FX Weekly Strategy: APAC, May 5th-9th

Central bank meetings unlikely to deliver surprises

Equity market recovery may be overdone

JPY has potential for gains

SEK and CHF look expensive

Central bank meetings in the US, UK, Sweden and Norway looks to be the main events of the week, although it seems unlikely that any will deliver a surprise. The Fed is priced to leave rates unchanged (probability 97%), while the BoE is expected to cut 25bps (probability 94%). The Riskbank is perhaps the most uncertain, with the market seeing a 27% chance of a cut, while Norges bank is seen as nearer a 13% chance.

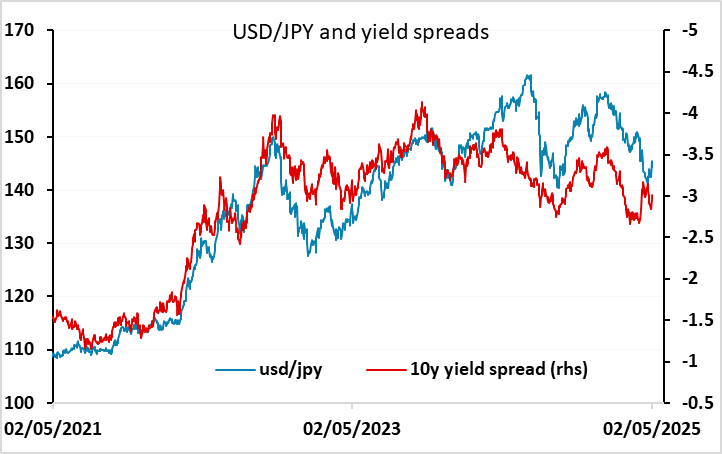

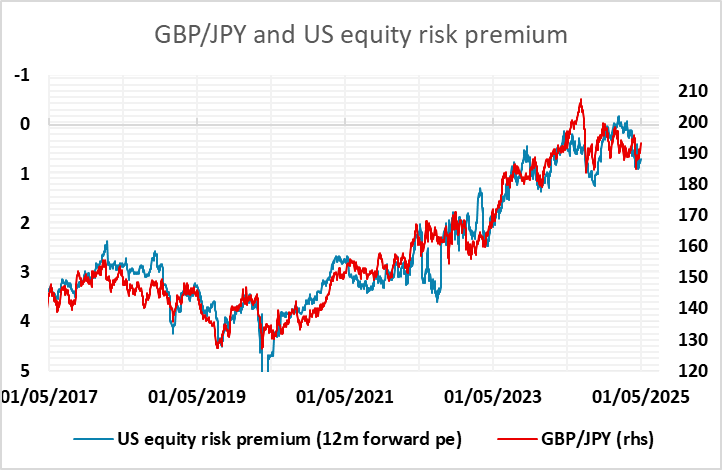

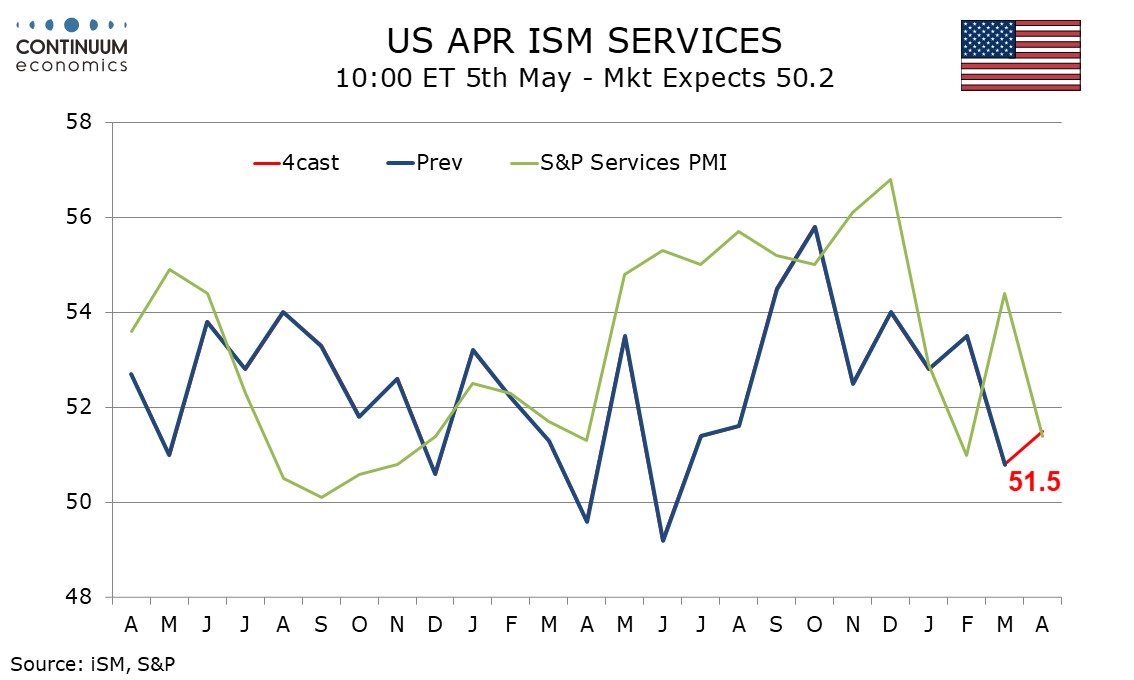

The FOMC meeting seems unlikely to clarify matters very much, and from the US perspective, the ISM services survey may be more important. The ISM manufacturing index was a little stronger than expected, and we expect the services survey to show a modest bounce. However, with the S&P 500 now back to where it was at the time of the tariff announcement on April 2, it’s hard to see much upside even if the data is less weak. There may be concessions made, trade deals done and tariffs reduced, but even then there will be damage done, and that doesn’t now seem to be priced into the market. We therefore see downside risks for the USD against the safe havens, particularly the JPY, which has fallen back in response to the risk recovery seen in the last week. USD/JPY still looks very expensive from a fundamental perspective, and yield spreads point to downside risks. JPY crosses may be even more vulnerable, as the correlation with equity risk premia already suggests the JPY is on the low side, and from here we see scope for risk premia to rise.

