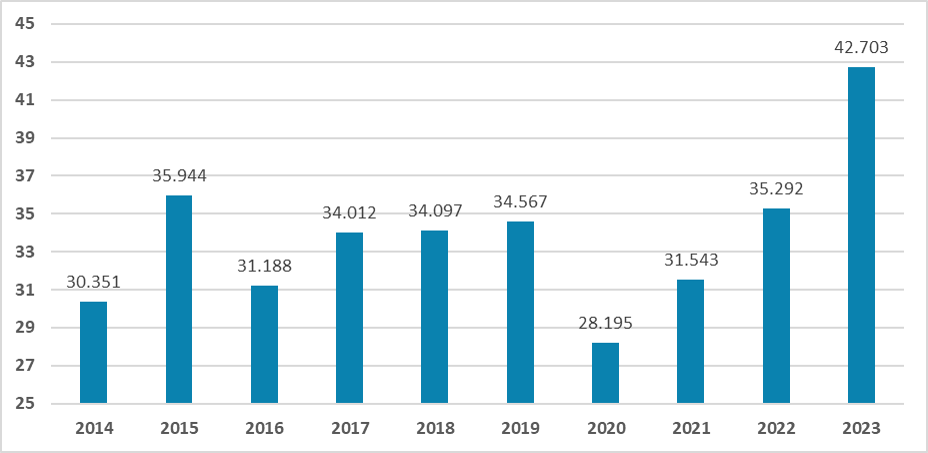

Figure 1: Mexico Foreign Direct Investment Inflows (USD Bn) Source: UNCTADThe United Nations Conference on Trade and Development (UNCTAD) has released its preliminary estimates of Foreign Direct Investments (FDI). According to UNCTAD, FDI to developing countries has decreased by around 9% compared to 2022. However, Mexico has not followed the same trend; initial calculations from UNCTAD indicate a 21% increase in FDI inflows towards Mexico, possibly due to nearshoring. Greenfield projects also grew by 21%, and there are strong reports that the Mexico Industrial Park has been expanding with new facilities under construction.

Source: UNCTADThe United Nations Conference on Trade and Development (UNCTAD) has released its preliminary estimates of Foreign Direct Investments (FDI). According to UNCTAD, FDI to developing countries has decreased by around 9% compared to 2022. However, Mexico has not followed the same trend; initial calculations from UNCTAD indicate a 21% increase in FDI inflows towards Mexico, possibly due to nearshoring. Greenfield projects also grew by 21%, and there are strong reports that the Mexico Industrial Park has been expanding with new facilities under construction.

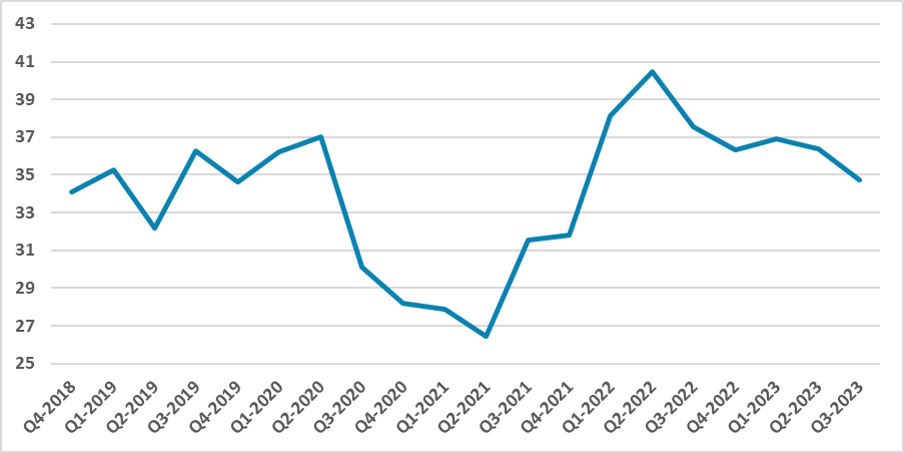

Figure 2: Mexico Foreign Direct Investment Inflows (USD Bn, 4-quarter sum) Source: SHCP

Source: SHCP

The official FDI numbers from the Mexican Government are yet to be announced. Quarterly data until the third quarter indicates that 2023 has been overall weaker in terms of FDI, but advanced numbers from UNCTAD are likely to indicate that most FDI inflows occurred during the fourth quarter. We have been arguing that, so far, most nearshoring impacts have come in the form of existing facilities in Mexico increasing their production capacity rather than new plants producing new products.

If Mexico can reduce much of the Chinese imports to the U.S., the capacity to increase exports to the U.S. will be tremendous, but there are still several bottlenecks that Mexico needs to solve. First, labor qualification, as many Chinese imports are concentrated on electronic parts that require qualified workers. Additionally, the infrastructure in the north of the country, which is receiving new investments from the government, needs improvement to facilitate the infrastructure to the north of the country.

Geopolitics will also be an important factor for the success of Mexico's nearshoring. Most U.S. companies' desire to decouple from China and bring their value chains closer to the U.S. was instigated by the official position of the U.S. government, especially Biden. Trump’s position on Mexico has usually been hostile, especially through his immigration policy, but Trump has also been hostile to U.S. imports of Chinese products. In case Trump wins the upcoming elections, it will be interesting to see whether he keeps Biden's policy of nearshoring by tightening U.S. ties with Mexico or not.