FX Weekly Strategy: APAC, December 2nd-6th

JPY biased higher medium term with Tokyo CPI supportive

Still some downside risks for EUR on Eurozone CPI data…

…with widening Germany/France spread also a concern

CAD may extend recovery on GDP

Strategy for the week ahead

Friday’s US employment report will be the main focus of the week, and we expect to see a stronger report than consensus, with payrolls up well over 200k in part due to a rebound from the impact of the hurricanes and the Boeing strike. But with a rebound widely expected, albeit a slightly less strong rebound than we anticipate, this may not have any great impact, with the market focus more on the likely policy mix under the new Trump administration. Indeed, there may also be more attention on Fed speakers this week rather than the data, as the December 12 Fed decision remains in the balance. The market is currently pricing a 25bp cut as around a 65% chance, but many see the decision as a very close call given the recent run of strong US data. The calendar is heavy with Fed speakers with Waller and Williams on Monday, Goolsbee on Tuesday, Musalem on Wednesday, and on Friday Goolsbee again, Hammack and Daly. The Fed’s Beige Book is also due on Wednesday.

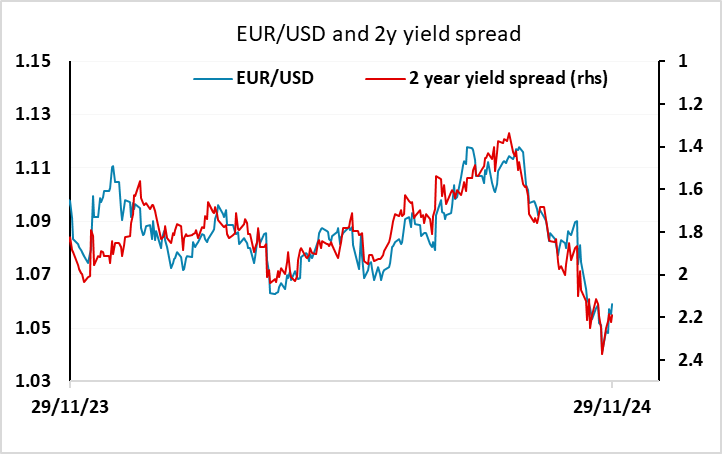

The relative strength of the US data and the pricing of a 25bp cut as a probability, along with our forecast of an above consensus employment report all suggest that the USD risks are primarily to the upside. The EUR and other riskier European currencies are probably most vulnerable, with the ECB primed to cut more aggressively in the coming months and the European economy struggling according to the latest PMI data. There may also be geopolitical considerations that are EUR negative, with Russian aggression ramping up and Europe concerned both about Trump’s attitude to NATO and the possibility of him introducing tariffs of European exports. So we see the risks as weighted to the EUR/USD downside, although central views may well see the 1.05-1.06 range persist.

