U.S. Retail Sales losing some momentum but initial claims low and PPI gaining some momentum

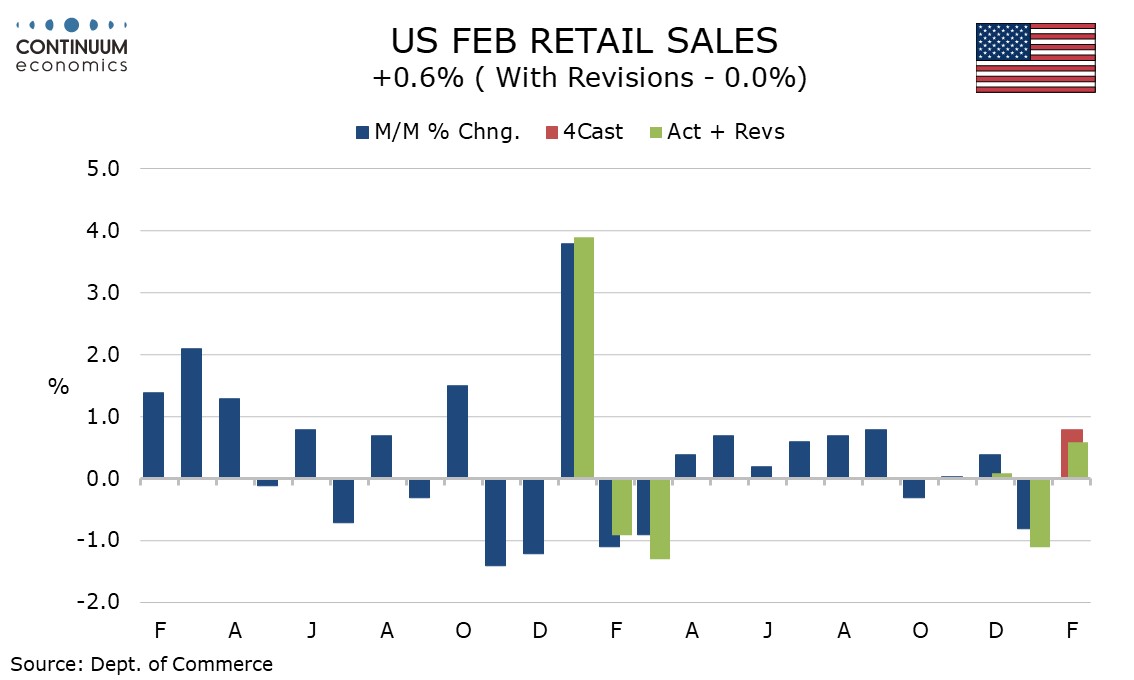

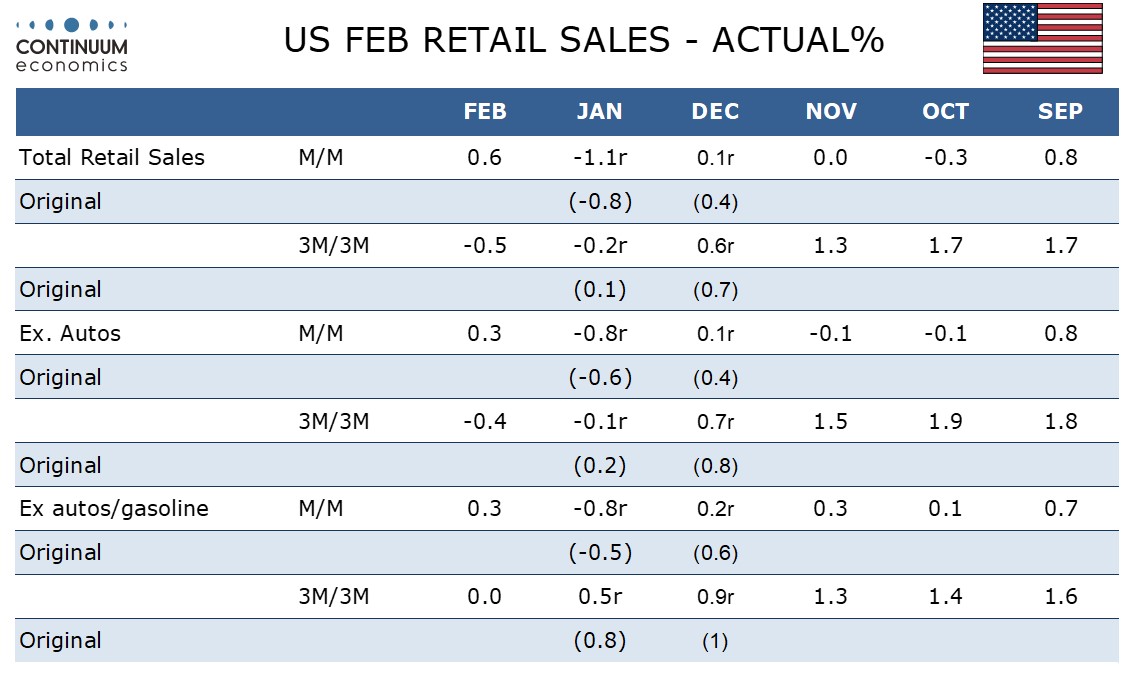

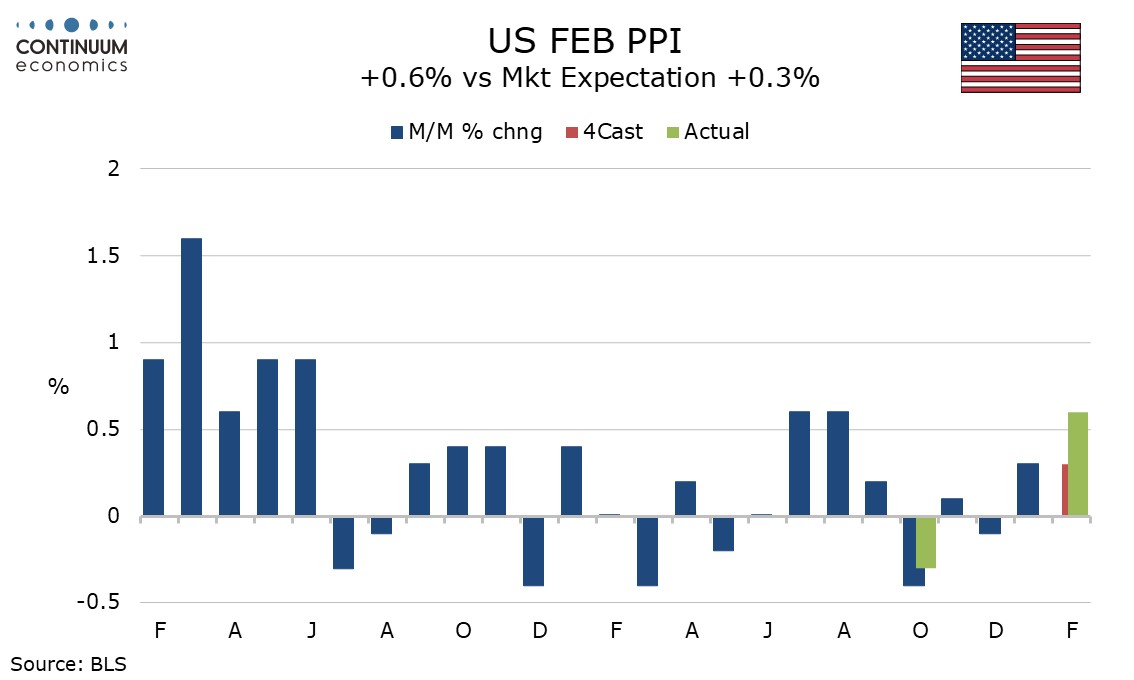

February retail sales with a 0.6% increase have not fully reversed a 1.1% decline seen in January and hint at some loss of consumer momentum in Q1. However initial claims at 209k suggest the labor market remains strong in early March while February PPI with a 0.6% increase backs the CPI’s message of stronger inflationary pressures in early 2024.

