UK CPI Review: Inflation Up on Energy But Services Resilience Diminishes

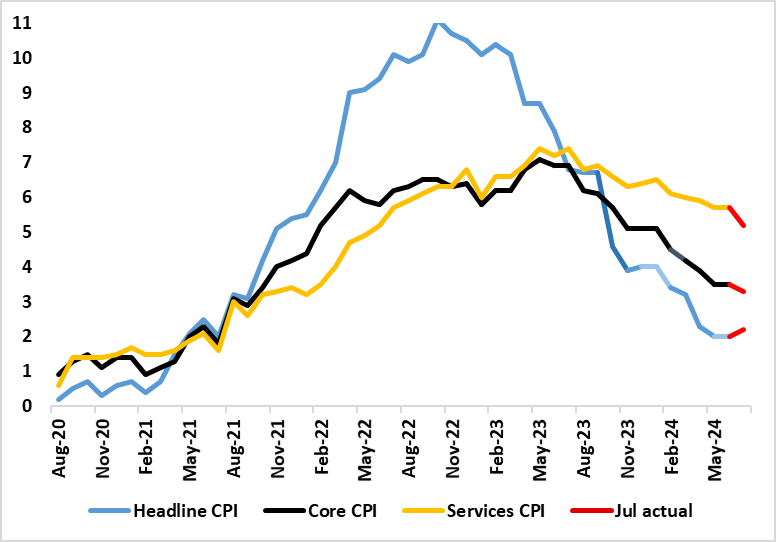

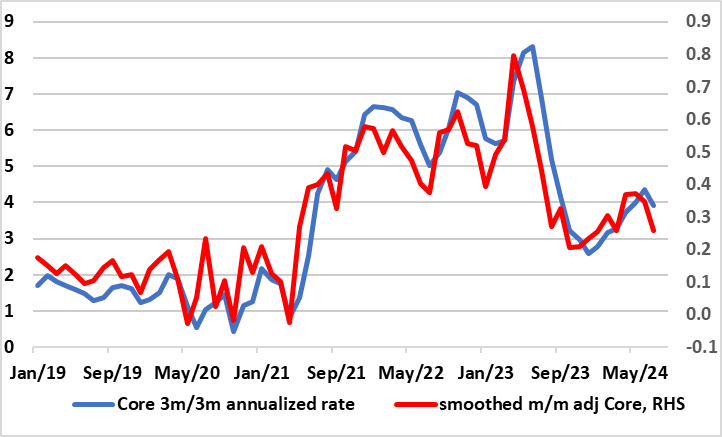

The July CPI is notable for a clear fall in services inflation, one driven by a fall in restaurant/hotel inflation, this often seen as a bellwether indicator of price persistence. Indeed, services inflation fell 0.5 ppt to 5.2%, a two-year low and well below the BoE projection. Even so, due to energy related base effects (related to the Ofgem price cap changes), the overall CPI headline rate rose to 2.2% in July from 2.0%, this projection being a notch below the consensus and a further notch under BoE thinking. Even so, the core still fell to 3.3% (Figure 1), the lowest in almost three years and adjusted m/m data suggest a clear slowing short-term price dynamics (Figure 2). Regardless, this underlines that headline CPI inflation having dropped back to the 2% target in May (for the first time in just over three years) and stayed there in June was important but far from definitive. Indeed, apparent service sector resilience has been troubling the BoE (certainly the hawks) and will continue to do so, but probably less discernibly given these numbers as they do put a further rate cut on the table for the Sep 19 BoE verdict, much depending on the August CPI due the day before that decision.

Figure 1: Headline and Core Inflation Diverge as Services Drop

Source: ONS, Continuum Economics

This makes any assessment using shorter-term adjusted measures are the more compelling. In this regard we, note that the July data did see fresh softer price dynamics on this basis both for services and the core (Figure 2).

As for details, the largest upward contribution to the monthly change in CPI annual rates came from housing and household services where prices of gas and electricity fell by less than they did last year; the largest downward contribution came from restaurants and hotels, where prices of hotels fell this year having risen last year. Core CPI (excluding energy, food, alcohol and tobacco) rose by 3.3% in the 12 months to July 2024, down from 3.5% in June; the CPI goods annual rate rose from negative 1.4% to negative 0.6%, while the CPI services annual rate fell from 5.7% to 5.2%. Prices for restaurants and hotels fell by 0.4% between June and July this year, compared with a rise of 0.9% a year ago. The annual rate rose by 4.9% in the year to July 2024, down from 6.3% in the year to June. The slower annual rate was almost entirely because of the price of hotels, which saw a monthly fall of 6.4% compared with a rise of 8.2% a year ago.

Headline CPI inflation stayed at 2.0% in the June numbers and with a stable core rate of 3.5%, but with services failing to ease by remaining at 5.7% (Figure 1) and thus some 0.6 ppt above then-BoE thinking. Thus, the data alone did not give a green light to the rate cut this month and explains the strong dissent to this actual easing. However, the narrow MPC majority were instead more swayed by the thrust of inflation news that has evolved of late and by the August Monetary Policy Report continuing to point to a clear inflation undershoot ahead even after readopting an upward risks bias. These July CPI data very much accentuate this disinflation thrust and may make the narrow majority who voted for the cut vindicated.

Figure 2: Adjusted Core CPI Pressures Falling Afresh

Source: ONS, Continuum Economics, smoothed is 3 mth mov average

Regardless, some of this (admittedly diminished) services resilience is partly due to strong, if not record, rental inflation. Overall, even with a lower core rate, this is still being held up by base effects. However, this outcome implied a m/m adjusted reading much more consistent with target at least in the manner in which the smoothed monthly basis and/or the 3-month annualized rate that some at the BoE favour have also risen of late. This we put down to the impact of annual indexing and regulated price changes (much of which arose in April) which will continue to buttress the y/y core and services numbers but not the shorter-term measures. This will not provide much solace to the BoE hawks who will also note the sturdier real economy numbers that the UK has been showing of late, albeit where labor market numbers are showing contradictory messages. But of course by the time of the next BoE decision on Sep 19, the question is will stock market weakness still be a dominant factor.