USD flows: USD stays firm

USD retians strength after strong employment report as US yields continue to edge higher. JPY looks oversold but stronger Japanese data needed to trigger recovery

The USD has remained strong overnight in the aftermath of the employment report. US yields have continued to rise, and spreads have generally moved in the USD’s favour. The news of more US strikes on Houthi targets over the weekend hasn’t had any significant negative impact on risk sentiment, with equities generally a little firmer despite the rise in yields.

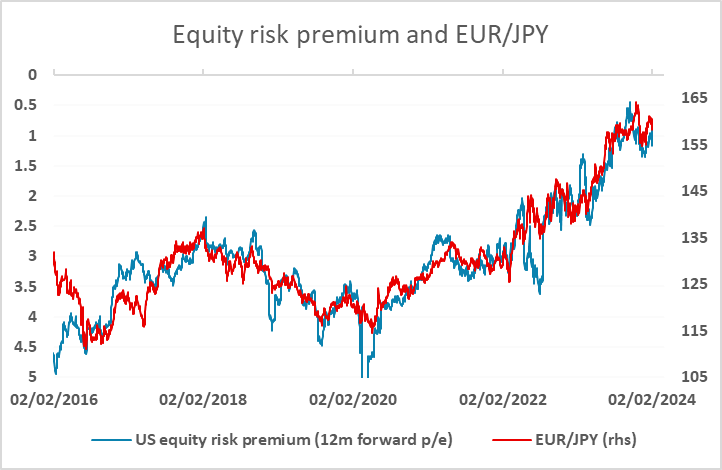

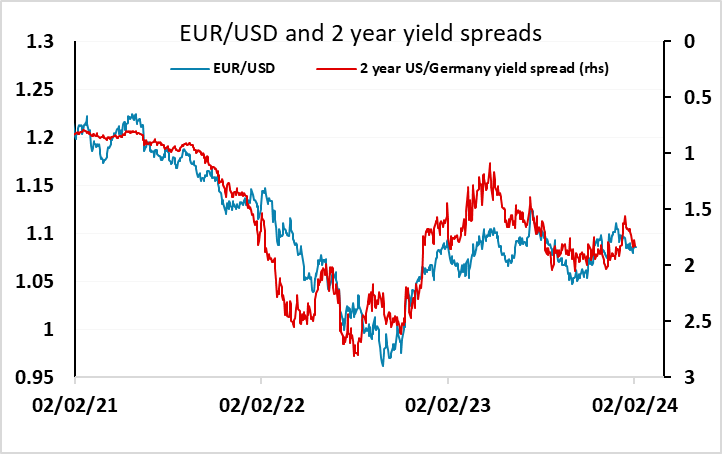

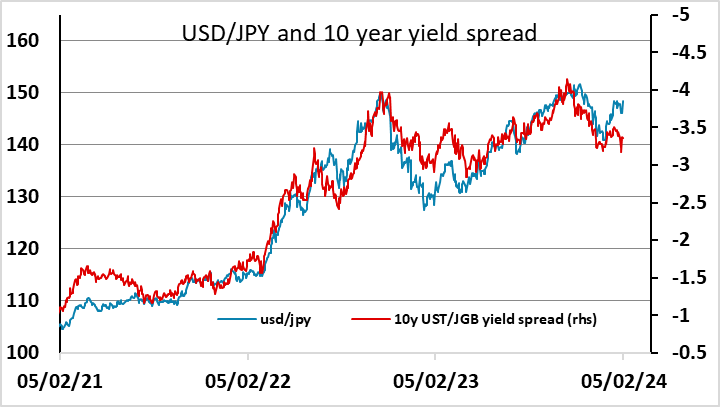

The USD strength remains hard to oppose after Friday’s employment numbers, and out models suggests that EUR/USD’s decline is well justified by the combination of higher US short term yields and US equity market outperformance. However, the strength of USD/JPY is less obviously supported by the move in spreads. We would nevertheless not look for any significant JPY recovery, although there is scope for some such recovery if tomorrow’s Japanese labour cash earnings data reverses the weakness seen in December and reignites expectations of BoJ tightening in the spring. While yield spreads imply scope for JPY strength on the crosses, the resilience of equities in the face of Friday’s sharp rise in US yields and the decline in equity risk premia it implies suggests that, for now, the JPY will struggle to make any ground on the crosses.