This week's five highlights

November FOMC Minutes Shows Few hawkish signals

No major surprises for U.S. Data

USD/JPY Broke 150 figure

RBNZ Front Loading Cuts

China Slowing LT Growth

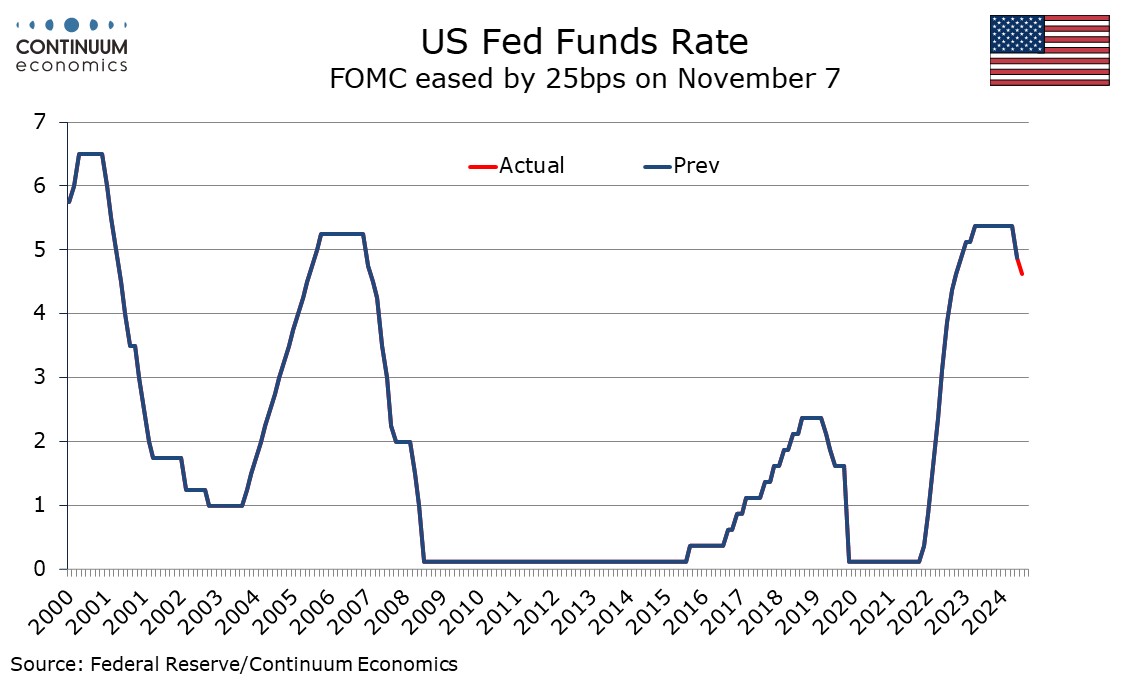

FOMC minutes from November 7 show agreement that almost all participants judged risks to their dual mandate objectives of maximum employment and price stability to be roughly in balance and almost all backed the decision to ease by 25bps at the meeting, a more moderate move than the 50bps move that had commenced the easing cycle in September. There is not much sign of hawkishness in the minutes, easing concerns generated by comments by Chairman Powell on November 14.

Upside risks to the inflation outlook were seen as little changed while downside risks to employment and growth were seen as having decreased somewhat. The views on inflation look quite optimistic, with almost all judging incoming data as consistent with a return to the 2% target, though a couple said the process could take longer than previously expected. Labor market readings were seen as consistent with conditions remaining solid, with strikes and hurricanes seen behind weak October data. Some still saw elevated risks that conditions could deteriorate, though many saw the risks of an excessive cooling as having diminished.