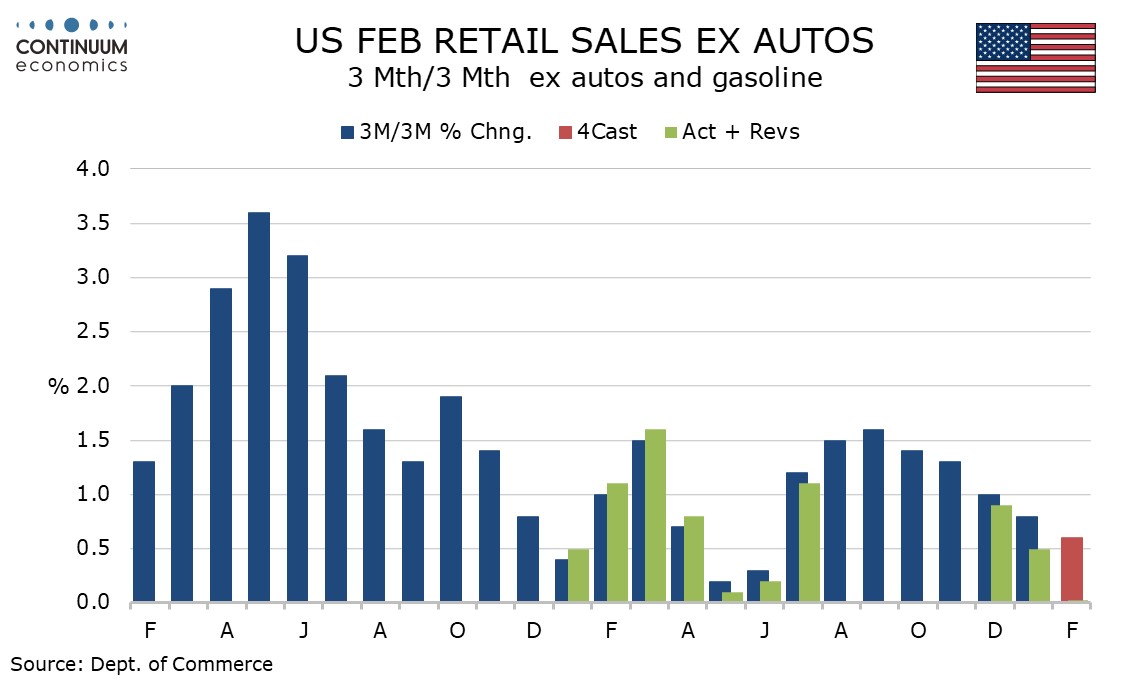

Retail sales rose only 0.3% ex autos and ex autos and gasoline, both after downwardly revised 0.8% declines seen in January. The control group that contributes to GDP was unchanged after a 0.3% January decline.

In addition to a downward revision to January, December was revised down too to a 0.1% increase from 0.4%. 3 month/3 month data is now negative overall and ex autos, and flat ex autos and gasoline.

Consumer spending was one of the main reasons that Q3 and Q4 GDP data surprised on the upside, but outpaced real disposable incomes. Q1 looks set to see some loss of momentum.

Initial claims at 209k are marginally up from 210k in the preceding week while continued claims at 1.811m are marginally up from 1.794m, but with the preceding data revised significantly from 217k and 1.906m respectively the data is below expectations.

