This week's five highlights

BoJ Hike by 25bps As Expected

BoE Splits More Entrenched

Is the tariff impact fading Shown in U.S. November CPI

Sweden Riksbank On Hold and For Some Time Ahead

Norges Bank Still Far Too Cautious Despite Clear Output Gap

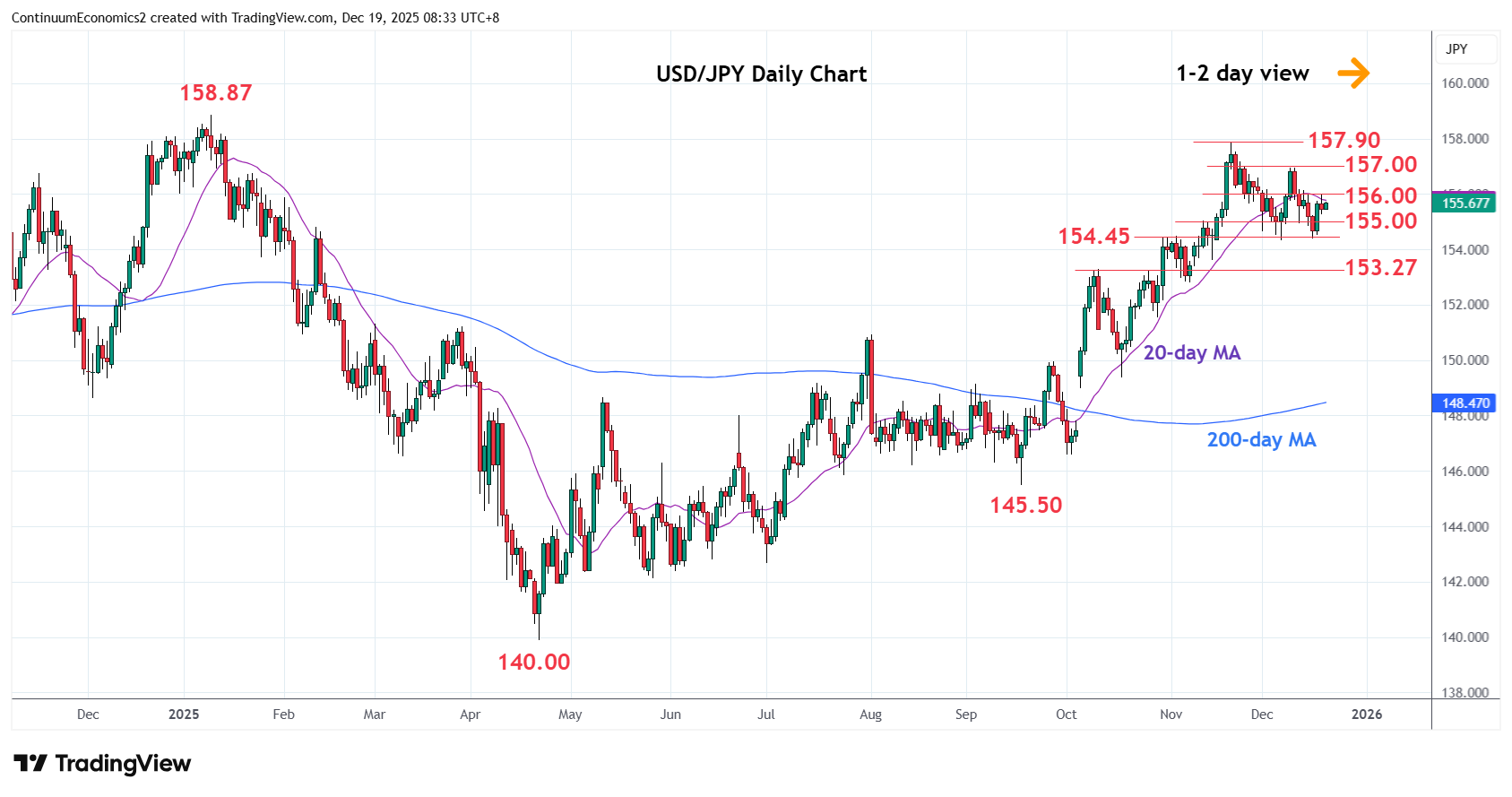

As per forecast, the BoJ has hiked rates by 25bps in the December meeting and bring short term interest rate to 0.75%. The forward guidance is straight forward in reinforcing their stance towards more rate hike if economic/inflation development aligns with their playbook but the timeline remain ambiguous. In contrary to the 7-2 vote to hold in October, the December decision is unanimous and suggest all members are now seeing sustainable inflation will be reaching its target of 2%.

