USD, CAD, EUR, JPY flows: USD reverses gains, CAD in focus

The rise in US yields and the USD after the election have largely been reversed, but equities remain elevated and commodity currencies have outperformed. But the CAD remains vulnerable if today's employment report is weak.

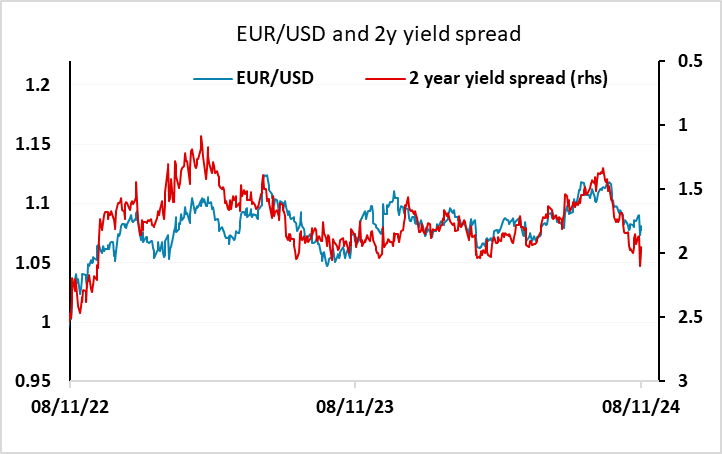

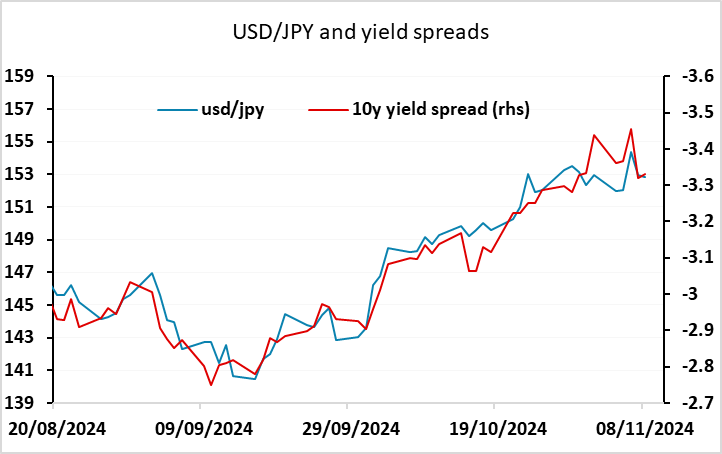

The rises in yields and the USD seen on the news that Trump had won the US election have now largely been reversed, but the rise in equities has been sustained. The best performers have been the commodity currencies, which correlates with the positive equity market performance. Both the AUD and NOK are now higher against the USD than they were before the election. The JPY is also outperforming slightly helped by a rise in JGB yields, while softer yields in the Eurozone have weighed on the EUR. GBP is also outperforming the EUR helped by the somewhat more hawkish tone to the BoE statement and Monetary Policy Report on Thursday. From here we would still expect the USD to hold its own, but unless the markets see a higher profile for US yields the USD advance is unlikely to be renewed.

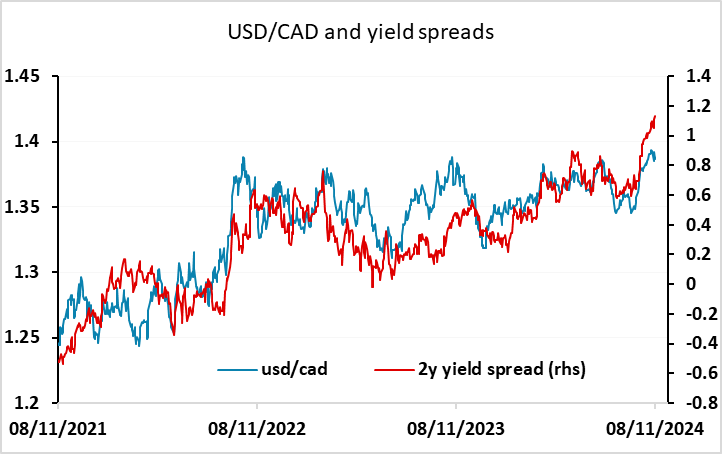

For today the Canadian employment report is the main data. The CAD has been helped by the generally stronger tone to commodity currencies, but has underperformed the AUD and NOK since the election. Yield spreads still suggests there are risks to the upside for USD/CAD, and if we see any sigs of softness in the employment report or a turn lower in equities we could well see pressure up towards 1.40.