FX Daily Strategy: APAC, July 19th

JPY focus on Japan CPI

JPY risks remain on the upside given cheapness and Trump preference for a weaker USD

GBP may slip on retail sales

JPY focus on Japan CPI

JPY risks remain on the upside given cheapness and Trump preference for a weaker USD

GBP may slip on retail sales

It looks likely to be a fairly quiet Friday, with Japanese CPI, and UK and Canadian retail sales the only data of note.

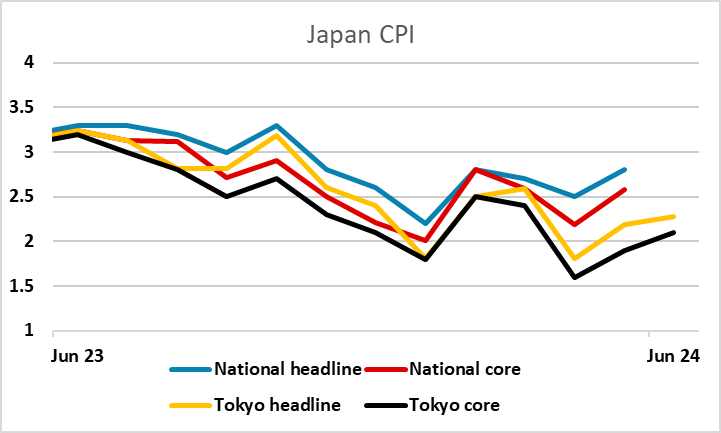

Japanese CPI is not typically that market moving, even though Japanese inflation is obviously an important economic indicator, because the Tokyo CPI data already released is typically a good guide to the national data. But the national numbers have been coming in a little above the Tokyo data of late, so there is a little more uncertainty than usual. The market is looking for a rise in the core rate to 2.7% in June from 2.5% in May, and such a rise might be enough to convince the BoJ into a tightening at the meeting at the end of the month. As it stands, the market is pricing in around a 43% chance of a 10bp rate hike, so it is clearly in the balance.

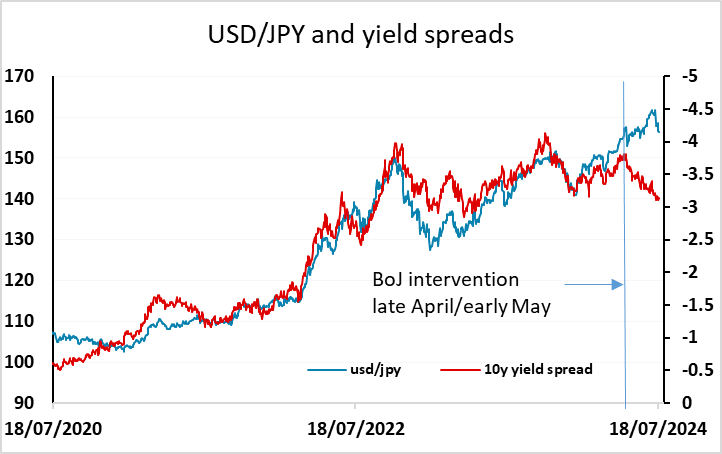

In practice, whether the BoJ hikes rates or not will make little difference to the progression in US/Japan yield spreads, which depends a lot more on what happens in the US than what happens in Japan, especially at the short end of the curve. However, the BoJ will also be deciding on how much to reduce JGB buying at the end of month meeting, and this could have a more significant impact on 10 year yields. Even so, most of the volatility in yield spreads is US driven. But sentiment towards the JPY is nevertheless likely to be affected by the BoJ’s stance, and with spreads already pointing significantly lower for USD/JPY, stronger CPI data that triggers expectations of a more hawkish BoJ might cause the next led down in USD/JPY.

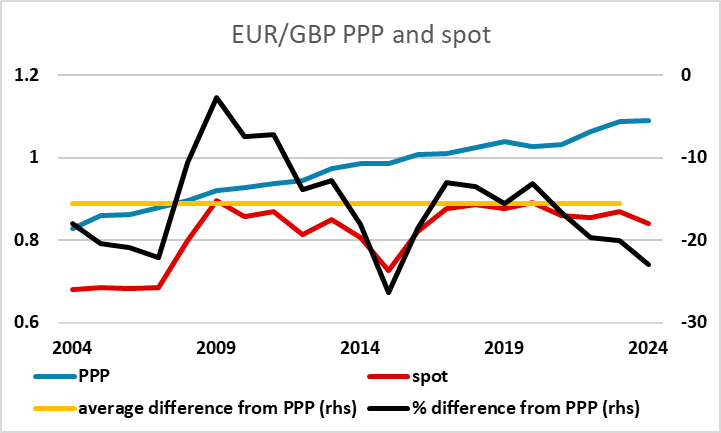

The break below 157.30 on Thursday was helped by the rising expectation that a Trump administration will have a preference for a weaker USD after recent comments from Trump and Vance. For most currency pairs this will make little difference, as there is not much the government is likely to do to have a big impact on currencies. However, for USD/JPY it would make a big difference if there was support for Japanese intervention from the US authorities. The comments from Yellen this year have been seen as opposing intervention, but we may see a different attitude if there is a Trump election victory. So we continue to see the main risks for the USD as being on the downside, but primarily against the JPY which remains vastly the most undervalued currency.

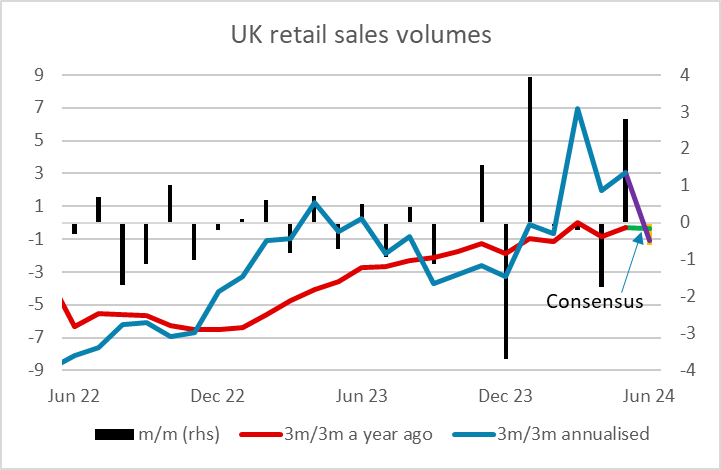

The UK retail sales data will probably show some reversal of the sharp 2.9% gain in sales in May, with the weather once again likely to have an impact. Even so, it’s clear that there is an underlying improvement in the trend in recent months, and in general here is a much more positive tone to GBP, helped by some optimism about the UK economy following the recent election. We may yet see some more GBP gains in the coming months if investors start to put some more money into what many see as being undervalued UK equities. But GBP is already quite expensive here against the EUR, so we would see the risks on retail sales as being a little on the GBP downside, with potential for sales to fall rather more than the 0.6% that the market is expecting after the 2.9% rise in May.