FX 2 Weekly Strategy: December 22nd - January 2nd

USD should be well supported by Q3 GDP

JPY the focus as it hits new lows in real trade-weighted terms

Japanese FX intervention looks necessary to reverse JPY weakness – probability of intervention now high

AUD and NOK look undervalued

Strategy for the weeks ahead

USD should be well supported by Q3 GDP

JPY the focus as it hits new lows in real trade-weighted terms

Japanese FX intervention looks necessary to reverse JPY weakness – probability of intervention now high

AUD and NOK look undervalued

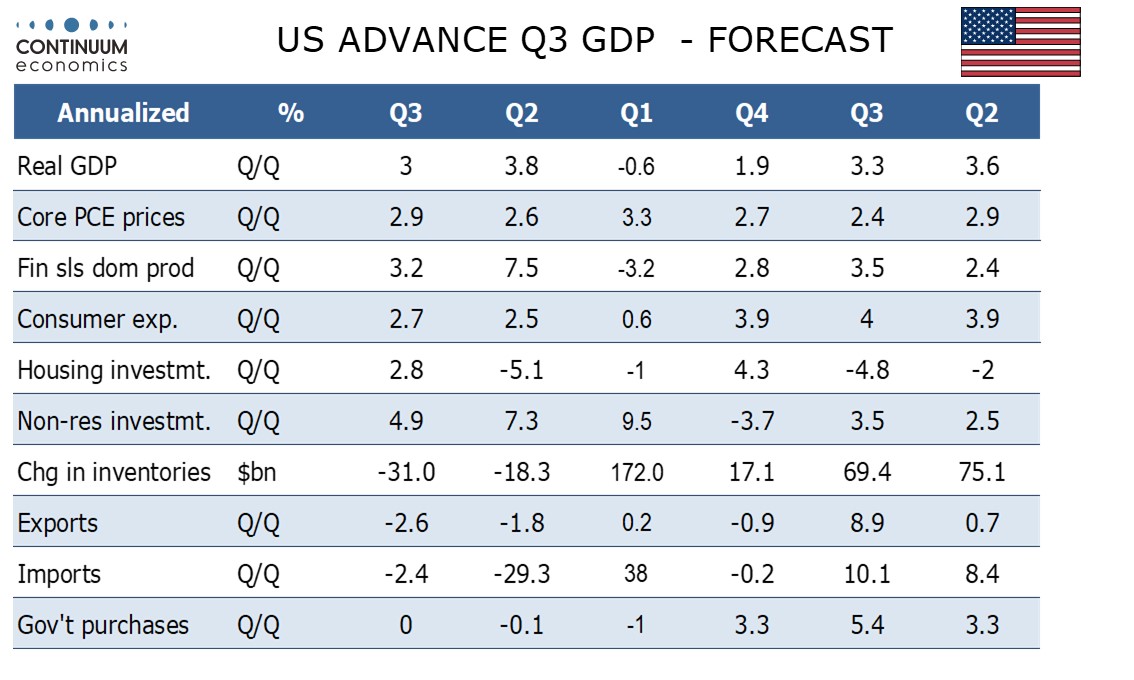

There isn’t a great deal on the calendar for the next couple of weeks that is likely to be market moving. The US Q3 GDP data on the 23rd will be of some interest, but our forecast of 3.0% annualized is similar to the market consensus of 3.1%. This follows 3.8% in Q2 after the tariff related Q1 decline. Even though our forecast is similar to the consensus, a 3% annualized growth pace is likely to be seen as USD supportive.

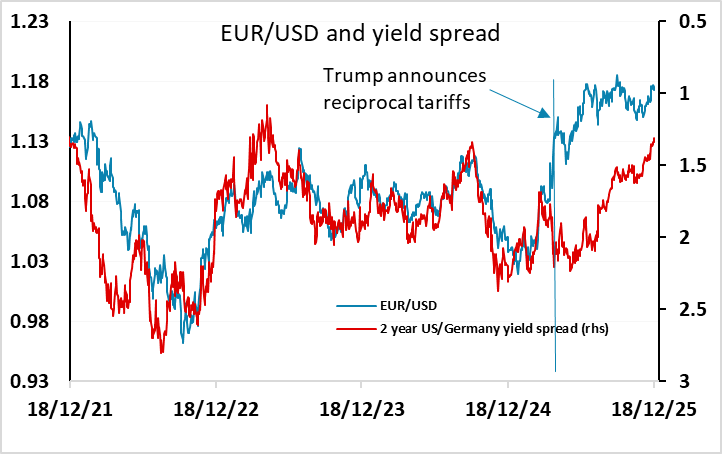

The USD has been strong against the JPY in recent weeks, but broadly rangebound against most other currencies, and closer to the bottom of its range against most of the riskier currencies. However, we see some risk of a turn lower in EUR/USD having failed the test of 1.18 if we see evidence of a continued strong US growth picture. While the softer US CPI data in October/November might be seen as a reason to see more scope for Fed easing, some see the data as potentially distorted by Black Friday and there has been little change in market expectations of the Fed. Coming into the New Year there is little expectation of any significant changes in monetary policy in the majors in Q1, which suggests the market will be looking for different drivers.

