This week's five highlights

The Hope for A Peace Deal in Ukraine Seems Not Close

China South China Sea Tensions

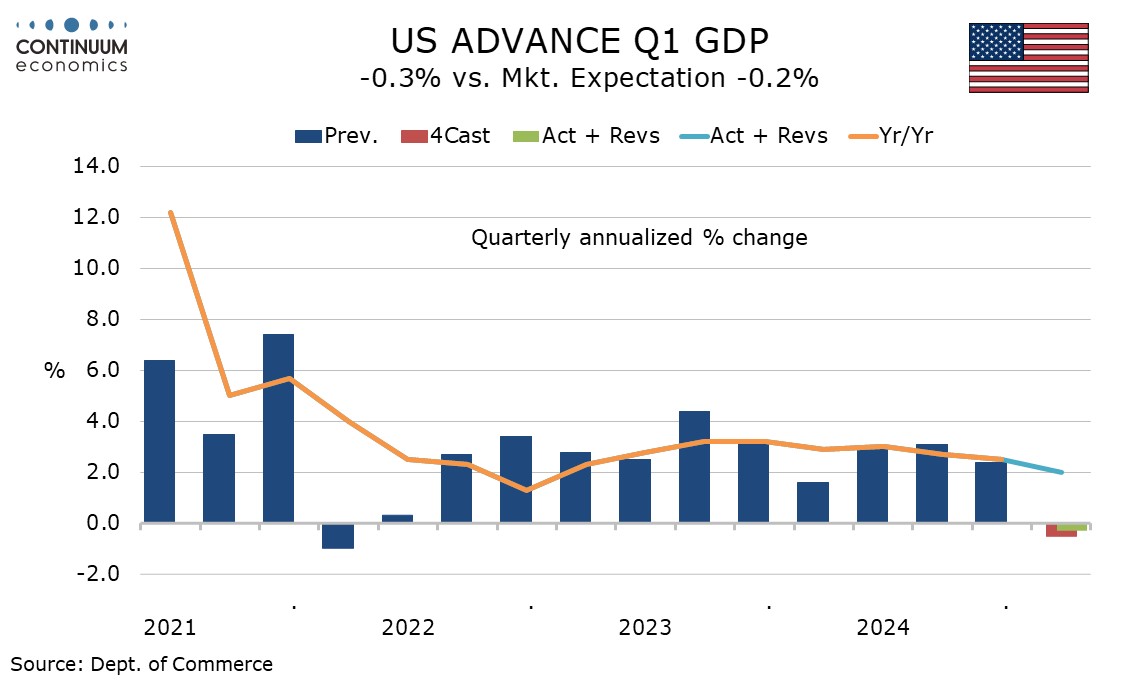

U.S. Q1 GDP dips while Imports Surge goes into Inventories and Business Investment

