USD, EUR flows: USD resumes gains on low claims data

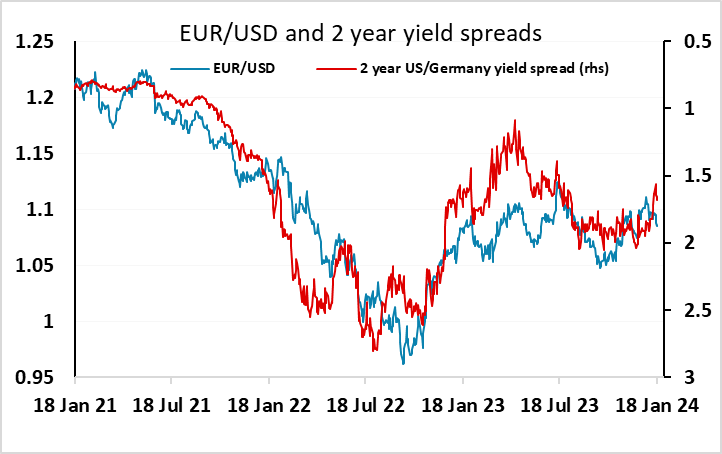

Significant decline sin initail and continunig claims have sent the USD higher again, althoguh a soft Philly Fed survey provides some offset. USD remains high relative to the normal yield spread correlation, so upside limited.

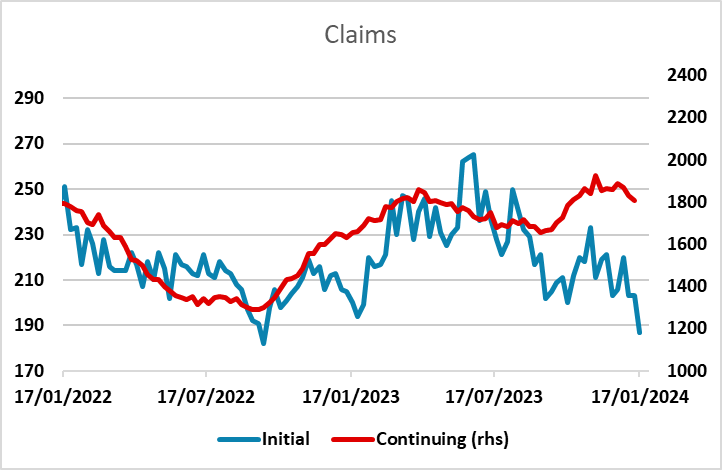

The USD is higher again on more declines in weekly jobless claims. Initial claims are the lowest since September 2022, while continuing claims have fallen back to their lowest since October. The USD is generally higher, although the EUR is proving more resilient than most, losing only around 10 pips.

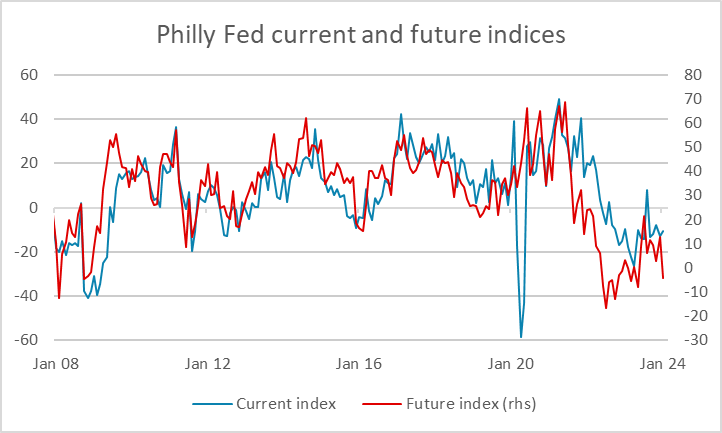

While the claims data is indicating a strong labour market (although there is always the possibility of erratic data and faulty seasonals) the Philadelphia Fed survey was on the weak side of consensus, particularly the forward looking index, which hit its lowest since May. With the Empire manufacturing index coming in much weaker than expected earlier in the week, this does provide some offset to the strength of the labour market. However, the surveys have been weak for some time without a significant impact on employment, so the claims data will dominate the reaction.

However, US yields are only modestly higher, and the USD looks generally extended on the basis of yield spreads, so we would not expect significant USD gains from here. But it will take something more clearly negative on the US economy or more dovish commentary from the Fed to trigger a USD turn lower.