USD, JPY flows: USD weaker as equities fall

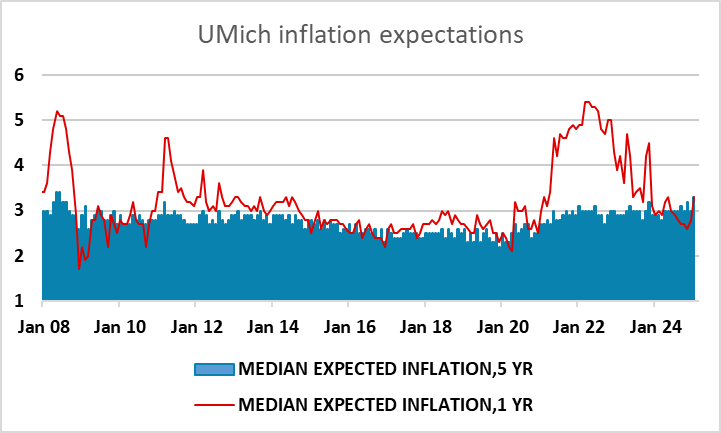

Rising inflation expectations in Universiyt of Michigan survey support higher yields and weight on equities, supporting the JPY

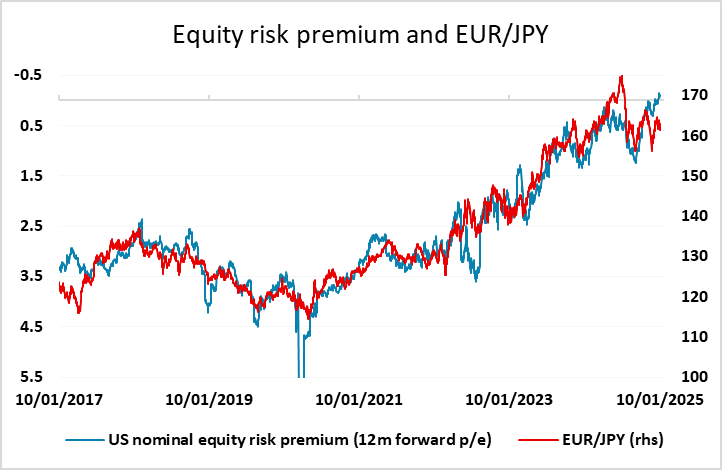

Higher inflation expectations in the provisional January University of Michigan survey provide further support for US yields. The median expectation for 5 year inflation is up to 3.3% - the highest since 2008. The impact has been negative for the USD because higher yields are starting to weigh on equity markets, and this is particularly benefitting the JPY. Certainly, the higher US yield profile makes it more difficult to justify current US equity valuations, and higher US yields will tend to have a larger and faster impact on the interest rate sensitive US economy than they do elsewhere. There is a persistent positive correlation between the JPY and US equity risk premia, so if we continue to see equities slip the JPY has potential to gain across the board. However, at current levels risk premia are still very low and don’t support major JPY gains.