USD, JPY flows: FX steady but USD downside risks rising

USD steady in quiet trading but rising JGB yields and softer US data suggest USD/JPY downside risks

It looks set to be a quiet Monday, with not much in the calendar. The US CPI and retail sales data on Wednesday will be the main focus of the week, and there is other significant data with the UK labour market data, Swedish CPI and Japanese GDP. But there is little of note today, and FX markets are not much changed from the European close on Friday.

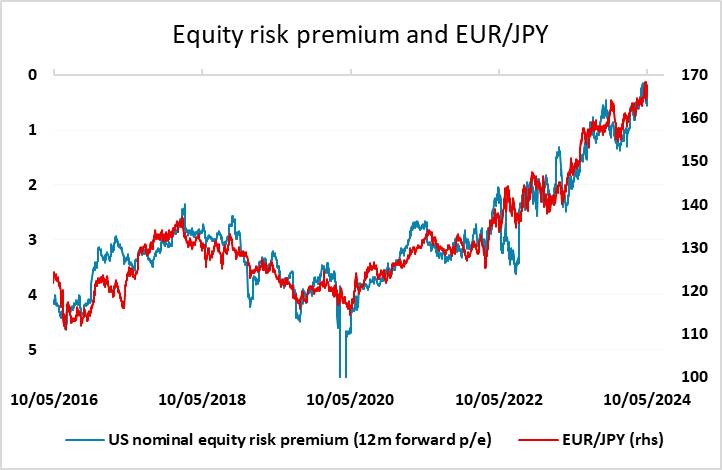

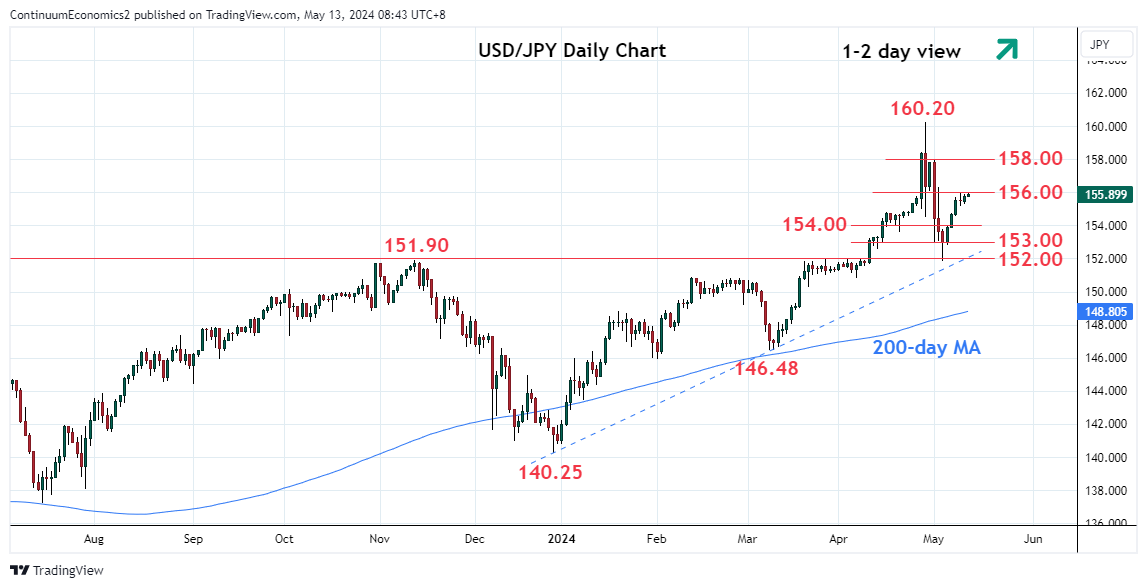

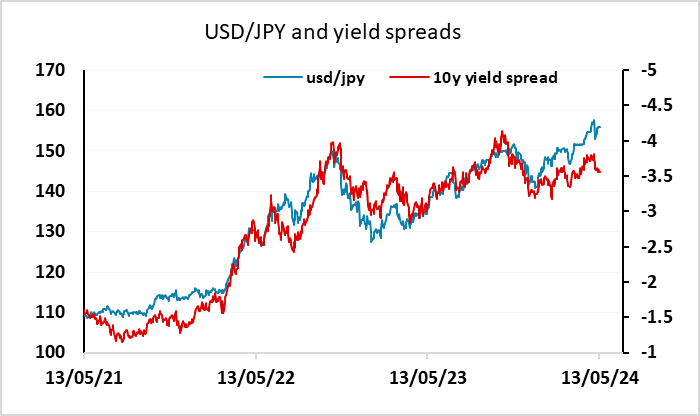

However, we do feel that the USD is potentially under threat after a string of softer numbers in the last couple of weeks culminating in a much weaker University of Michigan survey on Friday. Japanese yields are also a little higher overnight after Japan's Kato (potential prime minister candidate ) says it’s natural that monetary policy will revert to positive interest rates and the BoJ reduced purchases in the latest JGB purchase operation, so that spreads have once again moved in the JPY’s favour. While there is a technical target at 157 that may need to trade before a turn comes in USD/JPY, the potential for a USD/JPY decline is now substantial. While EUR/JPY remains supported by the continuing low level of equity risk premia, we see scope for both general USD losses and specific JPY strength. But with the US CPI data a focus, we may not see much action before Wednesday.