Optimistic signs from the 2026 spring wage negotiation seems to have boosted BoJ's confidence in their forecast. They believe the pace of wage growth in 2026 will remain steady as corporate profit is forecasted to be at a high level. The risk arising from tariffs has been reduced, despite a level of ongoing uncertainty, should not be significantly affecting Japanese business. The business price/wage setting behavior is transiting at a pace favorable by the BoJ and supports BoJ's future rate changes.

The real interest rate is still low in BoJ's eyes. Therefore, they will be comfortable to further increase interest rate if the traction of business price/wage setting behavior persists, which translates into sustainable inflation. However, they hints at a lower CPI in the first half of 2026 due to transitory factors fading and government stimulus. From there onwards, the BoJ seem inflation to pick up from impact of labor shortage and see sustainable inflation target to be around the corner by year end 2026.

We believe it could mean one more rate hike somewhere between Q2/Q3 2026 to bring rates to 1% and this is likely to be the terminal rate. Unless the dynamic of price/wage setting change, the BoJ could leave rates at 1% for a medium term.

Figure: Much Weaker Wage Pressures?

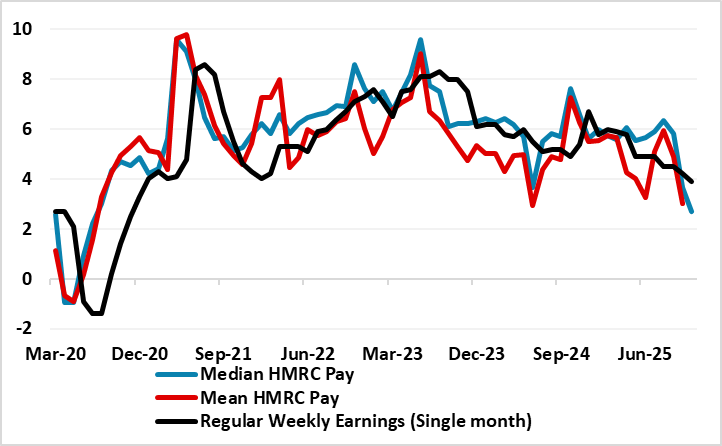

That the BoE delivered a sixth 25 bp rate cut (to an almost three-year low of 3.75%) was hardly in doubt. But we were surprised that amid the recent run of weak data, that there were (again) four dissents with Governor Bailey switching sides. Notably, in a clear combative overtone, at least some of the hawks are unwilling to accept that recent data means disinflation may have intensified with Chief Economist Pill actually questioning whether further cuts should occur. But overall, the majority do seem to back additional cuts but where they will be gradual and likely to remain ‘close calls’ in future. Admittedly, persistent sizeable dissents through 2026 may complicate policy making. But we think those dissents will be tempered as the MPC vast majority recognises the already ample signs of a weaker demand and a looser labor market backdrop. So far, this is purely evident to only two MPC members (Dhingra and Taylor) but even they not acknowledging clear signs of both price and wage pressures having subsided markedly. Thus we retain our below-consensus projection of Bank Rate falling to 3.0% by end-2026.

As with the November MPC verdict, a further 5:4 split was not unexpected. What seems clear is that the effective swing voter was Governor Bailey who remains of the view that further easing is likely. However, at face value, this further close December vote suggests that the two camps within the MPC may remain entrenched in their thinking; even the dovish camp is divided with only two pointing to downside risks to activity and inflation. Effectively, this means that Governor Bailey will be the key, swing voter. If so, this may be something he will find both testing and problematic if he has to wrestle with what could be two intransigent and possibly vocal halves of the MPC.

