USD, EUR, JPY, AUD, GBP flows: Awaiting US jobs data

German production and trade data has little impact. JPY stays firm, AUD supported by better risk tone

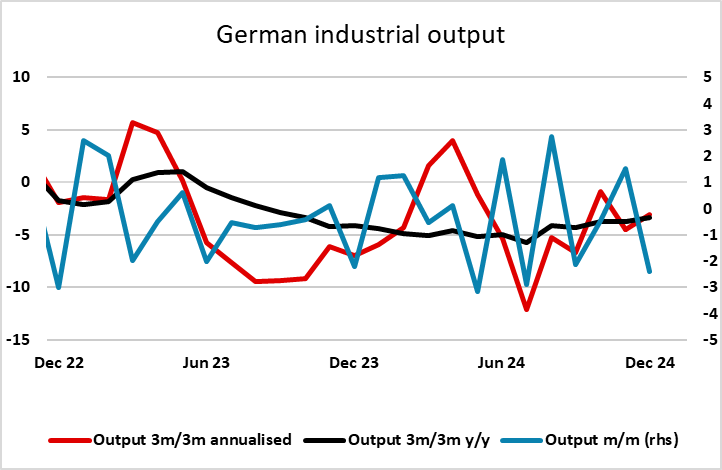

German December industrial production data came in much weaker than expected, falling 2.4% m/m, but mirroring yesterday’s orders data, the weakness followed strength in November, and the underlying trend remains quite flat. The German trade surplus for December was a little larger than expected at EUR20.7bn. There has been no reaction in EUR/USD, which continues to hover just below 1.04, close to its level a week ago before the imposition and retraction of tariffs on Canada and Mexico.

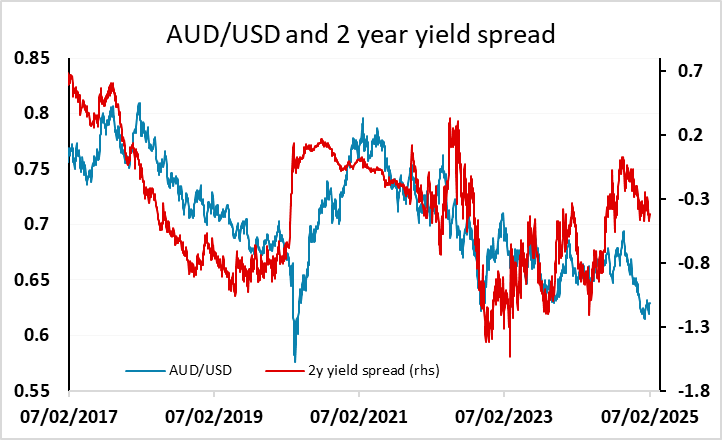

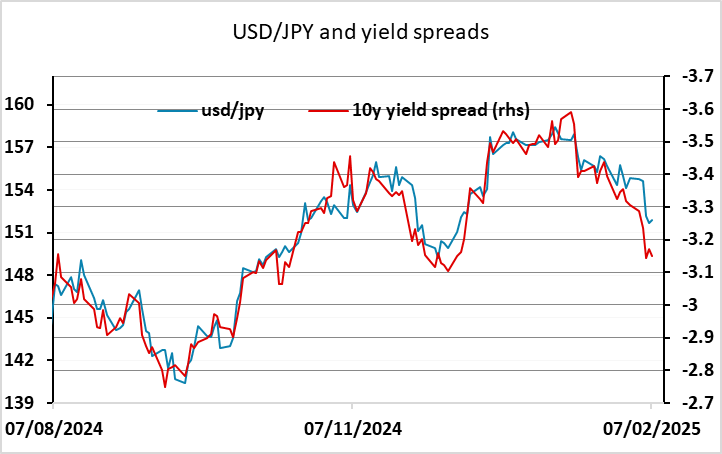

There isn’t a lot on the calendar ahead of the US employment report. The JPY remained strong overnight, helped by strong Japanese household spending data, and yield spreads still suggest some downside risk in USD/JPY, while somewhat better Asian equity sentiment is also encouraging for AUD. The picture for European currencies is more uncertain, with yesterday’s downgrading of UK growth forecasts by the Bank of England limiting any enthusiasm for the pound despite higher inflation forecasts.