USD flows: Election awaited, mild risk positive tone

Markets awaiting election news. USD starting close to fair based on recent metrics.

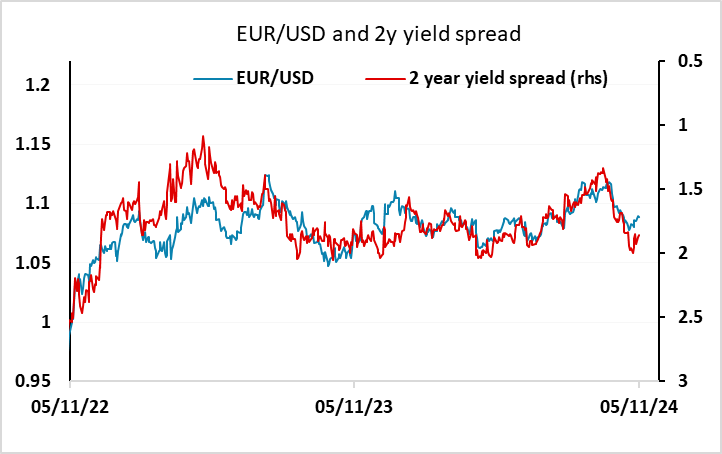

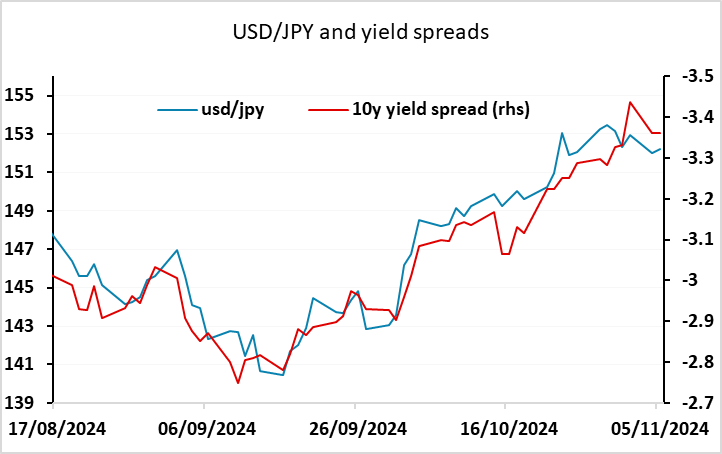

There is a mild risk positive tone in FX markets in early European trading, with the commodity currencies and GBP edging higher, and EUR/USD also slightly firmer, but there is unlikely to be a lot of volatility ahead of the US election results which will start coming out late US time. After the betting markets swung a little away from Trump at the weekend following some Harris-favourable polls, they are nearly back to where they were late last week with Trump around a 60% favourite. We suspect there is a little more than this priced into the FX markets, so that a Trump win would only have a modest USD positive impact, unless there is also a clean sweep for the Republicans in Congress, while a Harris win might have a more USD negative effect. As it stands, the USD is holding close to the recent yield spread correlations with the JPY and EUR.

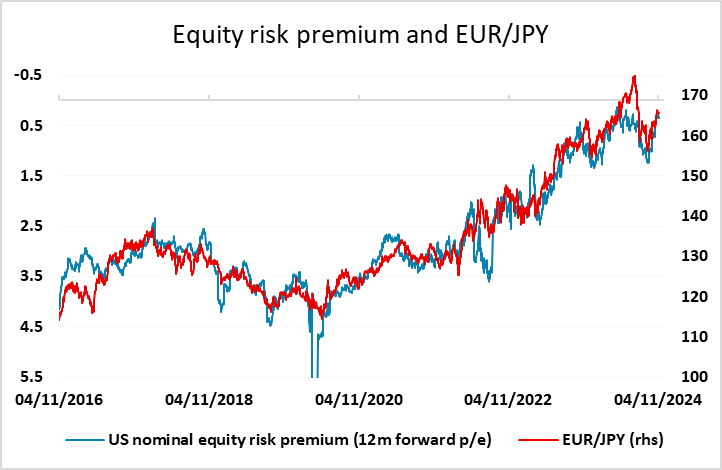

On the crosses, the JPY remains soft reflecting the resilience of equity markets to the rise in yields in the last few weeks. Typically, a Harris win and lower yields would be more favourable for the JPY than riskier currencies, as it would usually mean higher equity risk premia with equities not gaining enough to fully offset the impact of the decline in yields on the risk premium. A Trump win which also saw equities rise would tend to be JPY negative, as this would imply higher yields and higher equities and a lower equity risk premium. Longer run, we still expect substantial gains for the JPY across the board, but this continues to look like it will require either a much weaker equity market or a paradigm shift which sees the JPY break away from the nominal yield spread and equity risk premium metrics.