EZ HICP Preview (Aug 30): Disinflation Resumes?

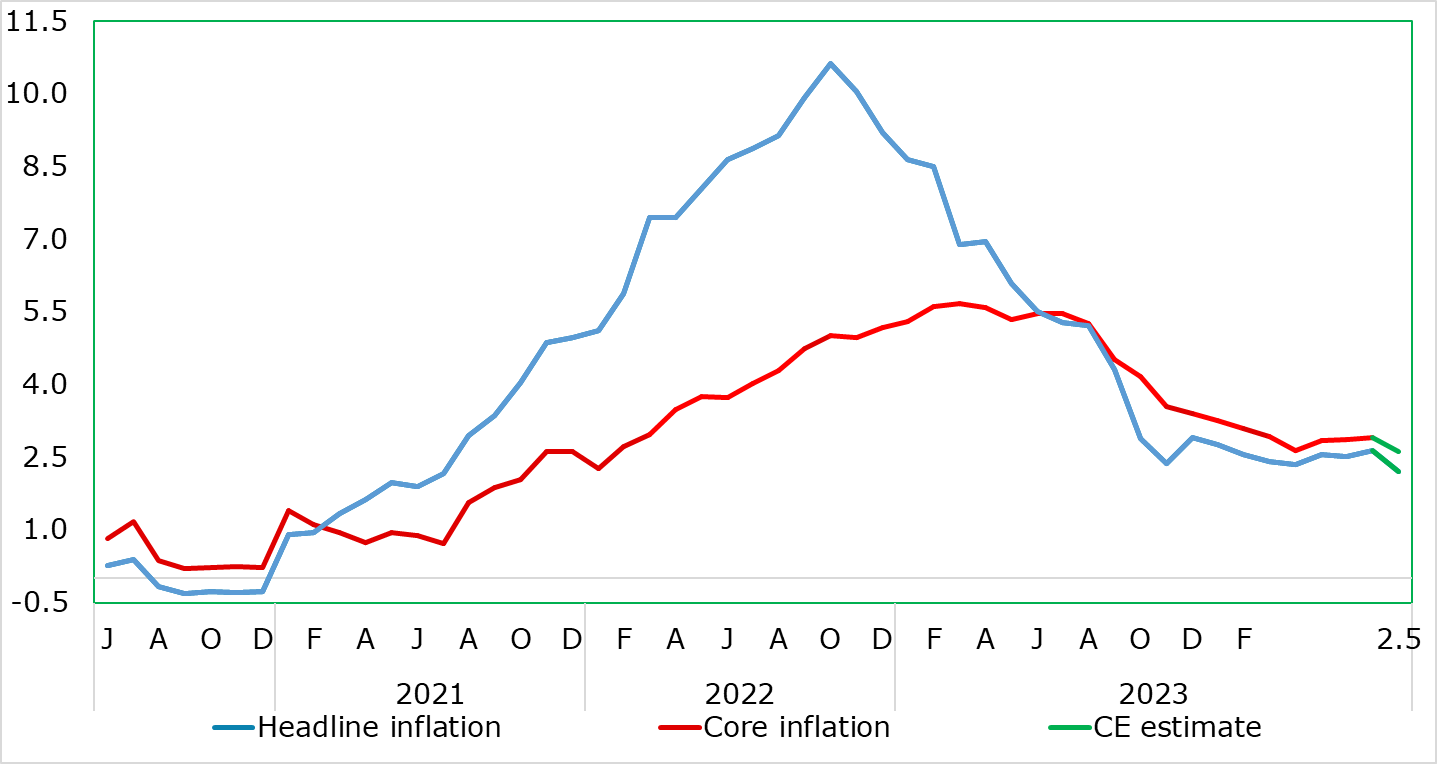

It could be argued that the EZ disinflation process has stalled given that no further drop beyond that to 2.4% in April has occurred. Indeed, somewhat unexpectedly, headline HICP inflation rose a notch to 2.6% in July, reversing the slide seen in June. This is even the case regarding the core rate which stayed at 2.9%, thereby still 0.2 ppt above the April low, with services inflation still showing apparent resilience after slipping a mere notch to 4.0%. But we see abundant signs of the disinflation process in survey data and with the ECB’s own measures of persistent inflation pointing very much to already below target inflation. These considerations are all the more important as the ECB hierarchy have made clear policy will be shaped by an array of data rather than particular data points! Thus it may be important that the August HICP flash sees the headline rate resume its fall with a drop to 2.3% on the cards ahead of what may be a rate back at target in September

Figure 1: Headline and Core to Fall Afresh?

Source: Eurostat, CE

The July rise in the headline was seemingly driven by a small rise in fuel costs, but this already seems to have unwound given the fall back in oil prices. It was partly offset by slightly lower food inflation. Services inflation edged down, but there are more promising signs in survey data suggesting that this resilience will soon buckle.

As a result, we still see headline and core inflation dipping but possible not to below target in coming month, but with the former very near, if not at, 2% in September before base effects take it higher by year-end – this occurring even with little further fall in services inflation.