FX Daily Strategy: N America, July 12th

US PPI watched in follow up to CPI

JPY has the most potential for volatility

SEK modestly weaker after soft CPI

US PPI watched in follow up to CPI

JPY has the most potential for volatility

SEK modestly weaker after soft CPI

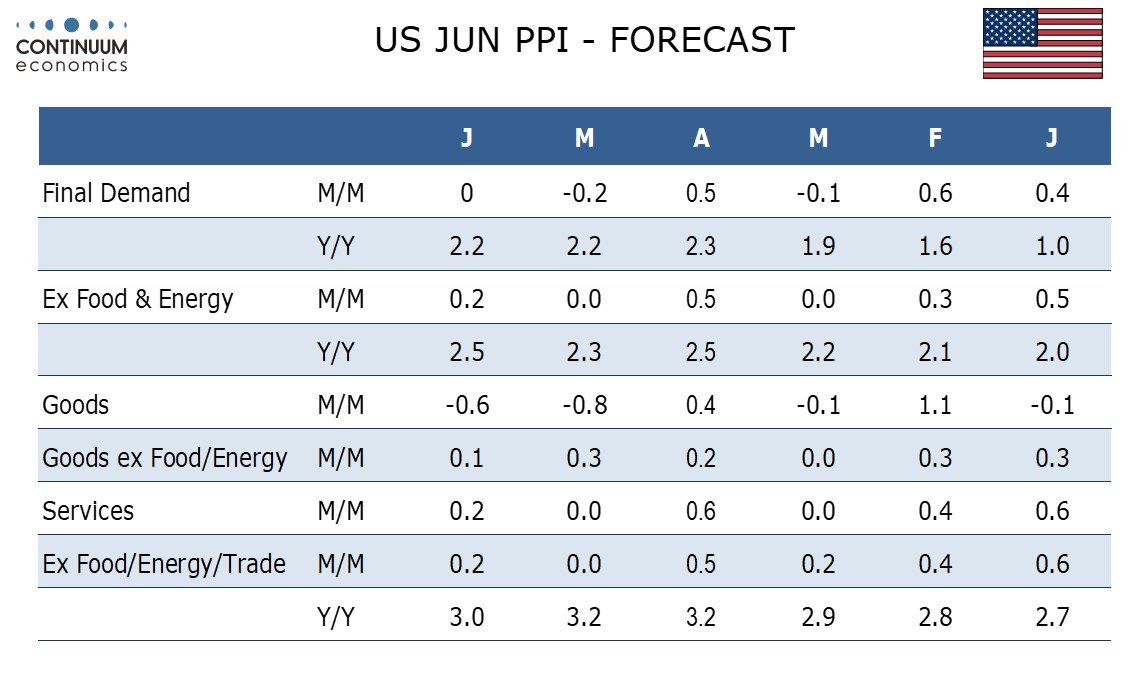

Friday sees US PPI to follow up on the CPI on Thursday, and before that we have Swedish CPI, which could be important given the sharp decline in the NOK that we have seen this week after the weaker than expected Norwegian June CPI. We expect a subdued June PPI, unchanged overall with a 0.2% increase in the core rates ex food and energy and ex food, energy and trade. However the data will be not quite as soft as seen in May, which corrected from a stronger April.