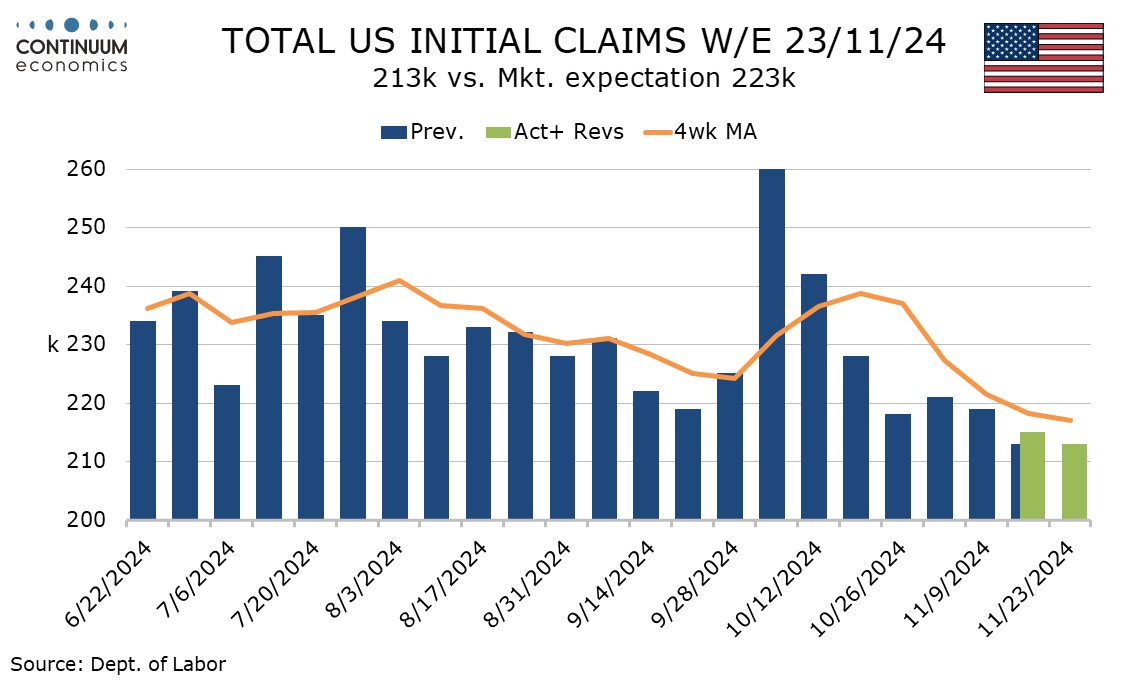

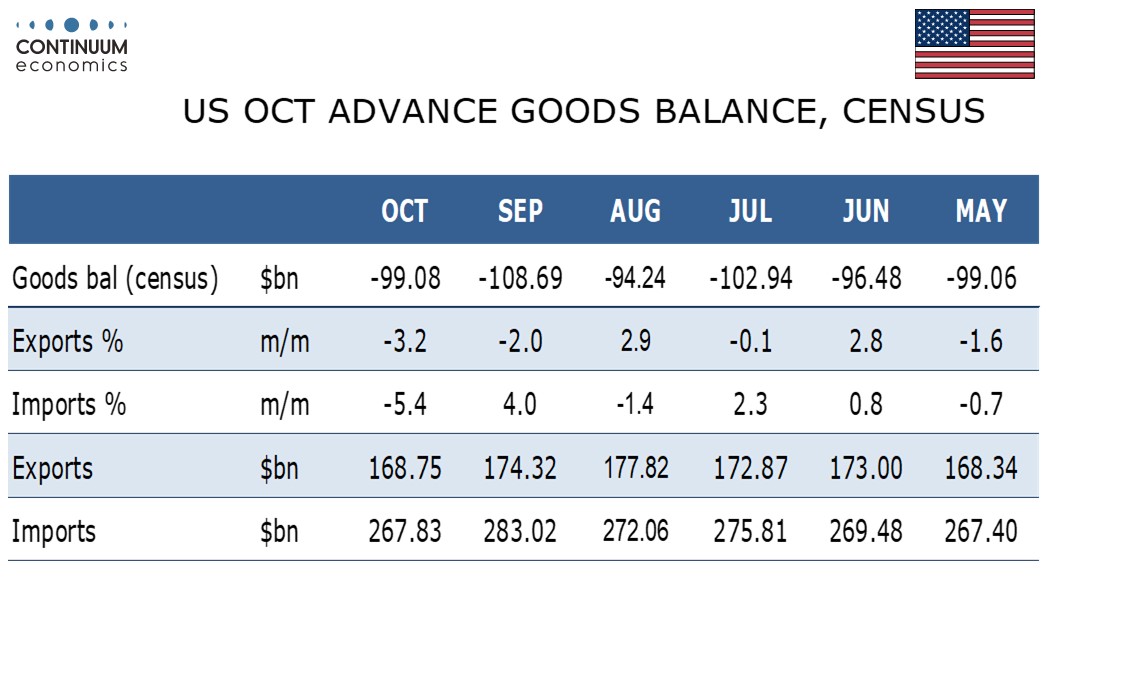

There are no major surprises in the latest round of data. Initial claims remain low but continued claims remain high, Q3 GDP was unrevised at 2.8%. October durable goods maintain a marginally positive trend, up 0.2% overall and 0.1% ex transport. October’s advance goods trade deficit corrected lower but may bounce in coming months ahead of expected tariffs. Initial claims at 213k are down because last week was revised up to 215k from 213k. The level is the lowest since April and the 4-week average has more than fully erased a bounce seen after the recent hurricanes.