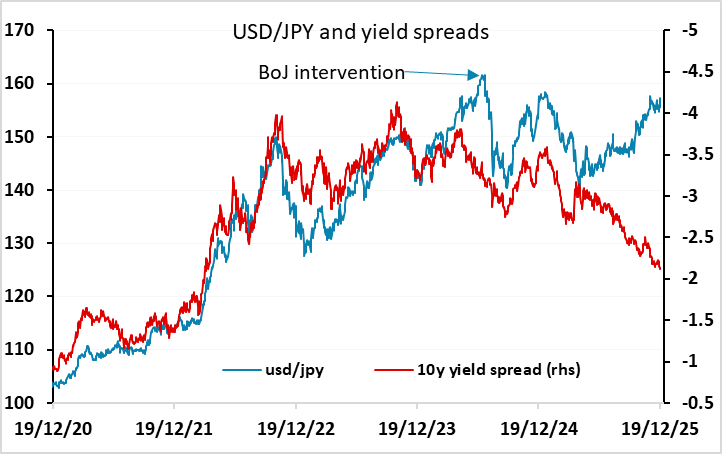

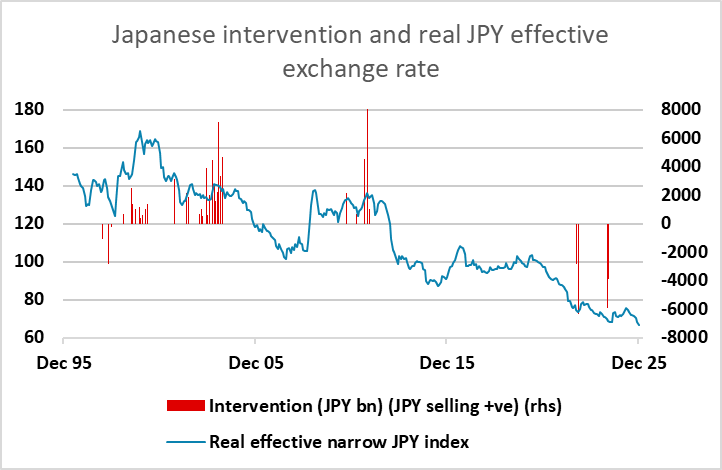

The weakness of the JPY is evidence of continuing interest in the carry trade, with the JPY declining despite the BoJ rate hike, and carry traders are likely to be encouraged by a world of solid growth and little risk of any monetary policy changes. This sounds like a low volatility world, which tends to favour higher yielders. However, JPY weakness is being driven as much by momentum as by pure carry. The sharp JPY losses after the BoJ rate hike even though JPY yields rose in response shows that JPY bears remain committed to the JPY downtrend almost regardless of news. But there is now an increasing risk of FX intervention from the Japanese authorities to halt JPY weakness, with the JPY now having fallen to new all time real trade-weighted lows, and showing no signs of recovery in spite of tighter monetary policy. We are at the stage where FX intervention is the only tool left in the box to prevent further JPY weakness.

The last intervention in July 2024 triggered a USD/JPY decline of more than 20 figures to 140, and came when USD/JPY broke higher without any support from yield spreads. The divergence between US/Japan yield spreads and USD/JPY is even more striking now, so intervention would not be surprising, and could cause as sharp or an even sharper decline in USD/JPY. Indeed, we would argue that we are at the stage where intervention is necessary, because the market at the moment is trend following and the JPY will just continue to weaken if there is no opposition.

