USD, EUR, JPY flows: USD soft on lower US yields

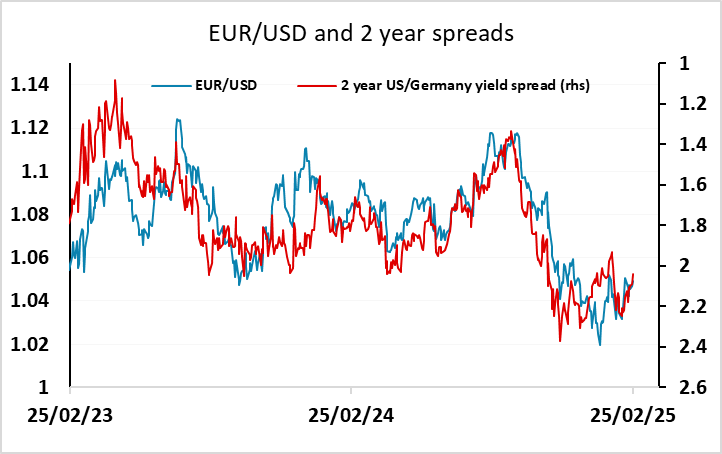

Lower US yields are driving the USD lower, as expectations of tax cuts and government spending are being revised down, while there are also uncertainties around tariffs and QT.

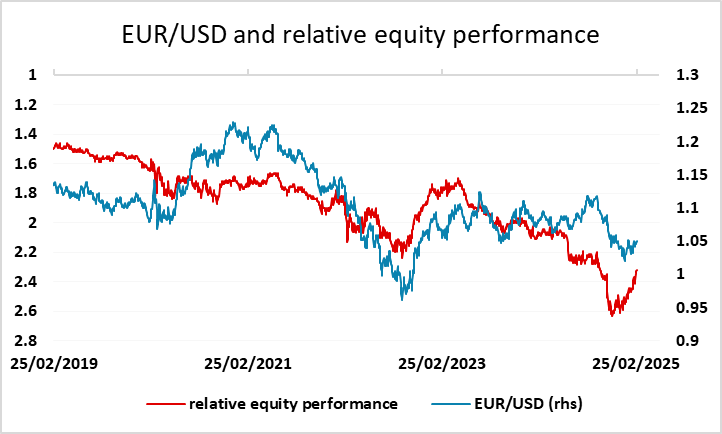

Lower US yields are putting general downward pressure on the USD, which for the moment is favouring the European currencies slightly more than the JPY or the commodity currencies. There may be some support for the European currencies from the perception that more defence spending will be seen from Germany, and perhaps others as part of the new order of things once the Ukraine peace deal is done. But the strength is probably more due to outperformance of European equities which have now recovered all the post-US election losses relative to the US. This may also reflect some switching from fund managers towards the more reasonably valued European equity market, some of which may not be currency hedged.

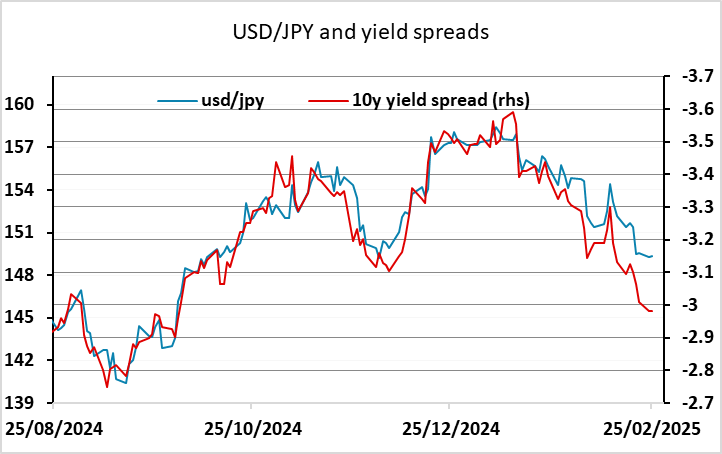

However, the general USD weakness is mostly about lower US yields. This is down to a combination of reduced expectations of a fiscal boost from tax cuts, increased expectations of DOGE related spending cuts, and some potential for the Fed’s QT to end sooner than expected. The tariff impact is unclear, both because no-one is sure whether tariffs will be imposed, and if they are when, on who and how large, and because any tariffs will be growth negative as well as raising inflation. The data has also started to edge softer, judging by services PMIs and confidence data. For now, it seems the economic optimism that accompanied the Trump victory is fading. We still don’t see huge upside for the EUR in the short run, as the European economy remains very sluggish and a weaker equity outlook in the US will also cap gains in Europe. USD/JPY still looks to have significant downside potential if it can break the 148.65 low from December 3. If equity markets remain resilient, we would also expect AUD strength on a break of 0.64.