Preview: Due June 27 - U.S. May Personal Income and Spending - Core PCE Prices to match Core CPI

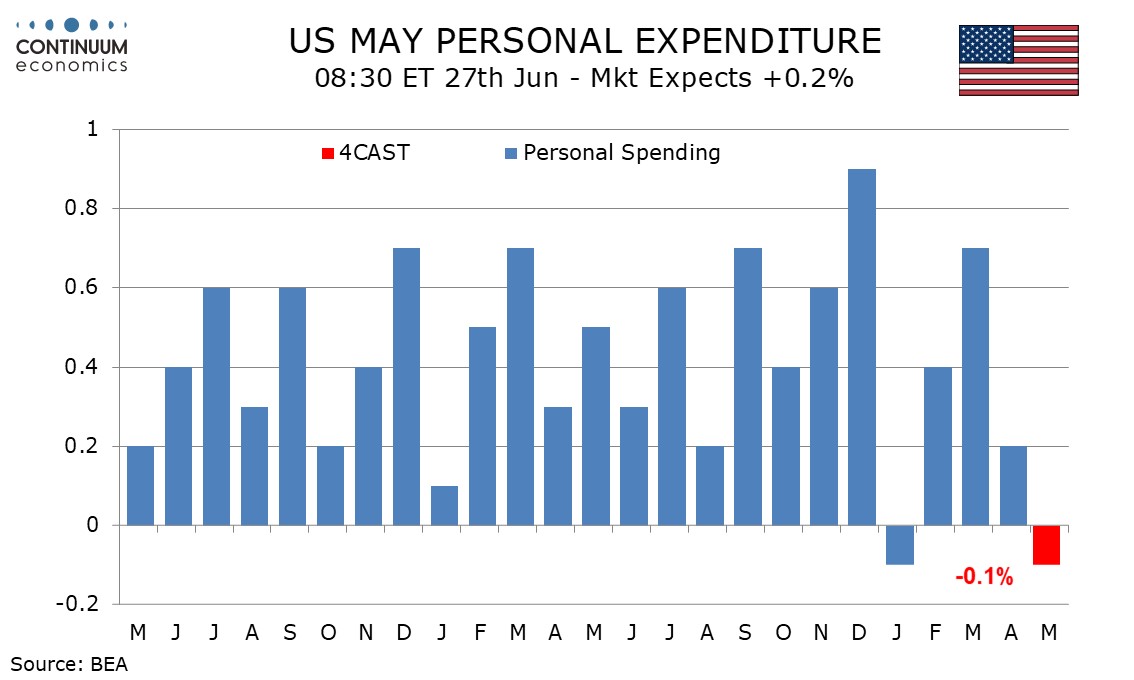

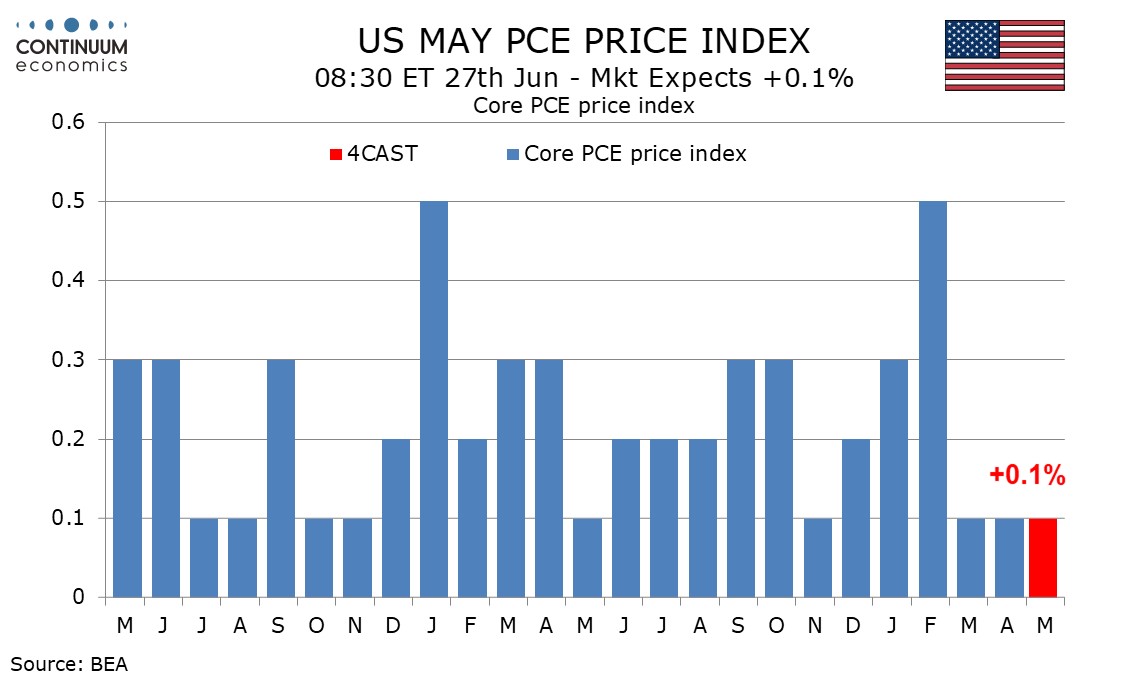

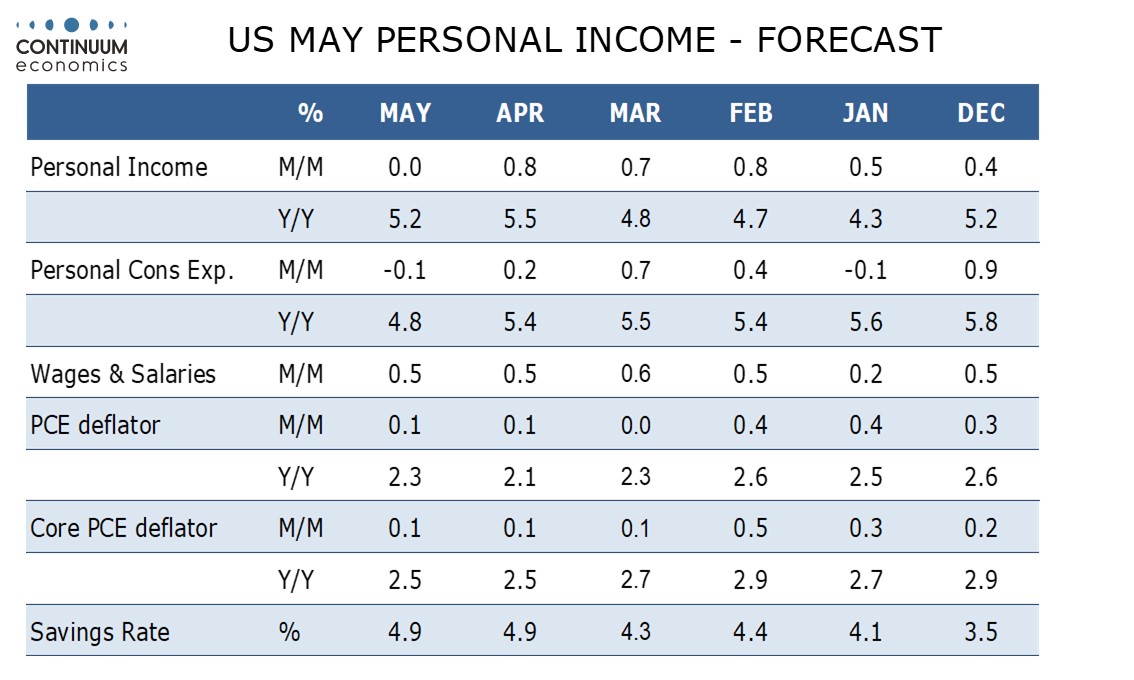

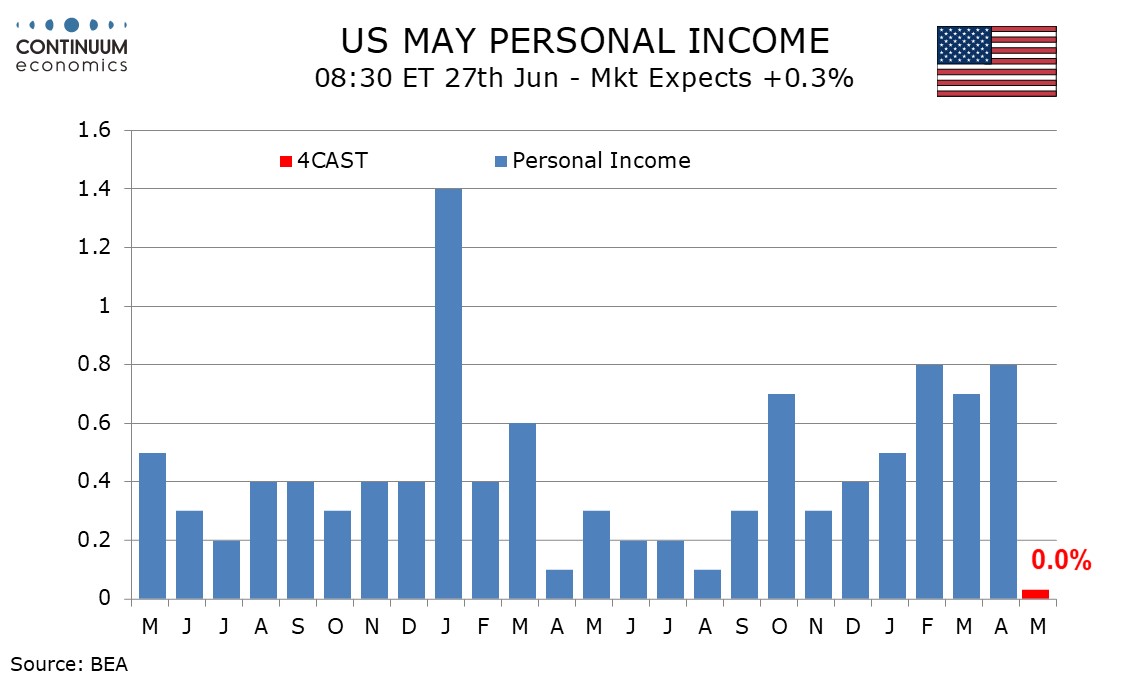

We expect a 0.1% rise in May’s core PCE price index, matching to core CPI, continuing to show limited tariff pass-through. Subdued data are also likely from personal income, which we expect to be unchanged, and personal spending, where we expect a 0.1% decline.

Core CPI was up by 0.13% before rounding, suggesting that while core PCE prices are usually marginally softer than core CPI, core PCE prices will be close to 0.1%. Overall CPI prices rise by only 0.08% before rounding, but with PCE prices less sensitive to gasoline than CPI we expect overall PCE prices to also rise by 0.1%.

The yr/yr core PCE price index would then remain at April’s 2.5% pace, which was the slowest since March 2021, while the overall pace will move closer to the core, rising to 2.3% from 2.1%.

May’s non-farm payroll implies a healthy 0.5% rise in wages and salaries, supported by both employment and average hourly earnings growth, but overall personal income is likely to be restrained to unchanged by a correction from a one-time lift to social security payments in April. Due to the Social Security Fairness Act, passed at the end of Biden’s term.

We expect personal spending to be weaker still, with a 0.1% decline, led by a 0.9% decline in retail sales already released. Autos led the decline. We expect service spending to slow to a 0.3% increase, which would be the slowest since August 2023, from 0.4% in April. Retail sales data showed slippage in food services, which are counted as services in the personal spending report.