JPY flows: JPY rises sharply in early Europe

USD/JPY falls 3 big figures in early Europe. Wires are attributing the move to the result of the Japanese LDP leadership election, although it looks like a move that might have been triggered by intervention. Either way, it breaks the JPY downtrend of the last two weeks, but further action may be needed to sustain a JPY recovery.

Europe kicks off with what looks very much like BoJ intervention after another overnight session of JPY weakness, but in fact appears to be related to the LDP leadership election victory for Ishiba. USD/JPY has fallen from above 146 to below 144 in a couple of minutes. Markets were worried about the potential victory of hardline nationalist Sanae Takaichi, a vocal opponent of further interest rate hikes, but the win for Ishiba should allow the BoJ to follow its planned tightening cycle if data allows. The JPY was on its tenth consecutive day of decline against GBP and CHF, and the carry trade that had sent USD/JPY to 160 was clearly back in play. As was the case back in July, the JPY decline was progressing far beyond the levels suggested by the normal metrics, so the JPY was ripe for a recovery.

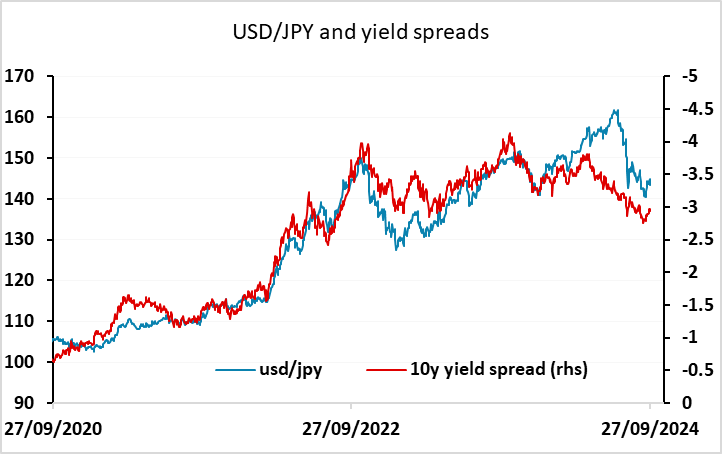

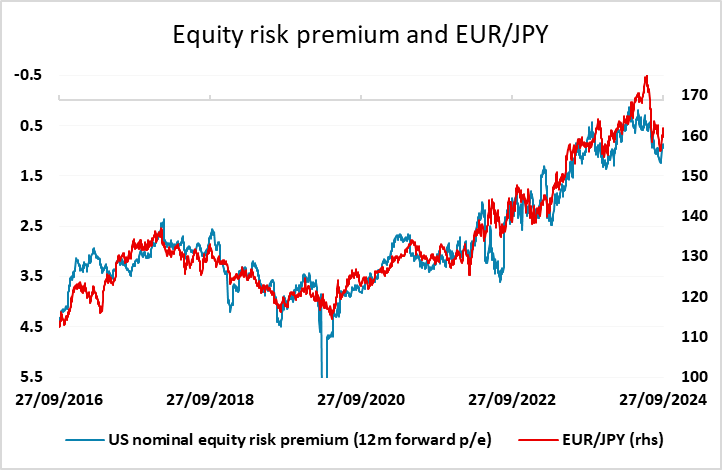

How persistent this move is will depend on how markets in general proceed from here. The BoJ has the option of raising rates as early as October, but is likely to be reluctant to do so after the latest inflation data showed a dip to 2.0% in core Tokyo CPI. They are looking for more evidence of higher wages feeding through to services prices before they are confident enough to enact further tightening. The movements in yield spreads and risk premia which are generally the drivers of USD/JPY are therefore likely to be determined by moves in US yields and equities. US 10 year yields have edged up since the Fed rate cut, but spreads are still at a level that suggests scope for USD/JPY to move back to 140. Equity strength has also been persistent since the Fed move, sending equity risk premia lower, but the EUR/JPY correlation with risk premia still suggests scope for a move sub-160. But if we see US yields rise further form here, and equities hold current levels, the case for further JPY gains will weaken.

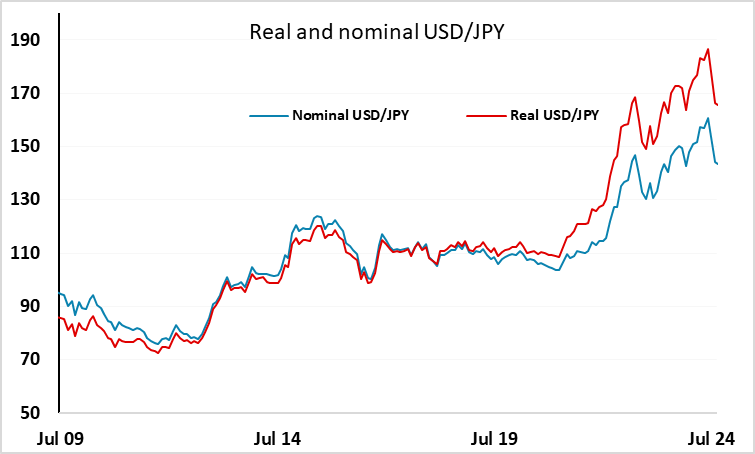

Even so, the BoJ hurt speculators back in July and there will now be more wariness of short JPY positions, so we doubt we will see USD/JPY back above 145. But either weaker US data or BoJ action may be necessary if we are to see sub-140 in the near term. Of course, longer term we would still expect JPY gains as valuation remains extremely low, and the market has yet to correct for the big real JPY depreciation due to relatively low Japanese inflation in recent years. This will come at some point, but may well only be seen when we have a longer period of weaker equity market performance.