USD, EUR, CHF, JPY flows: USD firm on retail sales, JPY under pressure

Stronger thna expected retail sales keep the USD well bid. JPY under pressure but risk of intervention rising.

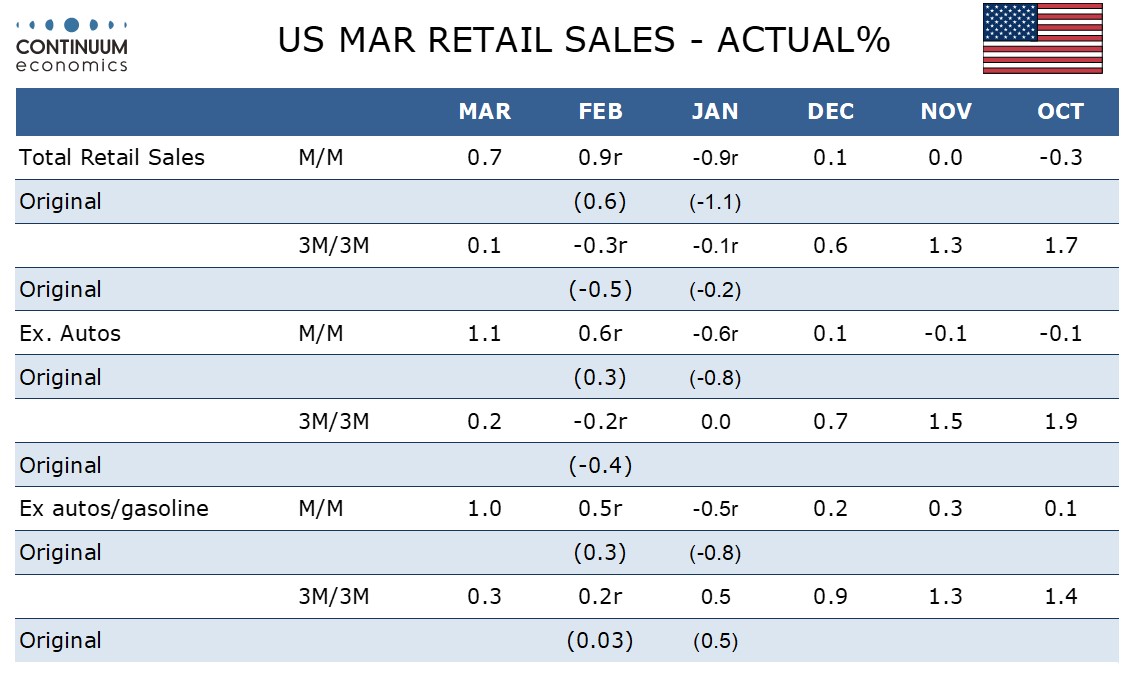

Stronger than expected US retail sales data have pushed the USD higher across the board, but the JPY has suffered the most, with US and European yields and equities all moving higher after the data. But although the numbers were stronger than expected, they weren’t really strong, with Q1 retail sales coming in just marginally positive. We doubt the data will affect the Fed’s thinking, and the market pricing of the first cut coming in September still looks a little overly cautious.

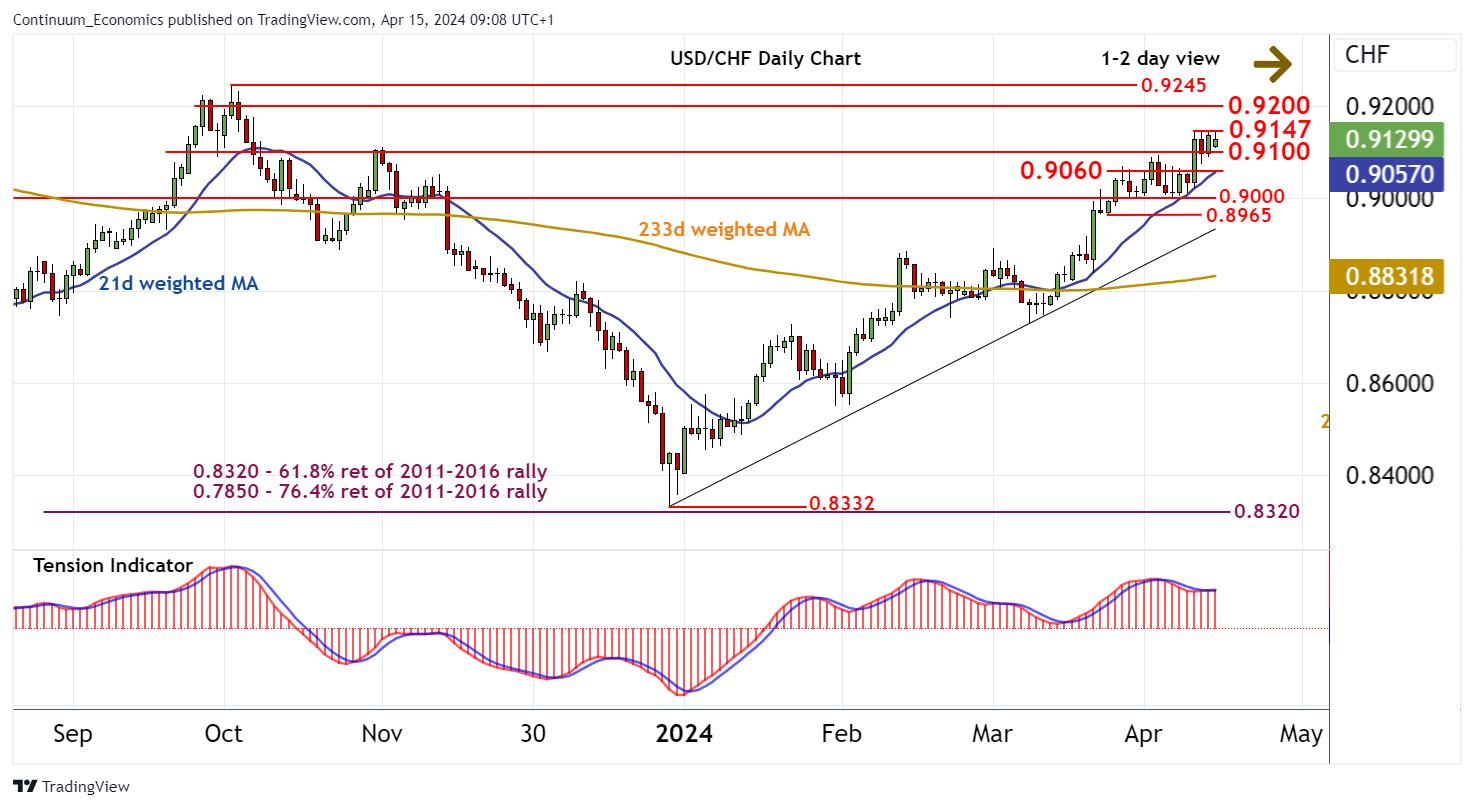

Nevertheless, it’s hard to oppose USD strength here, even though the move in USD/JPY to another new 34 year high may well attract more attention from the Japanese authorities now the JPY is also weakening on the crosses. We would therefore still see more upside in USD/CHF than USD/JPY, and expect EUR/JPY to hold below 165 with the rise in EUR yields today hard to justify on Eurozone fundamentals.