JPY flows: JPY supported by hawkish BoJ and weaker equities

JPY resumes gains as equities slip and Ueda maintains hawkish stance

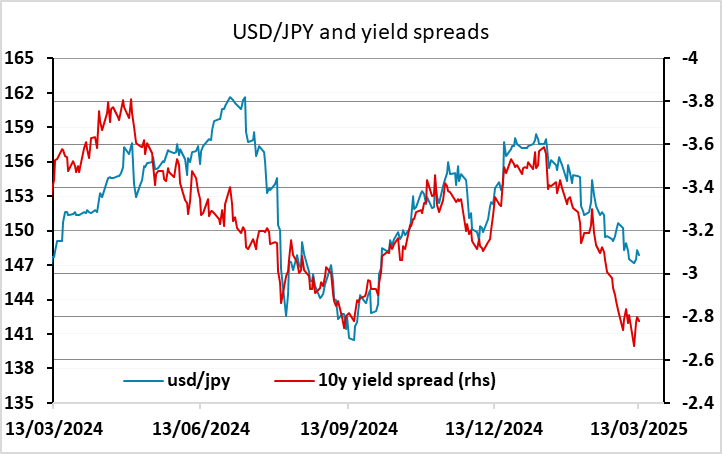

The JPY has been the best performer overnight, helped by the combination of some hawkish comments from BoJ governor Ueda and a generally softer equity market tone. JPY crosses have been the biggest movers, with EUR/JPY losing a big figure to 1.6050. While we still see USD/JPY as likely to be the biggest mover over the longer run, given the high level of the USD, JPY crosses also have plenty of potential to break lower, especially if we see a continuation of the more negative risk sentiment seen in recent weeks.

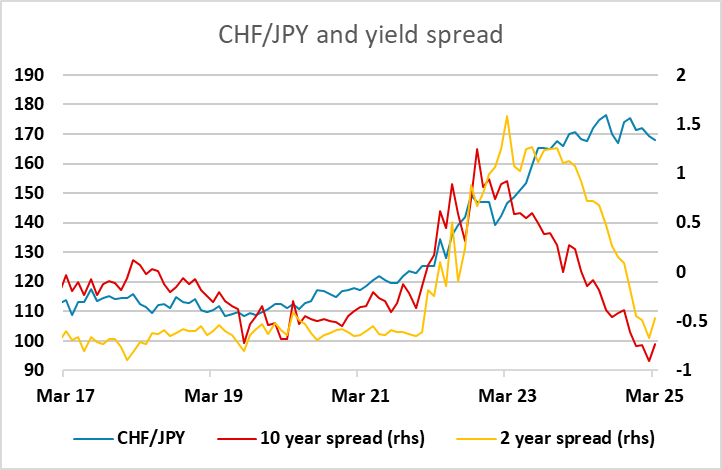

From a value perspective, CHF/JPY still looks like the most compelling story, with Ueda’s comments and reports of large wage increases in the coming Japanese wage round suggesting yield spreads will continue to move in the JPY’s favour, and we have already fully reverse the widening in yield spreads seen post-pandemic which triggered the sharp JPY losses.

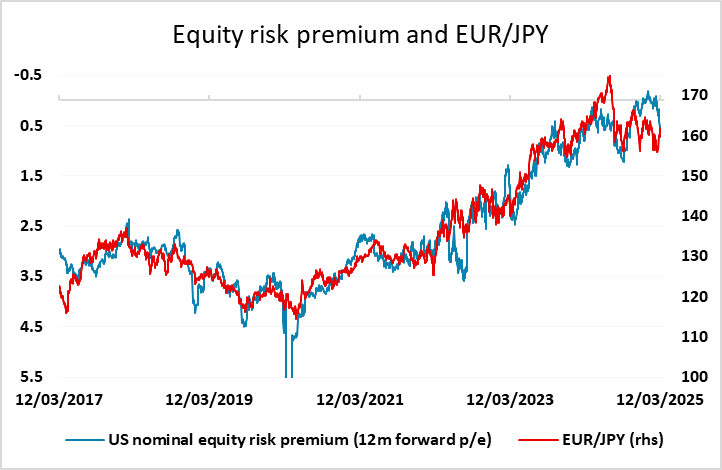

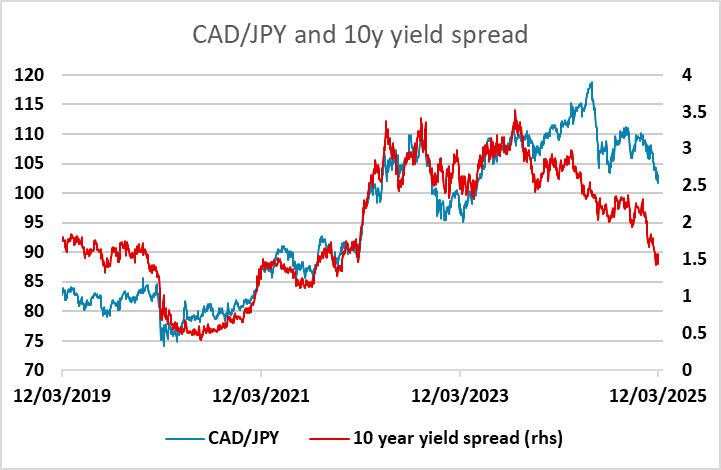

From a risk perspective, CAD/JPY may offer the best opportunity. Canada currently looks likely to be the most affected by Trump tariffs with recession possible if the recent swingeing tariff increase is maintained. Yield spreads point substantially lower, and USD/CAD has very little downside scope based on current rate expectations, with scope for further CAD weakness if the BoC decide that weak demand requires more easing. EUR/JPY shows the clearest long term correlation with equity risk premia, but the EUR is still at cheap levels and the long term correlation suggests further rises in equity risk premia are necessary if EUR/JPY is to decline further.