JPY flows: JPY continues to weaken

JPY continuing to weaken as US equity futures hit new highs

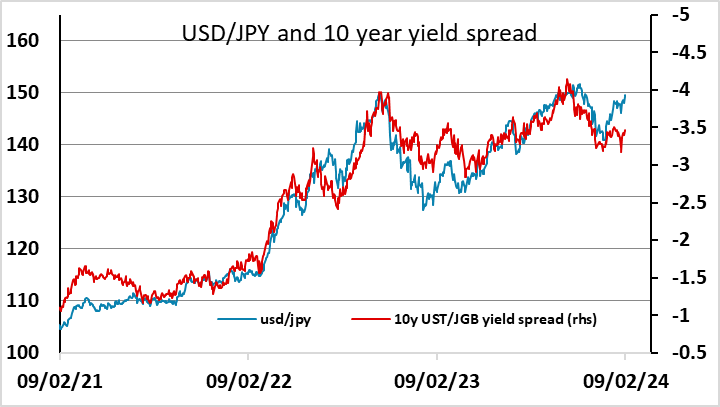

USD/JPY making news post-November highs this morning, tracking the surge to new all time highs in US equity futures. This is a risk/carry trade also driven by momentum and technicals, but has little basis in fundamentals. The JPY remains extremely cheap, especially in real terms, and USD/JPY has a strong historic correlation with yield spreads, but on that basis looks significantly above fair levels. There is an important distinction between a carry trade and yield spread correlation trade. USD/JPY does tend to move with yield spreads, but there is little historic evidence that USD/JPY rises purely because of the attractive rate differential in favour of the USD. There may be short periods when this is the case, characterised by strong risk appetite and low volatility, but historically they don’t last.

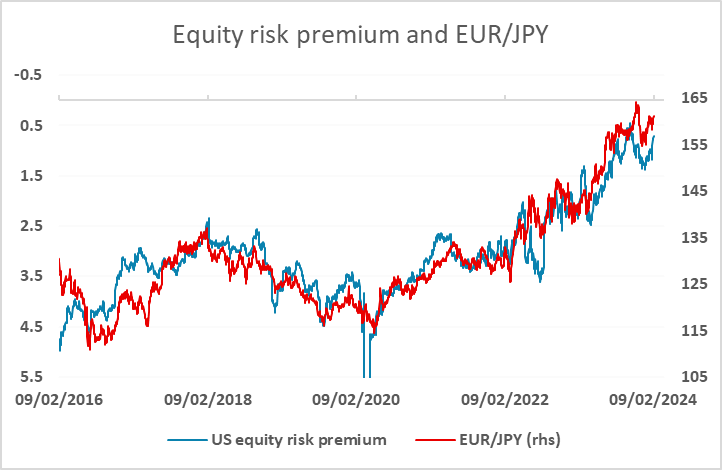

At the same time, there is a strong historic correlation between JPY crosses and equity risk premia, so that rising equities in a stable or rising yield environment correlate with JPY cross weakness. Current JPY weakness is being driven by this dynamic, so that JPY cross declines look more robust than JPY declines against the USD. Even so, the strength of US equity markets and the low level of equity risk premia continues to look hard to justify in a world of close to full employment in the US, which makes above trend growth very hard to achieve. So we remain wary of JPY weakness, but at this stage some negative equity news or some indication of tightening intentions form the BoJ look necessary to halt the trend.