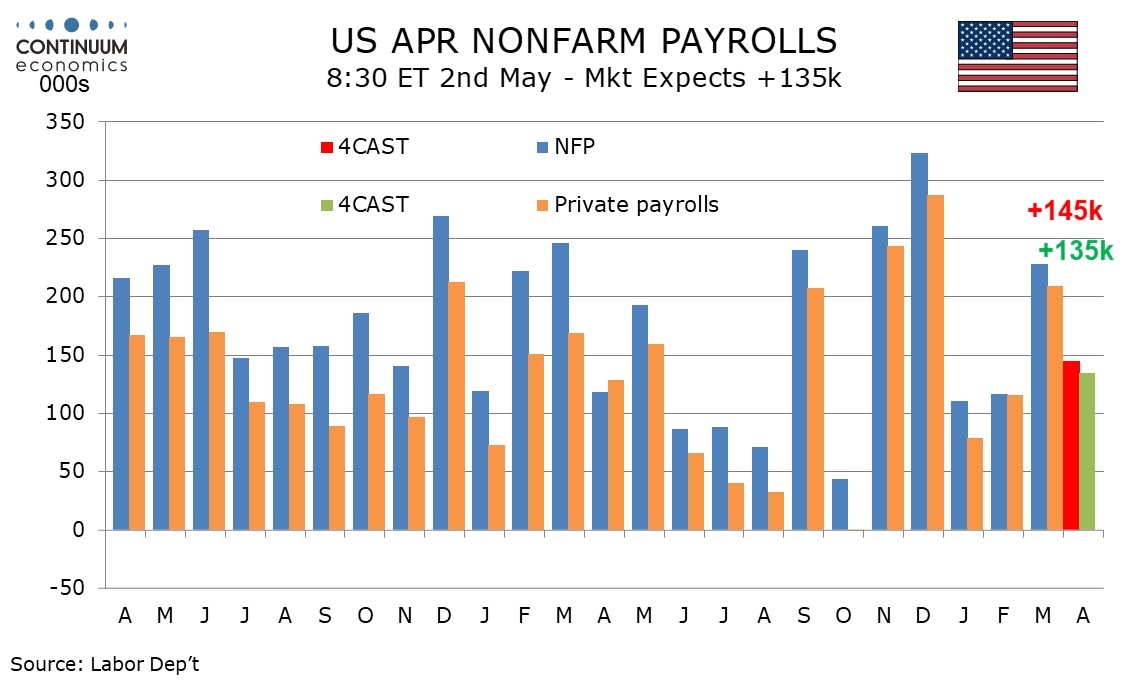

U.S. April Employment Will Provide few Clear Signals for Labor Market Weakness

BoJ Halved 2025 GDP Forecast

We have lowered a Russia-friendly peace deal following a cease-fire to 50% probability but have increased the alternative scenario of war continues to 50% probability in Ukraine as negotiations to end the war in Ukraine continue slowly. In the former scenario, we envisage Russia will continue to annex areas in and around four Ukrainian oblasts that it occupied, no NATO membership for Ukraine, and no European foreign troops in Ukrainian territory. Our second scenario is based on the war continuing after ceasefire talks fail since President Putin insists on his peace terms. The odds are that the U.S. will cut off financial and military aid. We feel the Kremlin currently holds the cards and President Putin will likely drag his feet to get a better peace deal terms before a ceasefire, causing a prolonged peace process taking months (maybe years) for sealing a full scale peace deal.

We foresee two major scenarios in Ukraine. First one is a Russia-friendly peace deal (50% probability) that Russia continues to annex areas in and around four Ukrainian oblasts that it occupied, no NATO membership for Ukraine, and no European foreign troops in Ukrainian territory. It is now clear that Russia won’t make any form of territorial concessions in Ukraine and Moscow will retain the territory it has captured so far, including Crimea. (Note: President Trump recently said he thinks Ukraine is ready to give up Crimea, demonstrating U.S. would also agree Ukraine losing part of its territory to Russia as a part of peace deal).

Despite the direct negotiation process between U.S. and Russia continuing, the process is going slower-than-expected due Russia side stubbornness. We envisage, at some point, the economic and military cost of the war will push President Putin to accept a form of ceasefire followed by a peace deal that lifts sanctions and allows time for Russia to rebuild despite the last three months showing that Moscow will resist until Russia gets what it really wants as it holds the cards. We know President Putin does not want to directly engage with President Zelenskyy signaling Zelenskyy could be forced to step down after the cease-fire will be in place. (Note: The Kremlin recently emphasized there are no concrete plans in place yet for direct talks between Kyiv and Moscow). It is now apparent that Russia wants the outline of a detailed peace deal agreed before a ceasefire.

Second scenario is based on the war continuing (50% probability) after talks fail since Putin insists on his peace terms. Taking into account that President Trump is not willing to support Ukraine as Biden did, Europe could step up and help Ukraine financially and militarily, but this won’t fill the gap of the U.S. – especially military intelligence. Additionally, European countries ae more focused on increasing their own military spending to defend the European soil as U.S. support declines. In the meantime, we foresee Ukraine will probably continue to lose more ground to Russia since it lacks military equipment and manpower, with Russia gaining more land and a weaker Ukraine. Europe could try to fill the U.S. financial gap for a number of years, but without U.S. military support a Ukraine win or stalemate will be almost impossible. (Note: Freezing front lines as discussed last week can also happen for some time, but it remains unclear what other demands Putin may present while military experts consider any concessions could be a tactic to draw President Trump into accepting broader Russian terms).

Figure: China South China Sea Territorial Claims

We see recent China activity as part of the normal grey warfare for long-term influence in the South China sea. It has involved the use of China coastguard and militia fishing boats rather than China PLA Navy, though the risk of escalation between the Philippines and China remains. China likely wants to see if Trump will trade Taiwan security for trade in any future trade negotiations, while the current tariffs against Asian countries allows a window to gain ground with Asian neighbors.

China coastguard have claimed the tiny Sandy Cay island over the weekend (here), which has caused further tensions with the Philippines. One question is whether this is just normal grey warfare by China in the South China sea or whether China is trying to test the Trump administration’s willingness to get involved as a proxy for any future China/Taiwan clash.