GBP/JPY is a case in point, and will be more in focus with the BoE expected to cut rates this week. While GBP has benefited somewhat from the better UK growth numbers in Q1, this seems unlikely to continue through Q2 and beyond, judging by the latest survey data and the expected hit from tariffs. EUR/GBP has already risen more than suggested by the moves in yield spreads as the EUR has benefited from some strategic shift away from the USD and a less risk friendly environment, so GBP may not be particularly vulnerable against the EUR unless we see a significant deterioration in risk sentiment. However, GBP/JPY has hit significant technical resistance levels above 193 and the correlation with risk premia suggests scope for declines from here.

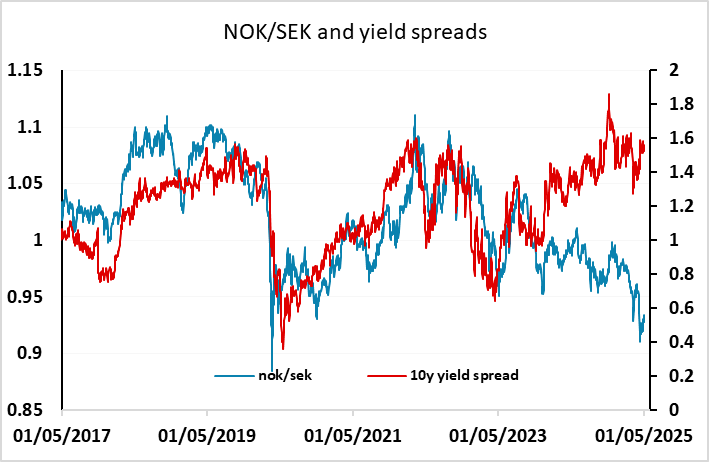

We don’t expct either the Riksbank or Norges Bank to cut rates, and with a larger risk seen in Sweden this may suggests a mild benefit for the SEK. But the SEK already looks quite expensive relative to the yield spread correlation with the EUR and the NOK. Indeed, the SEK and the CHF have been the two best performers since the tariff announcement. Both look expensive here and both may give up some ground to the NOK, especially if we see risks appetite hold steady.

Data and events for the week ahead

USA

With only a limited data calendar, Wednesday’s FOMC meeting is the highlight of the week’s US calendar, though policy looks set to remain unchanged as the Fed awaits further data in a highly uncertain situation. Downside risks to growth and upside risks to inflation will be recognized, though Powell is likely to make it clear that forthcoming meetings will be live and dependent on data, and that will sustain market hopes for easing.