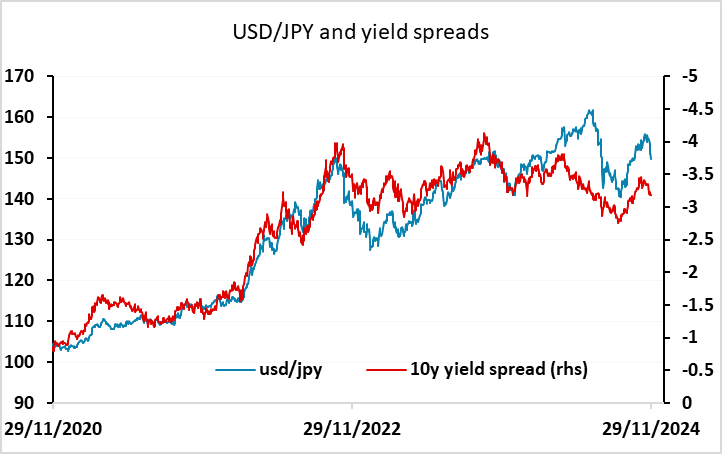

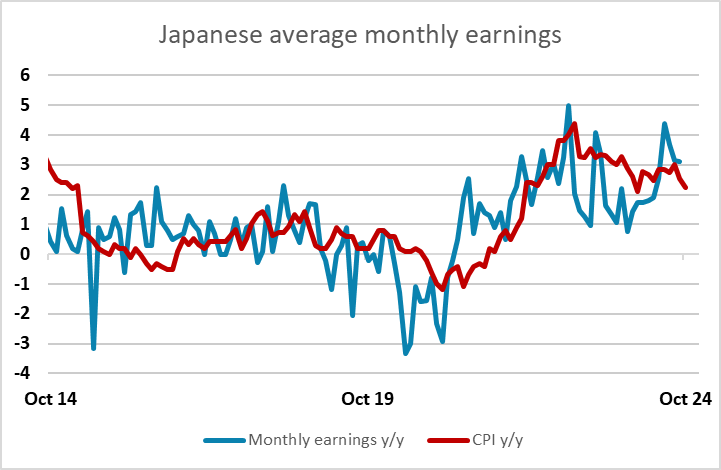

USD/JPY looks less likely to see significant gains after the stronger than expected November Tokyo CPI data increased the probability of BoJ tightening in December. While JPY yields didn’t rise significantly on the news, there is scope for JPY yields to match any rise in USD yields, limiting the upside for USD/JPY. The wage data at the end of the week could also be an important factor in the BoJ decision. Even so, if the US data is solid and equities consequently remain well supported, it’s unlikely that we will see much progress below 150.

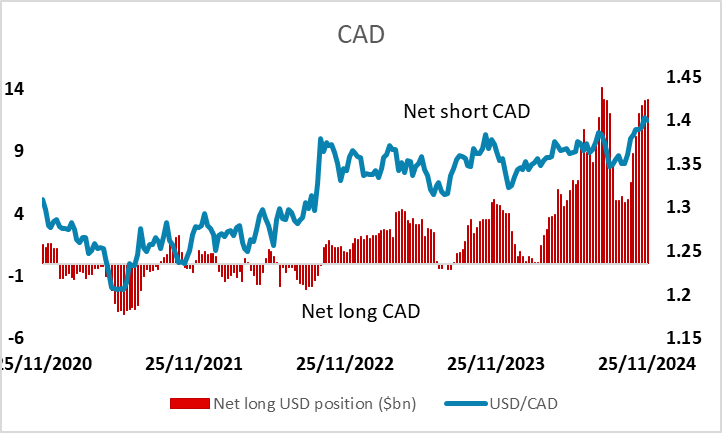

The CAD will also remain a focus with the Canadian employment report also due for release. The Q3 GDP data was mildly disappointing, and suggested there is scope for USD/CAD to hold above 1.40. But the CFTC data shows extreme speculative short CAD positioning, so further gains may well need to be driven by real money flows. Despite the tariff threat from the US, it is still the case that USD/CAD is broadly moving in line with short term yield spreads, so there isn’t any significant tariff related risk premium priced in. This suggests that there are still some CAD downside risks, but positioning mand valuation may mean that there is a bigger reaction to positive CAD news than negative news at this stage.

Data and events for the week ahead

OECD biannual forecast updates are due Wednesday! The new Outlook will provide the usual projections across a range of variables for all member countries, the EZ, and selected non-member countries.

