EUR, JPY flows: EUR vulnerable after weak German retail sales. JPY too weak

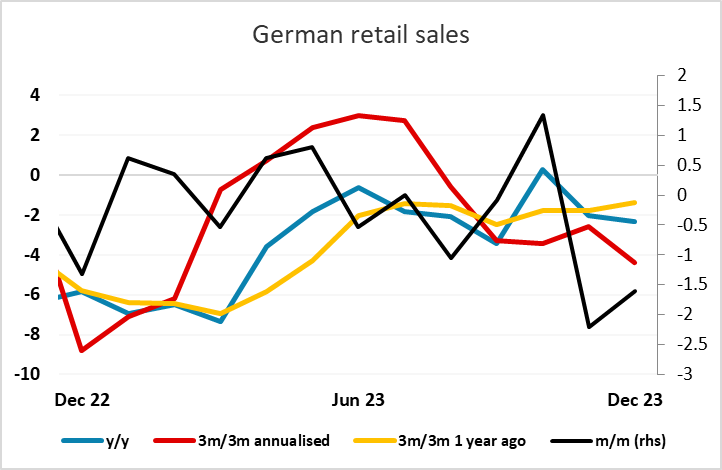

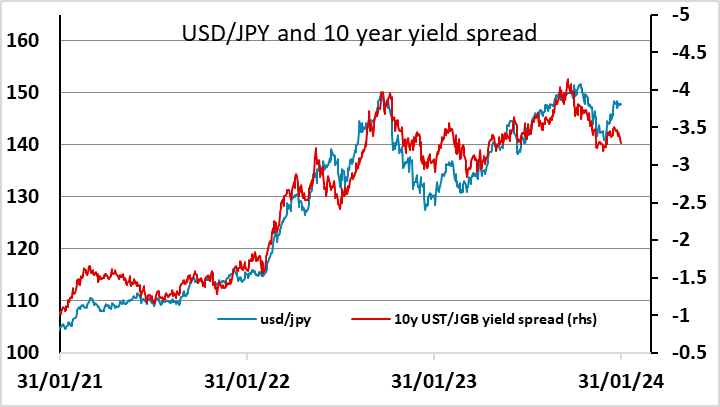

German retail sales show deteriorating underliyng trend, but EUR/USD downside likely depends on the FOMC. USD/JPY continues to defy the decline in yield spreads.

Wednesday kicks off with another weak German retail sales number. The December data showed a 1.6% decline m/m, following the 2.5% decline seen in November. The data is volatile, but even though these last two numbers follow a 1.3% rise in October, the underlying trend looks to be weakening, with the annualised 4.4% decline over the last 3 months the weakest since February 2023. EUR/USD hasn’t shown any significant reaction, and is likely more focused on the preliminary German and French CPI data due this morning, and the FOMC meeting later. But it is increasingly hard to ignore the weakening trend in the German economy. While the inflation numbers look to be being largely determined by supply factors, the impact of the ECB’s tightening on demand is being seen in the real sector numbers, and will only likely show up in inflation further down the road. While other Eurozone members (notably Spain) have shown stronger growth in the last quarter or two, the weakness of the German economy and the broad weakness in money and credit data should be an indication to the ECB that rate cuts are necessary sooner rather than later. Even so, while the ECB is reluctant to give any such indication at this stage, it is already priced into the market, with an April rate cut more than 90% priced in. So for now EUR/USD should hold above 1.08, with the US FOMC later more likely to change spreads via changes in US rate expectations. This risk for US rates looks to be on the upside in the wake of the run of strong US numbers we have seen in recent weeks, so the risk for the USD should also be on the upside, at least against the EUR.

USD/JPY is a different story. While EUR/USD looks broadly consistent with recent moves in yield spreads, USD/JPY continues to hover close to 148 despite yield spreads moving steadily lower and suggesting scope for USD/JPY to fall close to 140 based on the correlation seen in the las few years. If the FOMC triggers a rise in US yields, we may see some knee jerk positive reaction in USD/JPY, but the level of spreads suggests that any rise will be temporary. If the FOMC doesn’t impact yields, or yields move lower, there is scope for a sharp decline in USD/JPY from here.