GBP flows: GBP steady after GDP but risks on the downside

GBP not much changed after GDP comes in in line with consensus, but underlying picture remains weak

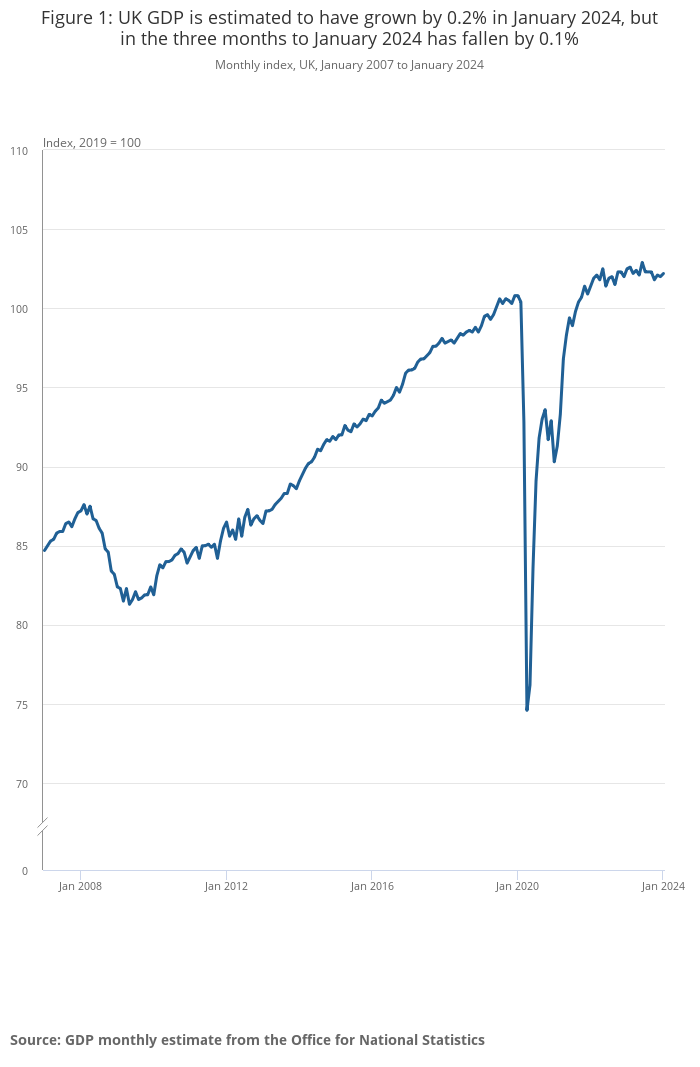

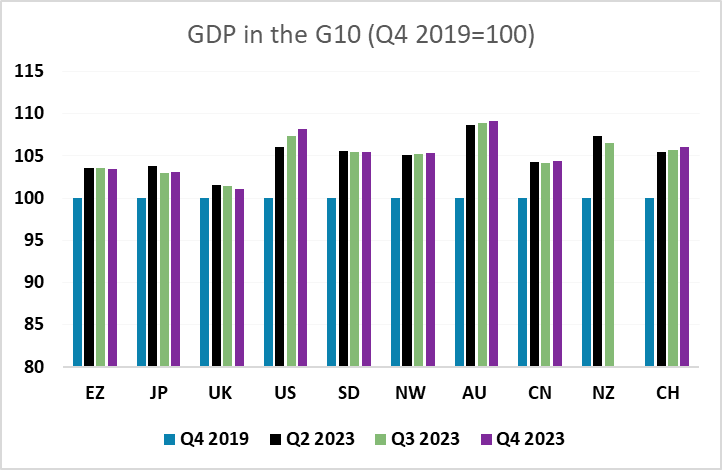

GBP is not much changed after the UK January GDP data came in in line with expectations, rising 0.2% after the 0.1% decline in December. However, on a 3m/3m basis, GDP is down 0.1%. GDP is also down by 0.3% in January 2024 compared with the same month last year and has fallen by 0.2% in the three months to January 2024 compared with the three months to January 2023. So although the monthly data is positive, there is little evidence that the UK is showing any underlying growth, and the UK performance since Q4 2019, the last quarter before the pandemic, remains the weakest in the G10.

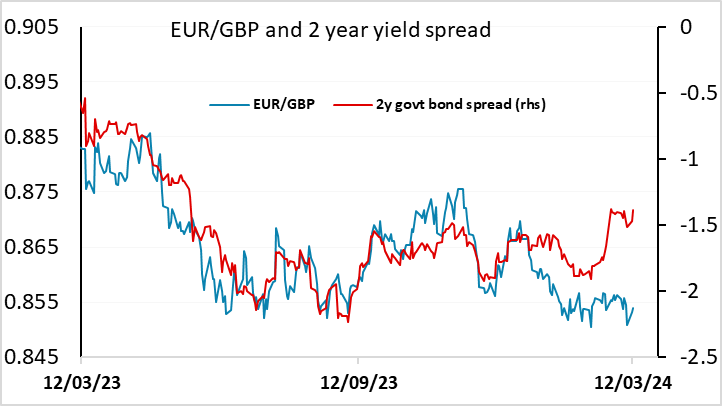

Of course, the BoE focus remains on inflation rather than growth, so that the weakness of UK growth is only relevant for monetary policy if it leads to lower inflation pressures. Up to now, the Bank have not seen weak demand as justification for easier policy because it has been offset by even weaker supply, particularly labour supply. However, there was evidence in yesterday’s labour market data that wage inflation is continuing to slow, and we would expect a more dovish tone at next week’s BoE MPC meeting. This suggests to us that GBP risks remain on the downside, with yield spreads against the EUR pointing that way and GBP net long positioning also looking extended in the latest CFTC data.