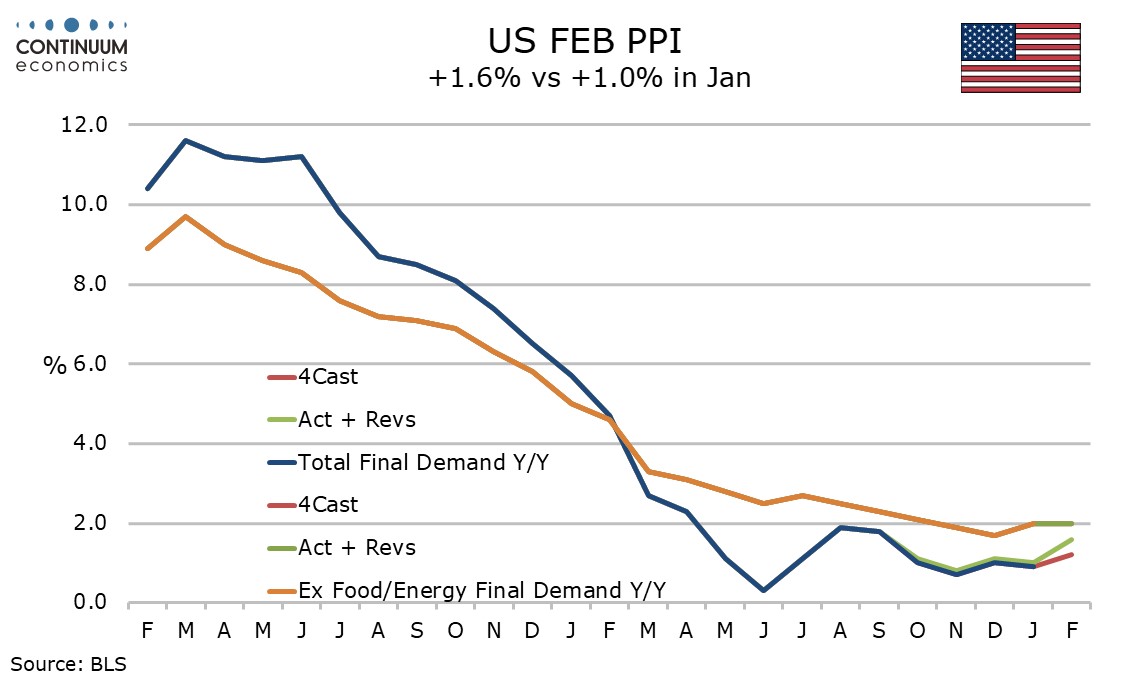

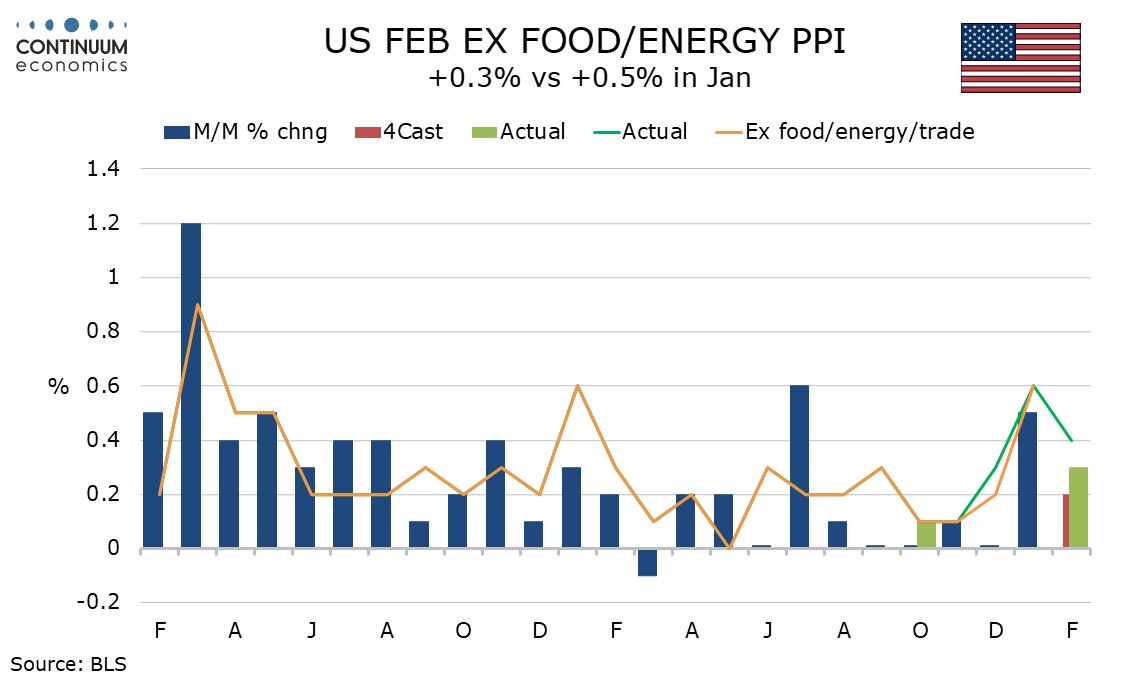

February’s PPI gain of 0.6% is the strongest since August led by a 4.4% rise in energy, its first rise since September and the largest since August while food was also strong, up by 1.0%. A 0.3% rise ex food and energy is modestly after above trend after a stronger 0.5% gain in January while ex food, energy and trade at 0.4% from 0.6% is stronger still.

Goods less food and energy have seen two straight 0.3% gains while services rose by 0.3% after a 0.5% rise in January. January data looked like a one-time new year bounce. February data is harder to dismiss and while it is too early to see it as an acceleration in trend, the strong GDP growth of H2 2023 may be feeding into underlying price pressures. The Fed still needs to be cautious.