JPY, GBP flows: JPY sells off again, GBP under pressure

JPY sells off as equities firm, intervention threat increases. GBP downside risks on weak data and political uncertianty

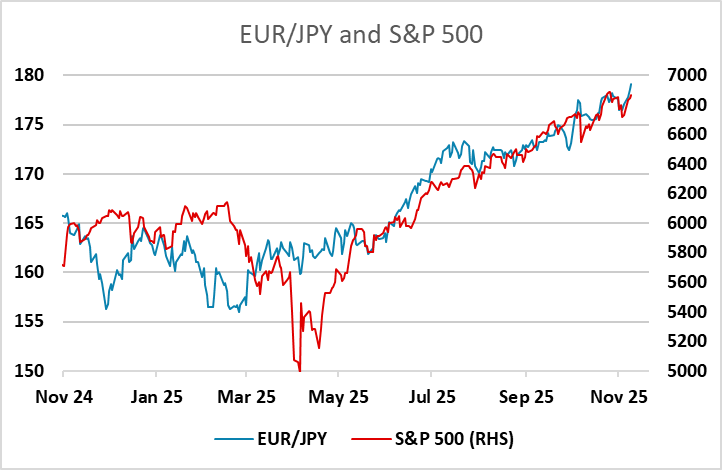

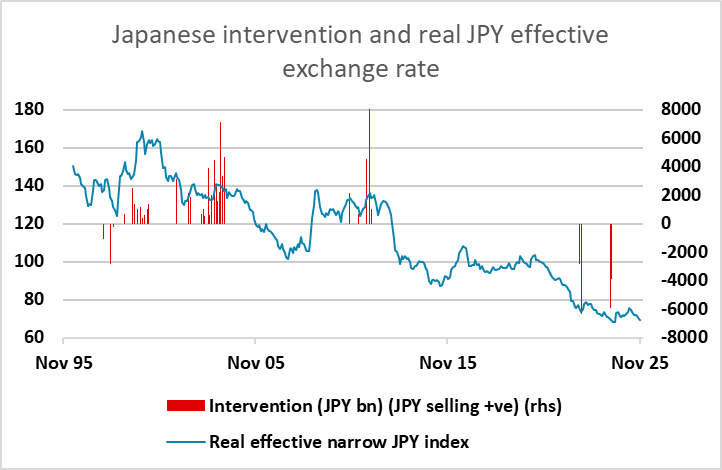

JPY weakness in a generally risk positive market was once against the theme overnight, with USD/JPY hitting its highest since February at 154.80, and EUR/JPY and CHF/JPY hitting new all-time highs. JPY weakness drew new protests from Japanese finance minister Katayama who called the moves “sharp” and “one-sided”, ramping up the rhetoric as is typically the case pre-intervention, and indicating that the disadvantages of a weak yen were outweighing the advantages. But there has bene no physical FX intervention thus far, and without it the JP looks likely to continue to suffer on any uptick in equities. EUR/JPY continues to broadly follow equity market gains, having broken away from the correlation with equity risk premia mid-year. This is not a sustainable state of affairs, but is unlikely to change near term without intervention or a significant turn in equities.

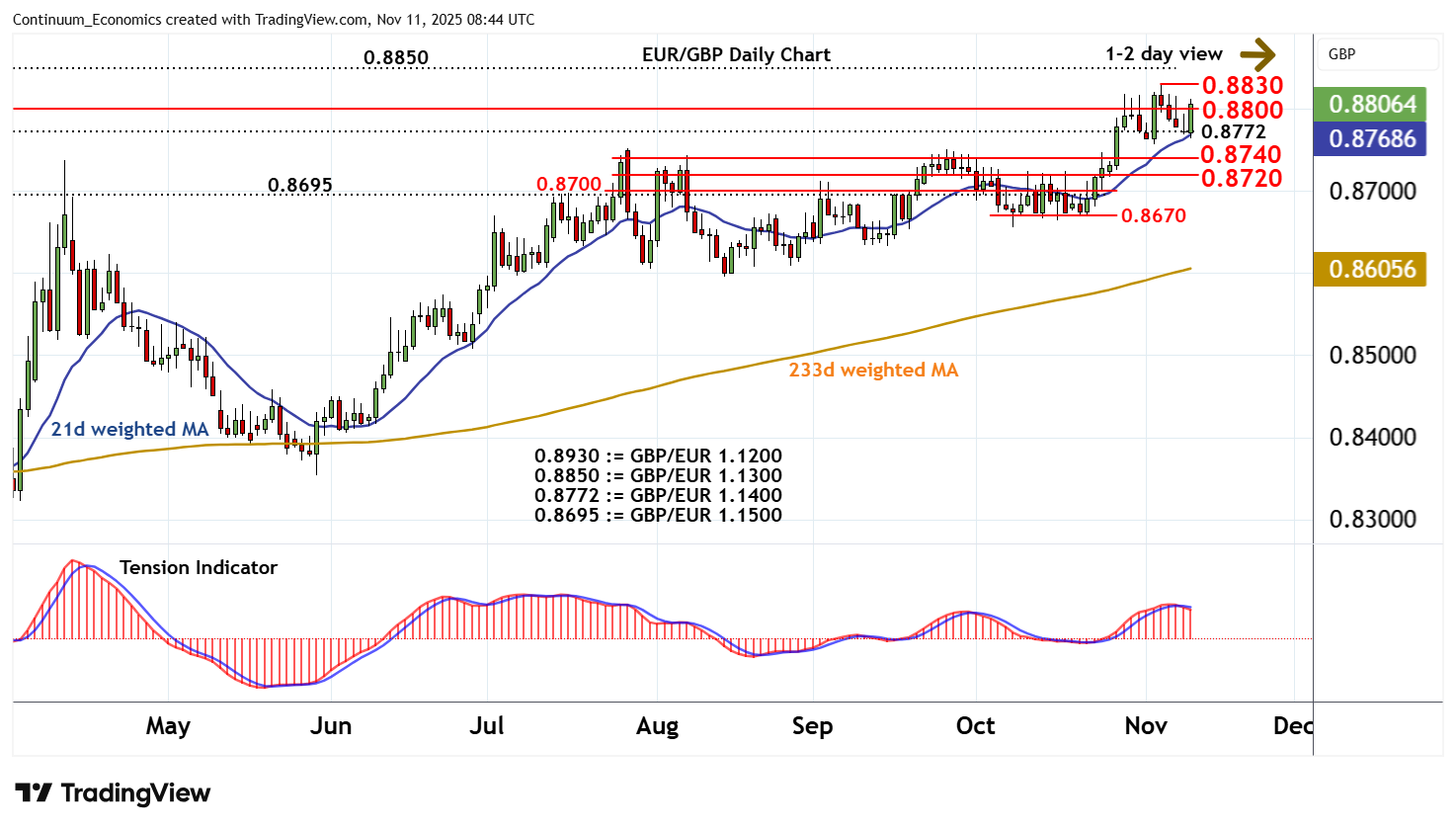

For today, there is little on the calendar to move markets, but GBP should be a focus after yesterday’s weak UK labour market data pulled EUR/GBP up towards the year’s high of 0.8830. A BoE December rate cut is now near 80% priced in, but there is scope for this to be near 100% given the expectation of a significant fiscal tightening in the November 26 Budget. But there will also be eyes on GBP and the gilt market today due to rumours of a leadership challenge within the ruling Labour Party. Markets would certainly not welcome the possibility of a left-wing takeover of the leadership, and this could propel GBP lower if gilts sell off this morning.