On Monday we expect April’s ISM services index to correct higher to 51.5 from March’s weaker 50.8. On Tuesday we expect a record trade deficit of $140.4bn in March, up from $122.7bn in February. Wednesday sees March consumer credit. Weekly initial claims on Thursday are likely to correct lower from a preceding post-Easter spike concentrated in New York. Q1 productivity and costs and later March wholesale trade are also due. Friday sees no significant data but a heavy schedule of Fed speakers. Williams, Kugler, Goolsbee and Barr are all due to speak, while Williams, Waller, Musalem, Hammack and Bowman will all appear on a panel.

Canada

Canada’s key release will be April’s employment report on Friday. Monday sees April’s S and P services PMI, while Tuesday sees March’s trade balance and April’s Ivey manufacturing PMI. Thursday sees the Bank of Canada’s financial stability report.

UK

The Bank holiday starts a week dominated by the BoE decision due on Thursday. It has been relatively clear that MPC divisions that reflected increased uncertainty and enough for the BoE to have altered its rhetoric recently to stress the need for policy to be framed carefully as well as gradually. Indeed, this shift very much pointed to the MPC majority envisaging rate cuts no faster than every quarter this year and a little further into 2026 but with no pre-set path being considered – at least openly. This would be consistent with a 25 bp cut (to a 2-year low of 4.25%) when the next BoE decision arrives on Thursday, this even more likely given the added downside risks that the UK is facing over and beyond that from a global trade flare-up. What will be important is how the updated Monetary Policy Report pares back its inflation surge for this year both due to lower energy prices and these added downside risks paring back growth ahead, even given what seems to be some resilience evident in official activity data in early 2025.

More BoE insight will come from speeches from Governor Bailey and Chief Economist Pill both on Friday. The BoE may take note to of any signs of a faltering housing market in RICS survey data (Thu), this possibly also evident in Construction PMI data (Wed) they arriving a day after the revised composite figures.

Eurozone

A far from busy week data-wise sees retail sales data (Wed), important to assess to what extent the consumer may be helping shore up recent solid EZ GDP numbers. But cracks remain as may be seen in Construction PMI data (Wed) they coming a day after the revised composite figures. Germany sees March industrial data where production figures (Thu) may see a boost ahead of US tariff imposition but where orders figures (Wed) may do the very opposite.

Rest of Western Europe

There are few key events in Sweden, most notably the Riksbank decision (Thu). A very likely stable policy decision would be the second in succession and where the Riksbank has now underscored that, with the policy rate now at 2.25%, this may be the end of the easing path. But amid the stronger currency, with real activity signs having largely disappointed even before tariff threats materialize, this time the Riksbank may be a little more open about the possibility of additional rate cuts. This would be even more likely if the April CPI data due the day before the decision add to signs that the inflation pick-up early in the year may have been a blip. We see the downside surprise in March numbers being consolidated

Norway too has policy update on Thursday. It does seem very likely that the Norges Bank will again keep policy on hold, albeit with a risk that if it has access to what may be much friendlier CPI data officially due the day after, or could ease, or at least be more explicit about when the rate cut cycle may begin. Indeed, we see CPI-ATE inflation down 0.3 ppt to a 3-mth low of 3.1%. Regardless, in March, the Board kept the policy rate at 4.5% on the back of inflation having been markedly higher than expected and where wage growth in 2024 turned out higher than projected. But in a clearly far from hawkish signal, policy easing is still seen starting this year and where the outlook still sees similar easing cycle to that previously envisaged but merely some 4-6 months later. With no new forecast due, on balance this outlook is likely to be retained.

Otherwise, in Switzerland, Monday sees CPI data likely to chime with the 0.3% SNB projection for the current quarter. The day after SNB results President Schlegel speaks, possibly offering some policy insight in lieu of the strong Franc, with any intervention speculation possibly fanned by SNB reserve data on Wednesday.

Japan

Labor cash earnings will be released on Thursday but it will not be reflecting any changes brought by tariffs as its reference point is March. Thus, it is likely to points toward another strong wage gains. The BoJ seems to be pessimistic about the trajectory of wage growth due to tariff impact, which will be revealed in the coming data releases. We also have the BoJ minutes on Wednesday which may provided more cues on their economic outlook.

Australia

Mostly tier two data for Australia next week. PMIs on Monday and Tuesday will not be as importation as the TD inflation gauge on Tuesday. The Q1 CPI has stayed below 2.5% while trimmed mean trade lower into the target range, any inflation expectation data will be more important going forward.

NZ

Labor data on Tuesday is the only release for NZ next week.