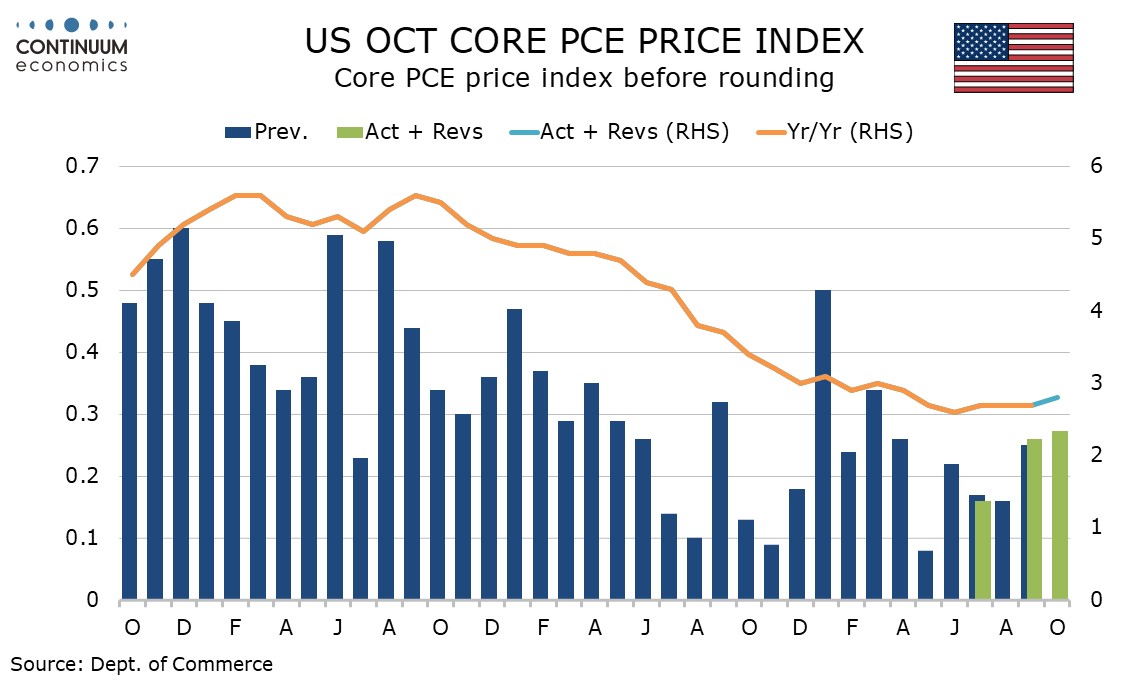

The unrevised 2.8% GDP increase keeps the pace healthy, with the detail showing consumer spending a little less strong at 3.5% from 3.7% but fixed investment and inventories revised higher. The first estimate for Q3 Gross Domestic Income showed a 2.2% increase, slightly slower than GDP. A downward revision to core PCE prices to 2.1% from 2.2% was minimal before rounding.

October PCE prices at 0.2% overall, 0.3% core, with yr/yr rates slightly firmer at 2.3% and 2.8% respectively are as expected and predicted by Fed’s Powell on November 14. The core rate at 0.27% before rounding is not quite as strong as the core CPI. The pace is a little higher than desirable, but will probably not generate any extra worries at the FOMC. Personal income with a 0.6% increase is well above expectations. A 0.5% rise in wages and salaries was a little stronger than the non-farm payroll had implied but the main surprise was that the other components of personal income outperformed, with dividend and social security income particularly strong. Personal income saw negative revisions in Q2, as already seen in the GDP release.