USA

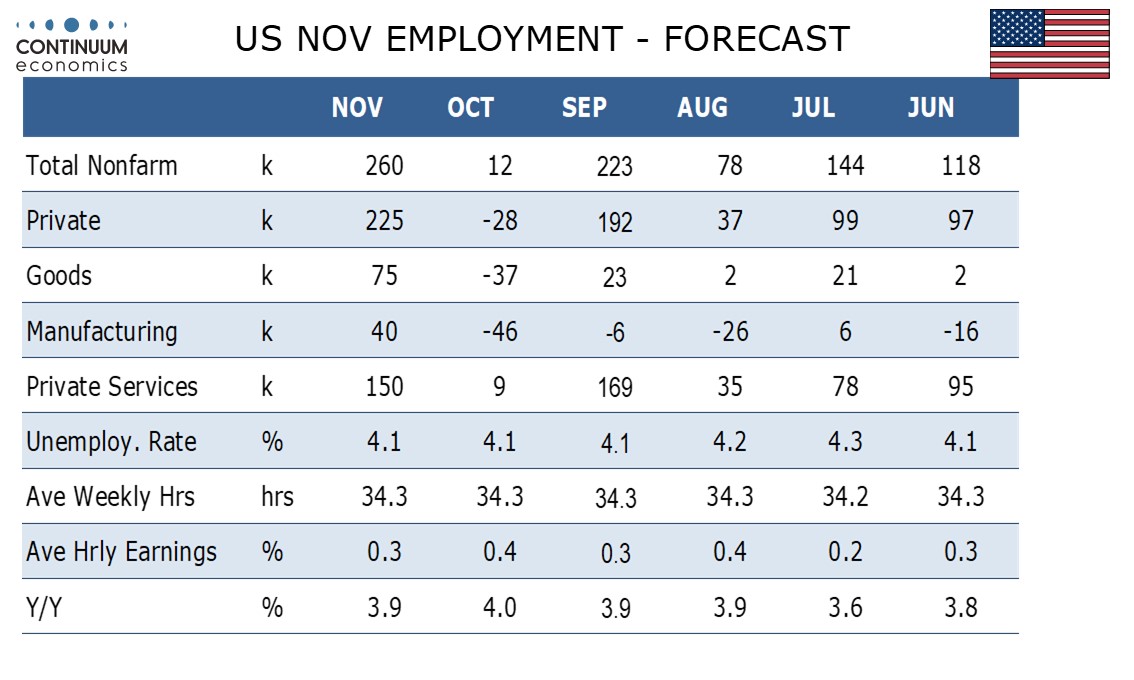

The key US release comes with Friday’s non-farm payroll for November, where we expect an above trend 260k increase (225k in the private sector) in a rebound from October data that was depressed by two major hurricanes and a strike at Boeing. We expect a slightly slower 0.3% increase in average hourly earnings and unemployment again remaining stable at 4.1%. We expect ADP’s private sector data on Wednesday to show a rise of 180k, underperforming payrolls after sharply outperforming in October. Other labor market indicators to watch are October job openings on Tuesday and weekly initial claims on Thursday.

Fed speakers include Waller and Williams on Monday, Goolsbee on Tuesday, Musalem on Wednesday, and on Friday Goolsbee again, Hammack and Daly. The Fed’s Beige Book is also due on Wednesday.

Canada

Canada releases November PMI data, starting with S and P manufacturing on Monday, followed by S and P services on Wednesday and the Ivey manufacturing PMI on Thursday. Q3 productivity is due on Wednesday, with October’s trade balance on Thursday. The most significant Canadian release however will be November employment on Friday, though a strong report may have less influence on the Bank of Canada’s December 11 decision given the looming threat of US tariffs.

UK

The BoE will release its Decision Maker’s Survey on Thursday, the same day as a speech from MPC member Greene. Final PMI data (Mon/Wed) may highlight downside risks, the question being whether they have spread elsewhere which the Construction PMI (Thu) may reveal.

Eurozone

Few ECB comments are on the agenda. But the question is whether there are any further signs of a consumer revival which may make EZ retail sales data (Thu) all the more interesting – there have been three successive m/m rises. The week also has several PMI updates, including final composite numbers (Wed) and the construction equivalent (Thu). Unemployment data (Mon) may show fresh signs fo a rise in joblessness. Q3 GDP details data arrive on Friday. German industrial production (Fr) is likely to see a further m/m correction back as may manufacturing orders numbers the day earlier as there is a likely reversal in bulk orders that boost September numbers.

Rest of Western Europe

There are key events in Sweden, mainly the flash CPI (Thu) where the data may exceed Riksbank thinking. Indeed, CPIF inflation may jump back above 2% in November and where CPIF excluding energy prices could rise 2% too, but mostly due a return to more normal electricity price backdrop; the Riksbank's anticipates 0.9% inflation in November. Tuesday sees Swiss CPI, number still reverberating from the downside surprise last time around. Indeed, Swiss headline inflation slowed unexpectedly to 0.6% from September’s 0.8%. We see the rate steady this time, but any further downside surprise could trigger a 50 bp move next month from the SNB.

Japan

After the CPI data this week, only Labor Cash earning and overall household spending on Friday next week will be of relevance. Ueda has stated that the current inflationary push has tilted towards wage rather than cost and they would like to see a continuous strong wage growth. We feel like on average a 3% growth is good enough to secure a December hike as it brings real wage back to positive territory again. On the other hand, household spending is also important for private consumption remains very sluggish in H1 2024 and most of Q3, it will be favourable top it to pick up on higher real wage.

Australia

GDP on Wednesday will be critical but was previewed by preliminary data and the RBA that it will be on the soft side. It would be more of a surprise to to see it beat estimates rather than miss. Yet, if the data missed there maybe a bigger reaction in the Aussie as it may draw speculation of an earlier cut from the RBA. We also have retail sales, ANZ Job ad and other PMIs on Monday.

NZ

All tier two data.