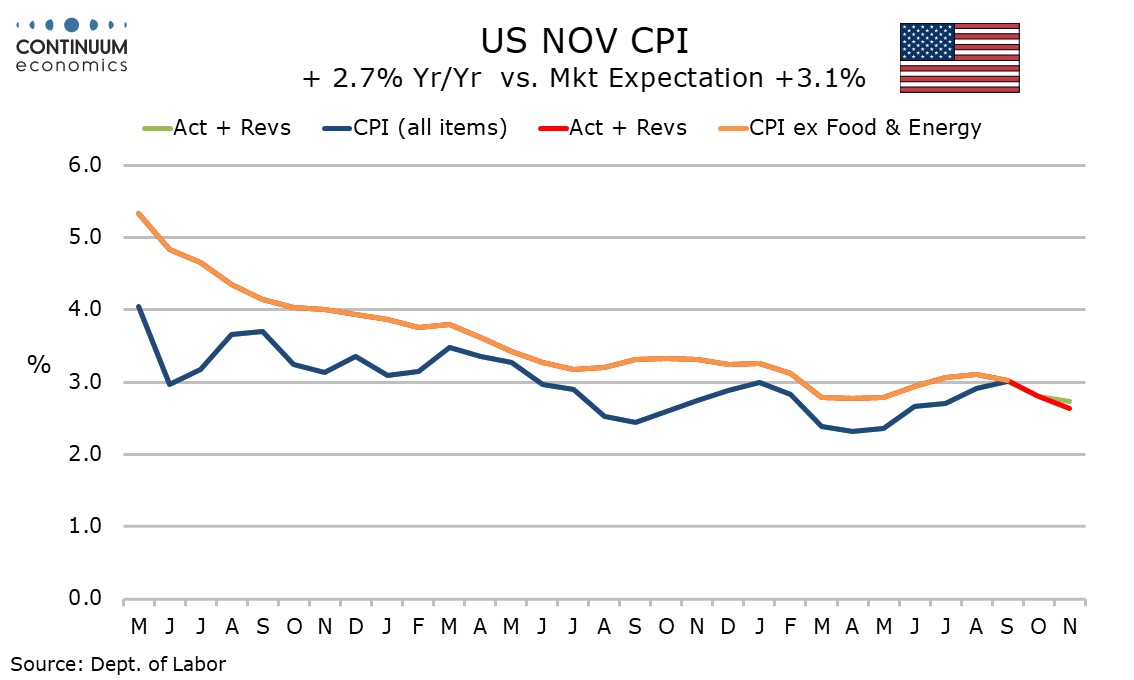

November’s CPI is significantly lower than expected, at 2.7% yr/yr, 2.6% ex food and energy, compared with 3.0% for both series in September (October data will not be released). November’s core CPI index is up only 0.16% from September’s, implying an average rise of less than 0.1% per month over the last two. Overall CPI is up by 0.20% over the two months, implying an average gain of 0.1%, though weekly data on gasoline prices suggested a dip in October and a rise in November, so perhaps CPI would have been unchanged in October and up by 0.2% in November.

The surprisingly soft data may reflect an easing of tariff feed-through, or pricing decisions being delayed until the Supreme Court delivers a verdict on the tariffs, or even pricing decisions simply being delayed until the New Year. The data is certainly significantly softer than expected. It may reflect a weakening consumer picture in Q4 restraining prices, though another possibility is that difficulties in measuring prices given the turmoil in government has the data under-estimated. Still, the data will be encouraging to the Fed doves.

