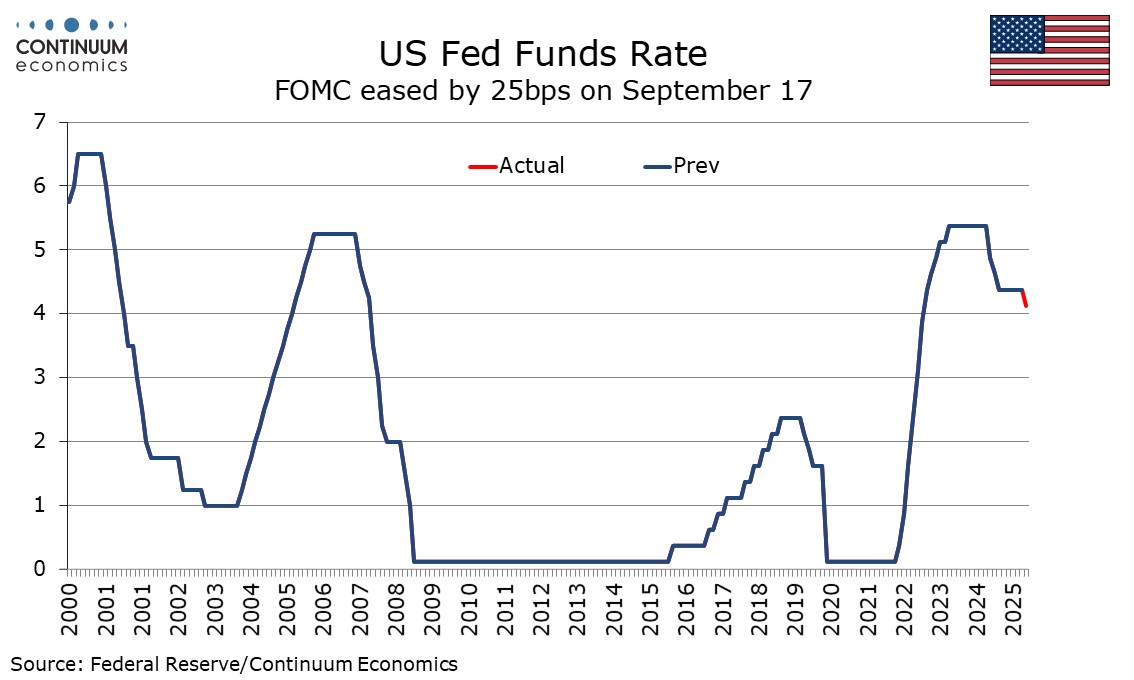

FOMC eases by 25bps, dots see two more 25bps moves this year

The FOMC has eased rates by 25bps to 4.0% to 4.75% with only one dissenting vote, the incoming Miran voting for 50bps. The main story in the dots is that the median sees two further 25bps moves this year rather than the expected one before seeing only one move in both 2026 and 2027, with no further moves in 2028 by when the rate will be near neutral.

Nine of the dots are on the median seeing two more moves, with one outlier below, presumably Miran, who wants 125bps in further easing. Two back one more move, six back no more, and one dot, presumably a non-voter, would like to see the latest move reversed. The dots for the next few years are reasonably balanced though only two are actually on the median for 2026.

Despite the more dovish dots, GDP forecasts have been revised higher for 2025. 2026 and 2027 while unemployment has been revised lower for 2026 and 2027. PCE prices have been revised higher for 2026, though unchanged for 2025 and 2027, and seen on target for 2028.

The statement notes slower job growth and increased downside risks to employment but adds that unemployment remains low, and is far from dovish on inflation, stating it has moved up as well as remaining somewhat elevated.