RBI Decision Preview: Growth Slackens, Inflation Soars: RBI’s Policy Tightrope

The Reserve Bank of India (RBI) is gearing up to announce its last monetary policy decision for 2024 on December 6. For the upcoming meeting, we anticipate that the RBI will likely keep the repo rate unchanged at 6.5%, given the recent uptick in inflation. The decision to hold rate will come despite the less than anticipated real GDP growth number of 5.4% in Q2 FY25.

As the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) prepares to convene from December 4-6, 2024, the central bank faces a critical decision that balances inflation control with the need to sustain economic growth. Inflation has surged beyond the RBI’s tolerance threshold, while economic growth shows signs of a notable slowdown, creating a challenging policy environment.

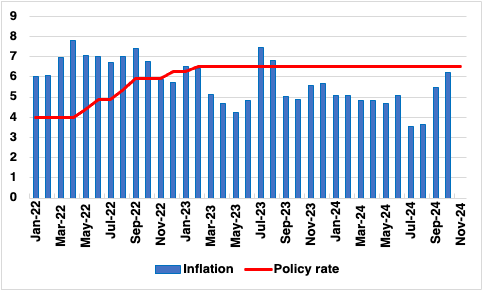

Figure 1: India CPI and Main Policy Rate (%)

India’s GDP growth slowed to 5.4% in the July-September quarter, a marked decline from 6.7% in the previous quarter. This underperformance, against the backdrop of global uncertainties and subdued domestic demand, has raised concerns about the robustness of the recovery. Key sectors such as manufacturing have yet to regain pre-pandemic momentum, and consumer sentiment remains fragile, weighed down by inflationary pressures. Inflation continues to be a pressing issue, with the Consumer Price Index (CPI) climbing to 6.21% in October, breaching the RBI’s upper tolerance threshold of 6% for the first time in over a year. The surge is driven primarily by escalating food prices, exacerbated by supply chain disruptions and adverse weather conditions affecting agricultural output. Core inflation, while stable, has shown subtle upward trends, reflecting underlying price pressures that cannot be ignored.

Amid these dynamics, the MPC’s decision is expected to prioritise inflation management, likely resulting in the central bank maintaining the repo rate at 6.5%. The RBI has consistently emphasised its commitment to anchoring inflation expectations, aware that any premature easing could destabilise long-term price stability. The growth slowdown adds complexity to the decision-making process. While supportive measures for economic activity are necessary, the central bank’s immediate focus is likely to remain on curbing inflation to prevent more persistent and widespread price pressures. As a consequence, RBI will maintain the 6.5% repo rate in the December meeting. Liquidity measures, including potential adjustments to the Cash Reserve Ratio or targeted open market operations, may complement the policy stance to ensure adequate credit flow without stoking inflation.

A rate cut might be considered if inflation trends decline in subsequent months, such a move would hinge on sustained improvements in the inflation outlook.