China Data: Retail Sales and Industrial Production Diverge, but No PBOC Cut

With the Yr/Yr distorted upwards by the weakness in Q4 2022, the monthly fall of 0.1% in retail sales contrasts with a 0.9% rise in industrial production. Though this is mixed in November, the domestic demand picture is the most crucial as industrial production growth is dependent on demand. Thus we maintain the slower growth view into 2024 and still forecast 4.2% growth, though we have technically revised 2023 to 5.4% given the Nov industrial production data.

Figure 1: China Retail Sales Yr/Yr (%)

Source: Datastream/Continuum Economics

November data from China shows a mixed picture. Industrial production rose +0.9% on the month, while the Yr/Yr at 6.6% compared to expectations of 5.7% (the Yr/Yr is distorted upwards by the last phase of COVID lockdown in Q4 2022 and will come down noticeably in Q1). In contrast, retail sales fell 0.1% on the month and the Yr/Yr at 10.1% came in below expectations of 12.5%. The breakdown of the retail sales data shows that the housing sector remains a drag with construction material -10.4% Yr/Yr and Furniture sales at a weak 2.2%. Restaurants and tourism led the way in the Yr/Yr data, but this will likely fade in 2024 as the post COVID pent up demand wave is tempered.

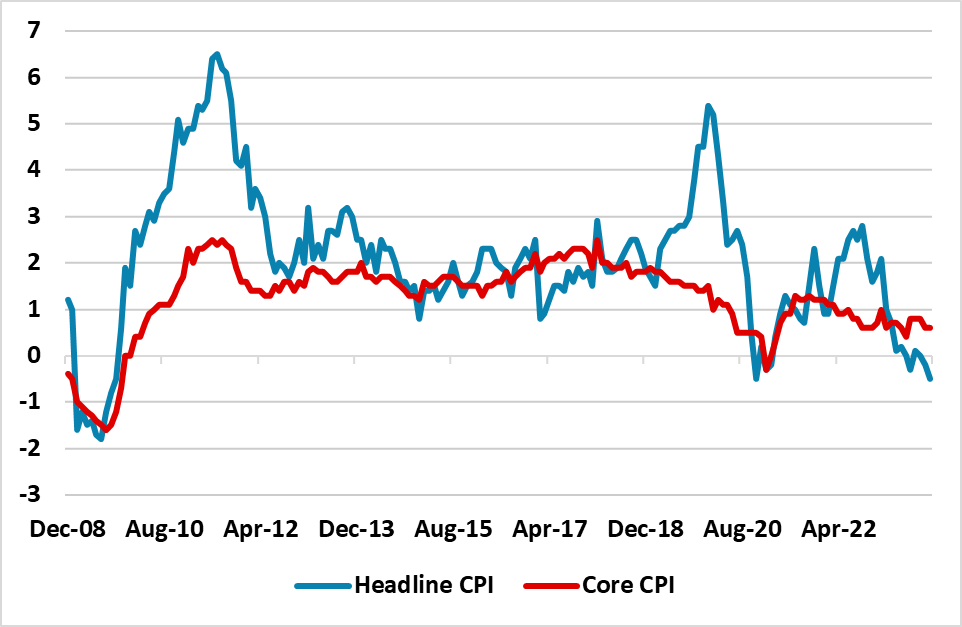

The November industrial production means that Q4 GDP will be around 6.0% Yr/Yr now and so we are revising up our 2023 GDP forecast from 5.2% to 5.4%. However, this is largely mechanical and does not change our assessment that economic momentum is slowing. A surge in industrial production is not sustainable without domestic consumption or exports picking up. The consumer is worried about long-term finances and outside of pent up demand the picture is soft. Meanwhile, global companies continue to move away from China centric supply chains and exports are not going to boom with a sluggish 2024 global growth picture. The excess of industrial production is also causing disinflation, with the November core CPI remaining at a low 0.6% Yr/Yr and well below PBOC desires.

Additionally, China policymakers appear to be less willing to support the economy than in July, with the latest Politburo statement less worried about the economy than in July. No cut in medium-term facility (MTF) rate today was widely expected, but the PBOC Yuan800bln 1 year injection of funds via MTF could be a substitute for an early RRR cut and an RRR cut could be delayed now to late Q1. Additionally, PBOC is guiding banks towards quality lending and supporting growing sectors (e.g. tech) rather than old sectors (e.g. property). This is tricky to pull off and will likely mean credit growth slowing to below 10%, which will sap economic momentum. We stick with the forecast of 4.2% growth in 2024.