GBP, AUD, JPY flows: GBP dips briefly on retail sales, risk negative tone

GBP dips briefly on weaker retail sales. Mild risk negative tone perissts. PMIs awaited

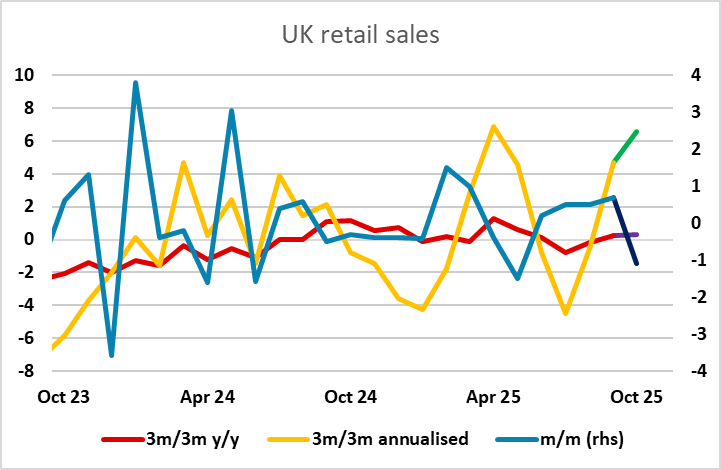

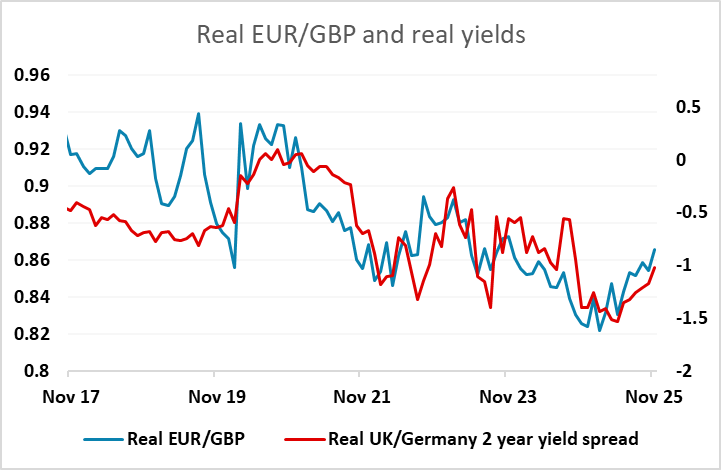

UK October retail sales have come in much weaker than expected, falling 1.1% m/m. However, this follows a stronger summer, and the 3m/3m trend remains quite strong, although there have been some revisions that means the y/y rate of growth is now little better than flat. EUR/GBP spiked higher in response, but has settled back to trade close to the opening level at 0.8820. Retail sales numbers are unlikely to have a huge impact on BoE thinking, but with the last vote being 5-4, softer numbers will help convince the necessary one member of the committee (probably governor Bailey) to switch their vote to a cut in December. But with a December cut already priced as an 83% chance, there is limited scope for GBP to weaken much further on the expectation of a rate cut, so we would still expect EUR/GBP to hold below 0.8850, but nevertheless we still favour the upside.

Elsewhere, the sharp dip in equities around the European close on Thursday has lent the market a risk negative tone, with AUD/USD dropping and JPY crosses topping out in response. But at this stage it looks corrective rather than any real change in trend. Today’s PMI data will be of interest, and we do expect it to be weaker than consensus, which may extend the risk negative correction, but this is unlikely to be enough to turn the recent trends. We still see AUD/USD as well supported at 0.64, and JPY weakness still looks likely to require at least a rate hike and probably intervention to turn it around.