As U.S. Treasury Yield corrects and JB yields steadily rises, USD/JPY's reversal is gathering steam. Since peaking at 156.75 in earlier November, the USD/JPY has been going south along the yield differential narrowing between U.S. Treasury and JGB yields. The latest trigger came from the higher than expected Tokyo CPI, which spurs market participant's anticipation of a December hike, which we have called for the past quarter on inflation dynamics development. A 25bps hike is still not fully priced in and if there are more cues from BoJ or Ueda regarding an imminet hike, there is more room to roam in the pair.

On the chart, the pair is under pressure as consolidation above the 150.45 low comes under fresh selling pressure below the 152.00 resistance. Both the daily and weekly studies are tracking lower and suggest scope for break lower to see room to the 150.20 Fibonaci retracement then the 150.00 figure. Reaction at the latter cannot be ruled out though a later will will see further losses to retrace gains from the September low and see room to the 149.10/00 area. Meanwhile, resistance remains at the 152.00 congestion which is expected to cap. Only above here will see room for stronger bounce to the 153.28/154.00 resistance.

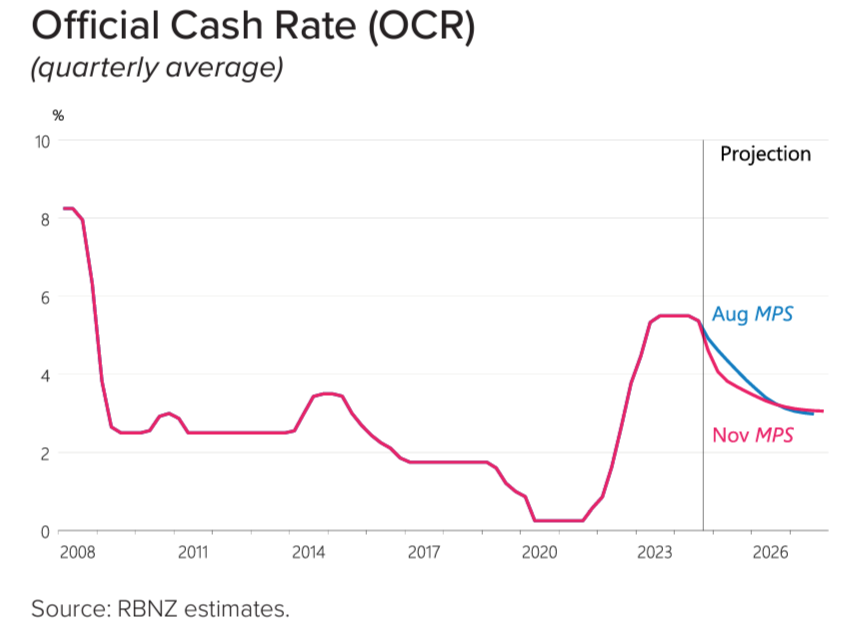

The RBNZ cut its cash rate by 50bp to 4.25% in the November meeting, revised the August OCR to indicate more front loading of rater cut in 2025 and sees CPI, core CPI & expectation to be closer to the middle of target range with further moderation momentum. Some key takeaways:

Front Loading Cuts: "If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year". The RBNZ cut by 50bps, more than what the August OCR forecast showed. The November OCR forecast now see the RBNZ to front load one more 50bps cut in February 2025 before smoothly cutting 25bps between meetings till 3% in 2026.

Inflation Expectation: The RBNZ sees CPI, core CPI & expectation to be closer to the middle of target range and they are forecasting such momentum to roll through 2025. Thus, the RBNZ is comfortable to remove the restrictive rate. Within the lines, it also seems that the RBNZ believe there is a chance inflation will be below target range in 2025, that is why we believe they try to front load the cuts.

Forward Guidance Change: The forward guidance is changed to "If economic conditions continue to evolve as projected, the Committee expects to be able to lower the OCR further early next year." from "The Committee confirmed that future changes to the OCR would depend on its evolving assessment of the economy." with RBNZ Governor Orr saying "projections are consistent with 50bp cut in February depending on economy". The RBNZ is signaling they will be front loading cuts and is expecting to cut rate till 2.25% by 2026.

The November meeting shows the RBNZ sees the inflation picture is cooling rapidly and "Significant spare productive capacity expected over the next year", persuading the RBNZ to cut more rather earlier than later.

