German Data Review: Inflation Edges Higher Ahead of Fresh Fall in Coming Months?

Base effects have caused the German disinflation process not to be smooth and this was even more clearly the case in the preliminary July data. This saw the headline HICP rate rise and unexpected 0.1 ppt to 2.6, unwinding a third of fall seen in June. Details from similarly sized rise in the CPI suggest stable services and core inflation but with less negative energy and slightly higher food inflation causing the higher headline outcome. To what extent both food and services were pushed higher by the European Football Championship is unclear, but the higher German HICP is offset by weaker Spanish numbers already reported.

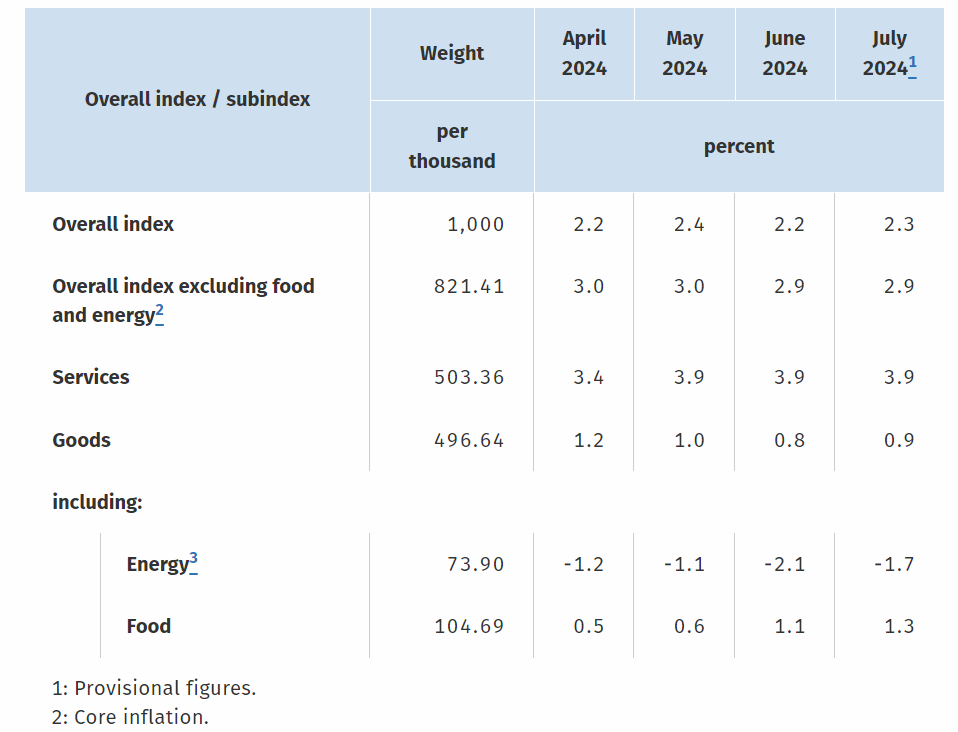

Figure 1: Inflation Still Bumpy?

Source: German Federal Stats Office, CE

Regardless, looking ahead, the disinflation trend is seen continuing, mainly due to slower core goods and energy prices. As a result, headline inflation is likely to fall to around 2% in the autumn but perk back to possibly above 2.5% by end-year due to energy base effects.