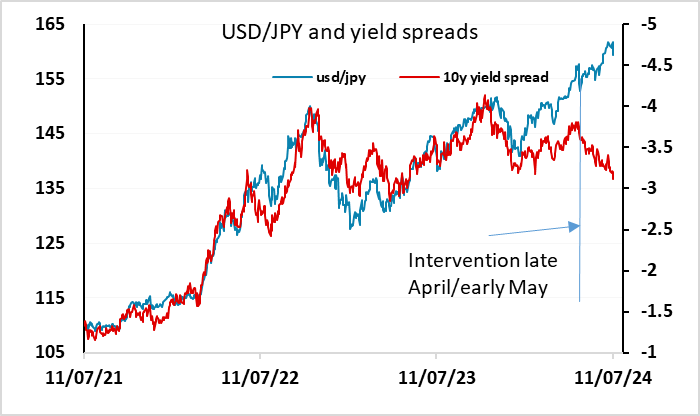

The biggest focus will be on the JPY after the big rise on Thursday following the US data. USD/JPY fell more than 3 figures from high to low, wiping out most of the gains of the last month, while EUR/JPY also lost around 3 figures, returning it to the levels seen at the beginning of July. There is no evidence of intervention, and the JPY move looks more likely to have been driven by stop losses being hit than by official action. It is still very much in the balance where it gores from here. Some may see this as a JPY buying opportunity, as we have had several sharp corrections in the long JPY downtrend we have seen in the last few years without any of them resulting in a proper trend reversal. Others may point to the fact that the fundamental drivers of JPY weakness in the last few years are no longer supporting the JPY bears, with yield spreads moving in the JPY’s favour and USD/JPY and EUR/JPY already a long way above the levels suggested by current yield spreads. We favour the latter case, but some weakening in risk appetite may be necessary to secure any longer term JPY gains.

In the early hours on Friday, USD/JPY dropped almost two big figures and was later revealed to be the BoJ doing rate check of EUR/JPY. While it is not an actual intervention, it succeeded in keeping speculative longs in check. Usually, an actual intervention is not far away after rate check especially as USD/JPY rebounds on Friday so far but we will have to wait and see.

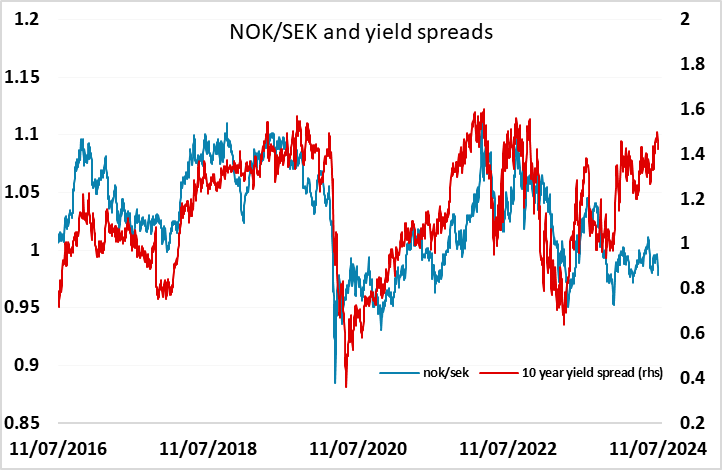

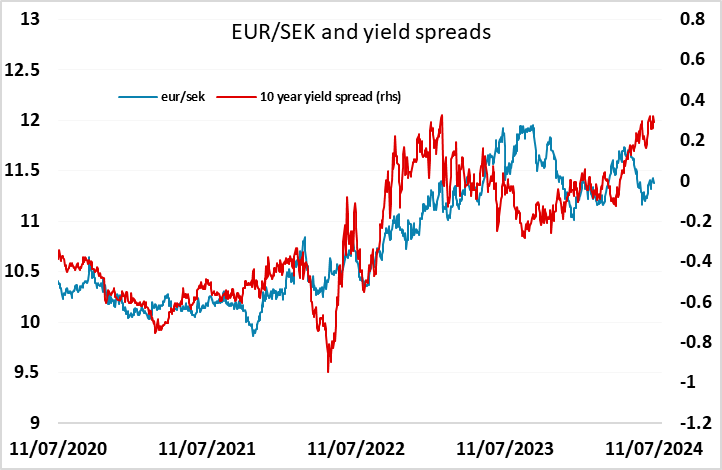

Like the Norwegian CPI data earlier in the week, Swedish June CPI has come in weaker than expected, with the headline y/y rate dropping to 2.6% and the core to 1.3%, well below market consensus of 2.8% and 1.6% respectively. The SEK has weakened in response, but much less dramatically than might have bene expected. While there was an initial surge from 11.43 to 11.47 in EUR/SEK, it has quickly settled back to 11.44, only marginally above opening levels. In comparison, EUR/NOK is up more than 1.5% since the weaker than expected Norwegian CPI on Wednesday. There should be scope for both EUR/SEK and NOK/SEK to rally further on this data, which makes earlier Riksbank easing more likely, especially since the SEK is starting from a level that looks strong relative to the usual yield spread correlation. But the SEK’s resilience this year, particularly against the NOK, will by now be discouraging sellers, so we may initially see another SEK rise before seeing further losses. Nevertheless, any SEK gains should be seen as a selling opportunity against the EUR and particularly against the NOK.