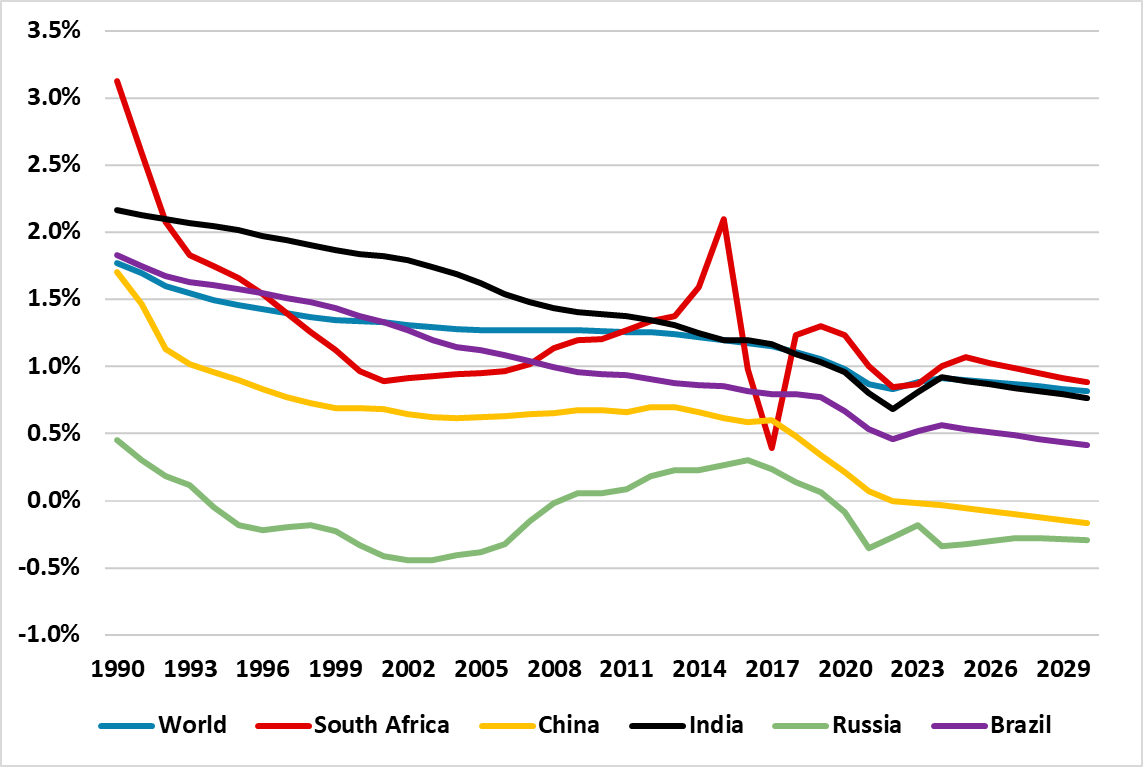

Figure: Population growth including net Migration (%)

China labor force will likely not grow in the remainder of the decade, due to falling population; reluctance to consider large-scale inward immigration; a female participation rate that is high by EM standards and limited growth in employment among those over 55. Meanwhile, education and rural to urban migration help China productivity, but the overall productivity trend will remain towards slowing as catch up gains become more difficult and due to only modest support from private companies/rule of law and lack of strong competition or openness. Structural long-term growth would likely slow to 3% by 2027, but actual growth will likely be modestly higher due to fiscal policy stimulation being used in 2025 and beyond.

One way to have consistently high growth is a fast increase in the labor force, which can drive employment/consumption and housing construction. Of the big EM, India is best placed, due to still good population growth (Figure 1); the demographic dividend of children currently coming into the labor force and scope for a healthy long-term increase in female participation. China has two headwinds and a challenge. Firstly, net population growth is turning negative in China (Figure 1) and it is politically highly unlikely that China will accept large-scale inward immigration. Secondly, female participation rates are high by EM country standards and not far below the DM average. Finally, the challenge is to increase the rate of over 55 working, given the low retirement age in China. Japan has shown that part time working and a focus on what older employees can contribute can both increase over 55 employment and allow a better work/retirement balance. China has finally passed plans to increase the retirement age by 3-5 years between 2025 and 2040 (here), which will help but is unlikely to produce a radical jump in over 55 employment.

All of this means that China labor force will likely not grow in the remainder of the decade, which reduces employment, consumption growth and the structural demand for housing – the IMF estimates that this will fall 35-55% (here). This is big structural headwind to growth.