Figure: Riksbank Policy Outlook

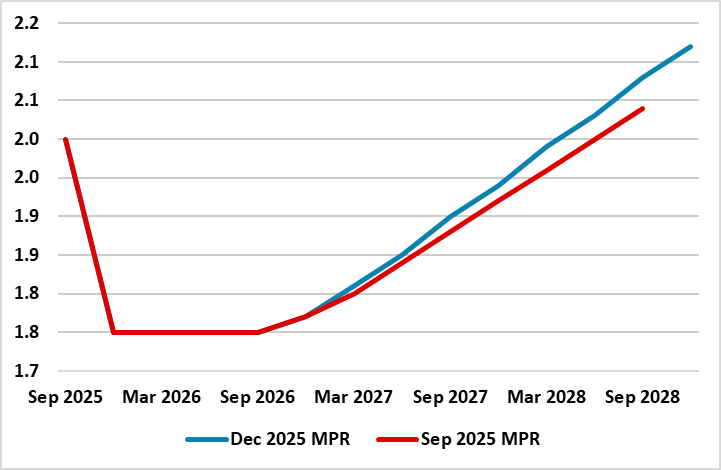

As widely anticipated, the Riksbank kept policy on hold with the key rate left (again) at 1.75%. It does seem as if the Riksbank Board is (very) pleased with the data flow since its last and very probably final rate cut on Sep 23. GDP saw a strong and unexpected Q3 showing of over 1% q/q while previously troublesome CPI data have softened appreciably thereby confirming (both our and Board) suspicions that the summer price spike was aberrant. Admittedly, that GDP pick-up may be aberrant too, not least given the still gloomy message from the Riksbank’s own business survey and what are still soft labor market and monetary numbers. Even so, the Board promise of no change for some time to come was repeated, this all the more notable given the updated projections, which while little changed, remained too optimistic in our eyes, especially regarding unemployment. Regardless, we still do not see any looming policy reversal, as we see this current policy rate (1.75%) staying in place through 2027, ie a little longer than the Riksbank (Figure).

Indeed, it now seems all the clearer that the CPI spike seen in the July data was aberrant even though it partly persisted into August – November data showed a very decisive drop for targeted CPIF inflation to 2.3% y/y, from 3.1% in October. The majority of this drop is explained base effect regarding electricity price. Even so, the estimate for CPIF excluding energy (CPIFXE) surprised to the downside, not only showing a resumption of gradual declines, but falling significantly to an 11-month low of 2.4% from 2.8% last month. Thanks to these declines, inflation fell back roughly in line with the Riksbank's forecast from its September monetary policy report. To us, the underlying picture is even more reassuring as smoothed adjusted m/m figures (not as prone to volatility via base effects) show most measures of underlying inflation ate rates consistent with, if not below, target.

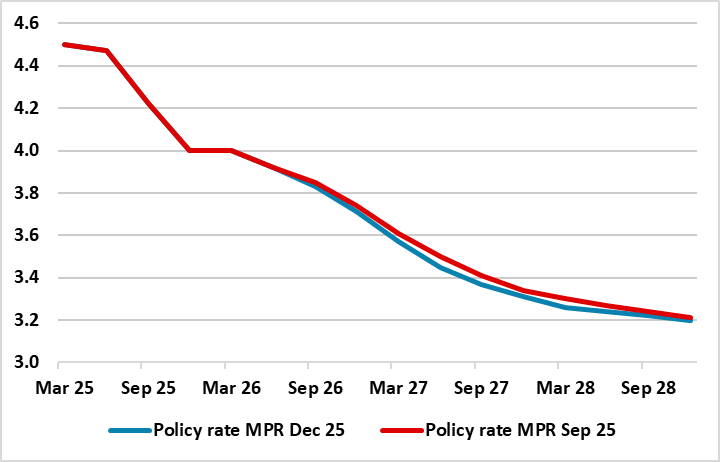

Figure: Norges Bank Policy Outlook

As expected, no change in policy and little shift in rhetoric and/or outlook was the message from the Norges Bank’s latest verdict. After two 25 bp cuts this year (to 4.0%), this month saw a second successive unchanged verdict with the policy outlook also retained (Figure). This was consistent with the Board’s repeated assertion that ‘the policy rate will be reduced further in the course of the coming year’. This December meeting came with both new forecasts and data, not least inflation and lending numbers, the latter possibly becoming a worry given the fresh slowing in corporate credit growth and weaker GDP backdrop. But with underlying inflation dynamics being friendly, we still think that the Norges Bank is being far too cautious as it plans to keep policy very restrictive through the projected timeframe out to 2028; we wonder why the Board therefore only sees inflation a little higher and only just approaching the 2% target by the end of that period.

Excessive inflation worries continue to dominate Norges Bank thinking. It sees 1-2 rate cuts next year and a further reduction to somewhat above 3% towards the end of 2028. Given this intransigence, we are a little less confident about the extent of easing into 2026 but envisage further 25 bp cuts every quarter through next year and then similarly into H1 2027. At 2.5%, that would still leave the policy rate still within the neutral rate range estimated by the Norges Bank. In other words, the Norges Bank will be merely taking its foot of the brake, rather than pressing on the accelerator. As for the inflation worries, running at a circa-3% rate, thereby still a full ppt above target, targeted (CPI-ATE) inflation is being boosted by stubborn services inflation. But this is largely offset by softer goods and imported inflation. Regardless, taking food out of the CPI-ATE, thus mirroring the core rate measure used by other central banks (ie ex food and energy), actually shows inflation running just above the 2% target.