USD, JPY, AUD, EUR flows: JPY and AUD gains o/n

USD generally soft with JPY and AUD leading the way overnight but without any obvious news trigger.

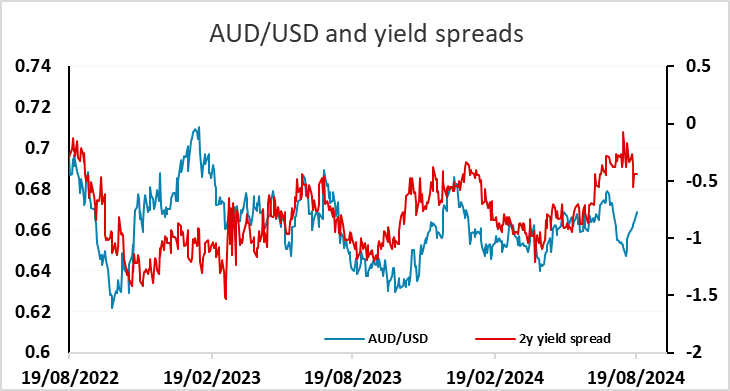

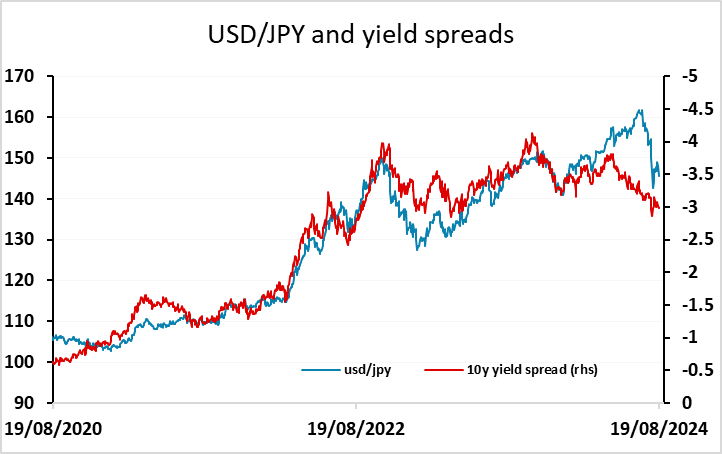

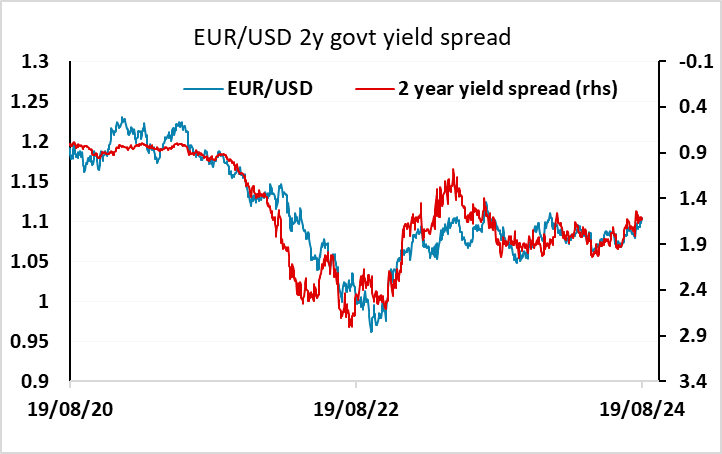

The USD has been generally soft through the Asian session with the JPY making the most pronounced gains. There is no convincing new rationale for general USD weakness, but JPY and AUD gains look be to playing catch up on the moves in yield spreads in their favour over the summer, while EUR/USD gains have been much more modest given the lack of significant yield support for the EUR. While the market is to some extent looking towards the Fed minutes and the Jackson Hole symposium later in the week, there has only been a modest decline in US yields overnight so the USD weakness can’t really be ascribed to any change in market expectation of Fed policy.

Monday’s calendar is quiet as usual, and European players may see the sharp USD/JPY decline overnight as offering a profit-taking/USD buying opportunity (depending on positioning and favoured stance), given the lack of clear short-term rationale for the move. But USD levels do not look too low relative to yield spreads so we would still favour the USD/JPY downside and some upside risk for AUD/USD.