Bank of Canada to Leave Rates Unchanged on April 10, Noting Stronger GDP and Slower CPI

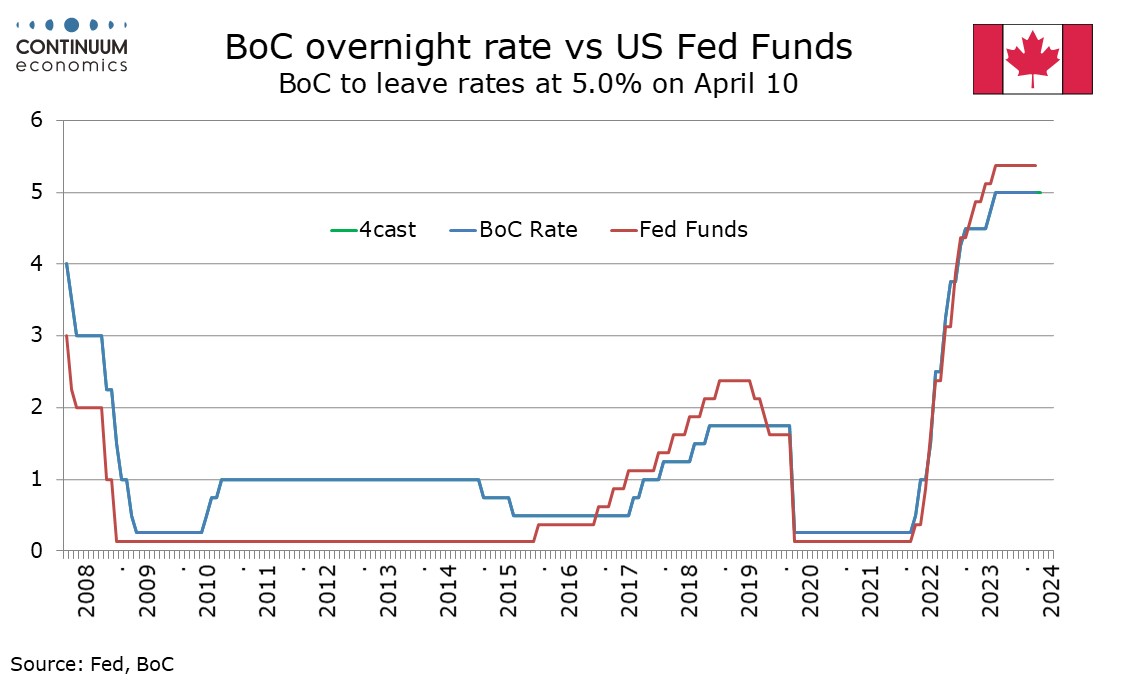

The Bank of Canada meets on April 10 and no change in rates from the current 5.0% is likely. The BoC is likely to revise near term forecasts for GDP higher and CPI lower, and leave its options open for easing at future meetings, dependent on incoming data, without giving any clear signals on timing.

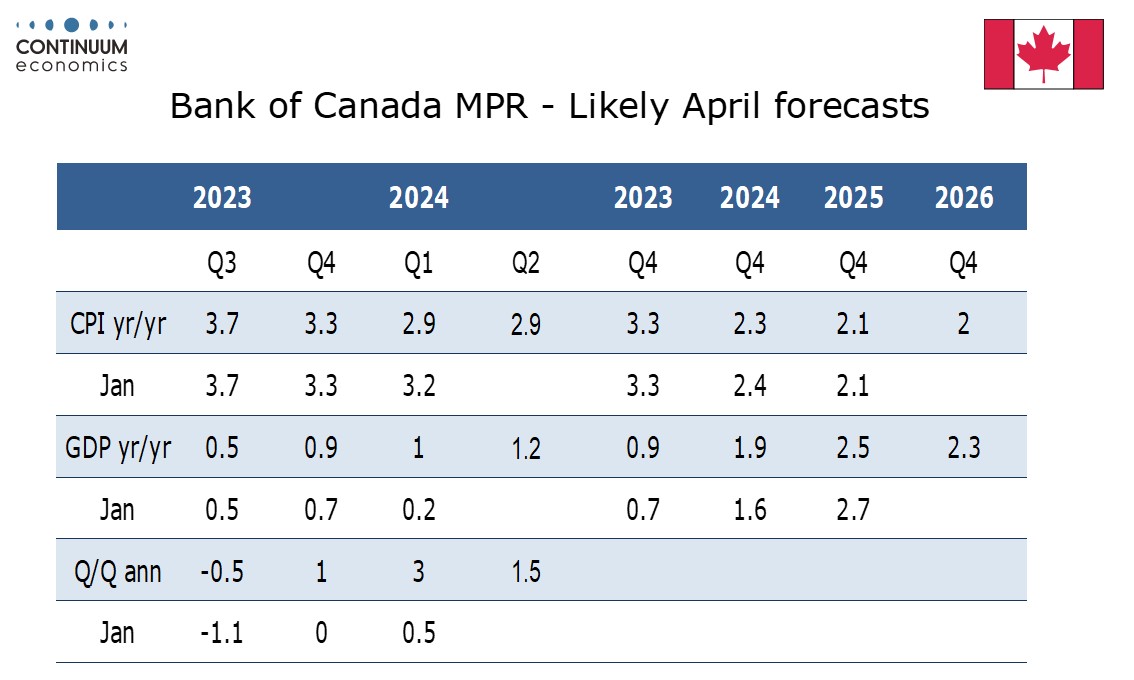

This meeting will contain a quarterly Monetary Policy Report which will see the BoC’s economic forecasts updated. The last meeting on March 6 saw no MPR but the statement did note that Q4 GDP grew by more than was expected in Q4 but the pace remained weak, while noting CPI eased to 2.9% in January, below the 3.2% expected for Q1 in January’s MPR. Since then we have seen another encouraging CPI release, at 2.8% for February and a stronger than expected January GDP rise of 0.6%, with a preliminary estimate for February of 0.4%.

The BoC will take this data into account and is likely to look for a Q1 CPI pace slightly below 3.0% and a Q1 GDP pace of around 3.0% annualized, the latter well above a 0.5% January projection. The BoC will note that the January increase was flattered by the end of a public sector strike in Quebec, though this shows that Q4 would have been stronger than its 1.0% outcome without the strike. We expect the BoC will treat the recent data cautiously, and make only modest adjustments to its 2024 CPI and GDP forecasts. The economy is still likely to be seen as in modest excess supply.

In March the BoC stated it expected inflation to remain close to 3% during the first half of the year before gradually easing. Year ago data suggests more scope for the yr/yr pace to ease in Q3 than Q2. The BoC also stated that underlying core inflation measures were in the 3-3.5% range on both yr/yr and 3-month measures. The upcoming statement is likely to note some signs of progress in the 3-month rates.

In March the BoC stated it is still concerned about the risks to the outlook for inflation, particularly the persistence in underling inflation, and that it wanted to see further and sustained easing in core inflation. This assessment could be fine-tuned in a dovish way, perhaps by removing the reference to persistence in underlying inflation, though a dovish shift on inflation could be balanced by seeing the stronger growth picture as a potential threat to further progress on inflation. The statement is unlikely to give any hints of a near term rate cut, but should further progress on inflation be seen before the next meeting on June 6, easing should not be ruled out. The press conference may suggest that all upcoming meetings are live.