Published: 2024-04-16T14:04:34.000Z

JPY flows: JPY spike probably not intervention, but...

Senior FX Strategist

3

The sharp JPY spike after the US equity market open doesn't look like intervention, but the threat remains

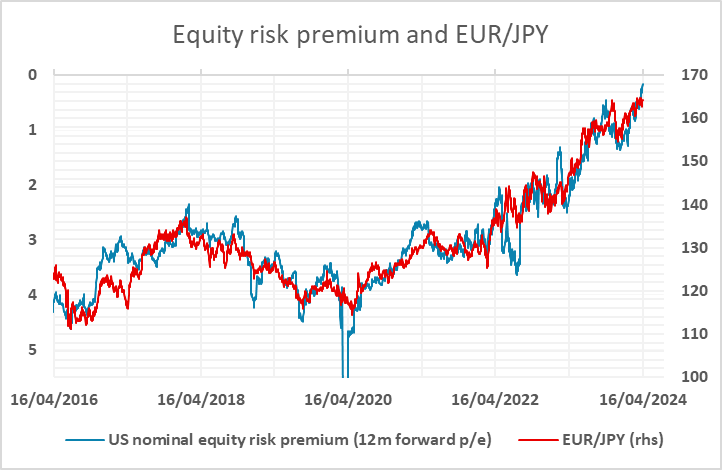

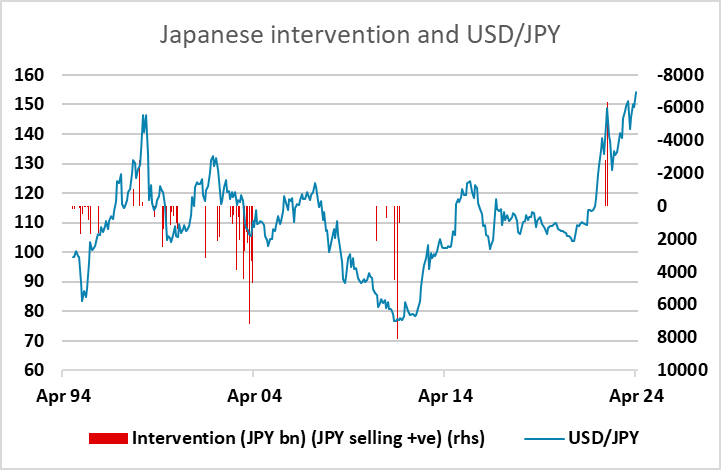

USD/JPY dipped sharply just after the equity market open at 14:30, losing nearly a big figure, but at this stage there is no evidence that the decline is a consequence of BoJ intervention. Equities also fell at the open, and we saw weaker commodity currencies as well, so the JPY rise might just reflect risk averse trading. Even so, we are at levels that should make markets nervous about potential BoJ action. The JPY is at extremely low levels – real terms lows in the floating era – and BoJ intervention has typically been effective at extremes. There have been plenty of warnings from the Japanese authorities, and if they allow a break above 155 in USD/JPY and 165 in EUR/JPY without acting, they will lose credibility. So although this dip doesn’t look like it is intervention related, it is a warning about the possibility.