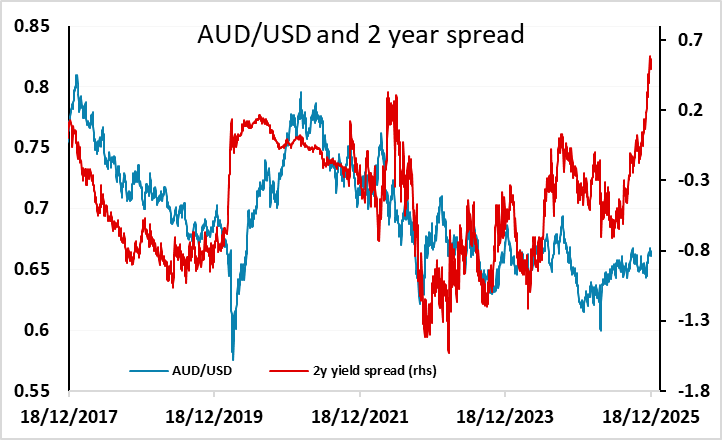

Other than the JPY the FX markets have been relatively subdued, but we would highlight two other potential movers in the AUD and the NOK. AUD/USD has stopped short of a test of the highs of the year above 0.67, but the market’s switch to expecting the next move in AUD rate to be up in recent months has led to a sharp yield spread move in the AUD’s favour which suggests scope for a break higher.

For the NOK, EUR/NOK once again briefly moved above 12 last week, but the few moves we have seen above this level in recent years have been short-lived, and there is little fundamental reason for NOK weakness to extend. NOK/SEK has been correspondingly weak, and dipped below 0.91 on Thursday, hitting its lowest levels since April. Historically, NOK/SEK has had a base at 0.90, and it’s hard to find a good rationale for extreme NOK weakness given relatively attractive yields and a strong budget and current account position.

Data and events for the weeks ahead

USA

Tuesday December 23 is a busy day for US data. Most significant will be Q3 GDP where we expect a solid 3.0% annualized increase with core PCE prices above target at 2.9% annualized. Also due are October durable goods orders, where we expect a 2.0% decline, but a 0.4% increase ex transport. October and November industrial production follow, and we expect a 0.1% decline in the October to be outweighed by a 0.2% increase in November. Weekly initial claims are due on Wednesday December 23.

Monday December 29 sees November pending home sales. Tuesday December 30 sees October house price indices from FHFA and S and P Case-Shiller, and more significantly FOMC minutes from December 10. A variety of opinions will be expressed but most are likely to be cautious about further easing. Wednesday December 31 sees initial claims for the week including Christmas, which could see some seasonal adjustment difficulties.

Canada

Canada releases November’s IPPI and RMPI on Monday December 22. On Tuesday December 23 we expect a 0.3% decline on October GDP, in line with a preliminary estimate given with September ata.

Week Ahead w/b Dec 22

UK

Final Q3 GDP data (Mon) are not seen seeing any material revision and come alongside Q3 current account data, the latter likely to see fresh deterioration from the underlying 3.2% set in Q2

Week Ahead w/b Dec 29

UK

Nothing until the new year with Friday seeing final manuf PMI numbers.

Eurozone

Friday also sees final manuf PMI numbers, they coming alongside ever more interesting ECB money and credit figures.

Rest of Western Europe

There are few events in Sweden, what there is most notably are the Riksbank meeting minutes (Tue). The same day sees Swiss KOF survey figures.

Week Ahead w/b Jan 5

UK

There is the BoE money and credit data (Mon) where housing market volatility and distortions may again be the order of the day but with further signs of an underlying weakening. Otherwise, no appreciable revisions are expected in final PMI numbers (Wed) but perhaps with more interest in the first insight for the month into the Construction PMI (Thu) and then the labor market from REC survey data (Fri).

Eurozone

Flash December HICP data (Wed) should see the headline drop to 2.0% and possibly even 1.9% from the 2.1% final November figure. Thus will be partly energy-induced with the core rate dropping just a notch. German and French CPI data (Tue) will give some early insight.

Otherwise, there is more survey data from the ECB on consumer expectation and then from the European Commission (Thu). And the week ends with German orders (Thu) and industrial production on Friday, the latter likely to see a m/m correction back.

Rest of Western Europe

There are few events in Sweden, most notably flash CPI numbers (Thu), where the targeted CPIF rate may rise a notch. The same day sees Swiss CPI figures where a small rise from the zero y/y November figure is seen to chime with SNB thinking. Friday sees Norway’s CPI, where the CPI-ATE rate may inch a notch lower.

Japan

We have the Tokyo CPI on Christmas. It is expected to be barely below 3%. However, it may not be as impactful if we have some kind of forward guidance from the BoJ in the coming days after the December meeting decision. Retail trade is also on the same day.

Australia

The RBA meeting minutes will be released on Tuesday and it could bring more hawkish expectation from market participants if thoughts of rate hike has been raised. Still, we think market is a bit ahead of themselves and could see hawkishness eases if there is no mention.

NZ

Christmas Week for NZ.