China has many long-running territorial disputes in the South China sea and has built military and aircraft bases on a number of the islands close to and in disputed territory (Figure). China ambitions are in terms of natural resources and fishing in the area, but of greatest importance is the huge flow of global shipping through the area and on via the straits of Malacca. However, tactical clashes from China have to be careful to avoid a strategic backlash among Asian countries, with the 2022 Philippine’s election has seen a swing back to a pro U.S. government.

The 0.3% decline in Q1 GDP is in line with expectations that were downgraded from a marginal increase after yesterday’s sharp rise in March’s advance goods trade deficit. A 3.5% rise in the core PCE price index is stronger than expected. While the Q1 data does not tell us very much about Q2, the stagflationary risks are real.

Detail shows a massive 41.3% rise in imports, which with exports up by a modest 1.8% means a negative contribution of 4.83% from net exports. Some of the import surge went into a large inventory build-up, which added 2.25% to GDP. Final sales to domestic buyers (GDP less inventories and net exports) rose by an in line with trend 2.3%, while final sales to private domestic buyers rose by a healthy 3.0% with government weaker than expected at -1.4%. The government weakness was led by a fall of 8.0% in defense following three straight strong gains. Federal nondefense fell by 1.0% while state and local rose by a below trend 0.8%. A 1.8% rise in consumer spending was a 7-quarter low, though stronger than expected with the upside surprise largely on a 2.5% rise in services. Goods rose by a modest 0.5%, after having been hit by bad weather in January. Real disposable income outperformed spending with a rise of 2.7%, but was supported by some one-time increases in government benefits.

Outside inventories, the imports surge appears to have gone into a strong rise in business investment, which rose by 9.8%, led by a 22.5% surge in equipment which added 1.06% to GDP. Also lifting business investment was the end of a strike at Boeing, which contributed to a decline of 8.7% in Q4. Business investment in structures was subdued at 0.4% but intellectual property was solid at 4.1%. Housing investment rose by a modest 1.3%. With so many special factors the Q1 detail does not tell us much about Q2. Imports will surely correct sharply lower but the Q1 gains in business investment and inventories will probably do so too. That Q1 consumer spending was restrained by weather, underperforming real disposable income, suggests the consumer still has some underlying momentum, but if employment growth slows and inflation rises in Q2 the consumer fundamentals could deteriorate quickly. That will be key for Q2.

We expect a 145k increase in April’s non-farm payroll, with 135k in the private sector, the latter equal to the Q1 average. Initial claims were showing no signs of labor market weakness in the payroll survey week, with a bounce in the latest week not yet a clear change in trend. We expect unemployment to correct lower to 4.1% after a March rise to 4.2%, and an in line with trend 0.3% increase in average hourly earnings. January and February saw below trend data with bad weather probably a factor followed by an above trend March as weather improved. The 3-month averages of 152k overall and 135k for the private sector are probably representative of trend and we expect April data to be in line with that. The overall gain may be slightly below its 3-month average as Federal government layoffs pick up, but we still expect hiring at the state and local level to outweigh declines at the Federal.

Tariffs are downside risk with manufacturing, where we expect a 10k decline, but the impact of tariffs should be limited so soon after April's announcement. A late Easter could even inflate retail employment in this report. Seasonal adjustments get tougher in the spring with increased hiring assumed, but near term downside risk looks modest. In addition to initial claims remaining low through the payroll survey week, the Dallas Fed’s weekly economic activity index remains resilient. ADP weakness was led by education and health, a sector that has been strong in recent payrolls and is unlikely to be sensitive to tariffs.

The BoJ has kept rates unchanged at 0.5% in the May meeting with significant change to economic forecast. The BoJ is caught between the rock and a hard place when they are seeing inflation to continuously heating up during a time of uncertainty from U.S. tariffs. The BoJ sees great downside from tariff as GDP forecast for 2025 has been halved from 1.1% to 0.5% and 2026 from 1% to 0.7%. Interesting enough, core CPI and core-core CPI are revised individually. Core CPI has been revised lower, from 2.4% to 2.2% in 2025 and from 2% to 1.7% in 2026; core-core CPI has been revised higher in 2025 from 2.1% to 2.3% and lower to 1.8% in 2026. It suggest the BoJ is forecasting the tariffs may impact the current trajectory of wage growth.

The economic outlook is tilted towards the downside but it does not seem to derail BoJ's plan to further tighten. They continue to see higher inflation expectation and inflation to be sustainably above target rate in the second half of forecast period, which is likely in 2027. The BoJ is seeing short inflation to be pushed lower by energy prices and GDP growth. The market has not priced in any hike this year and may not be changing that view by much after the May meeting.