GBP flows: GBP rallies modestly as retail sales bounce

January retail sales reversed the December decline, but the data tells us little and GBP still looks biased lower after this week's data

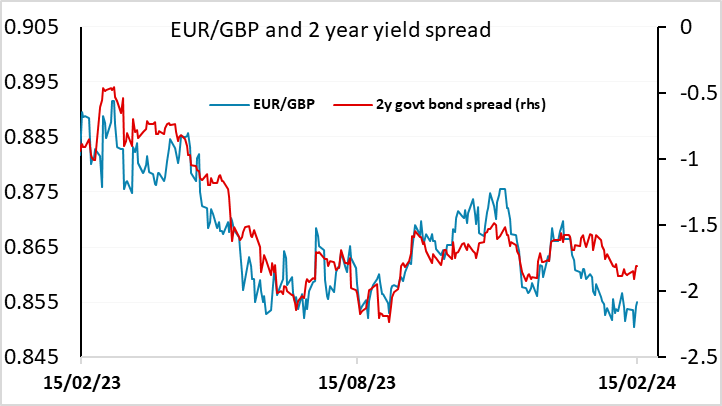

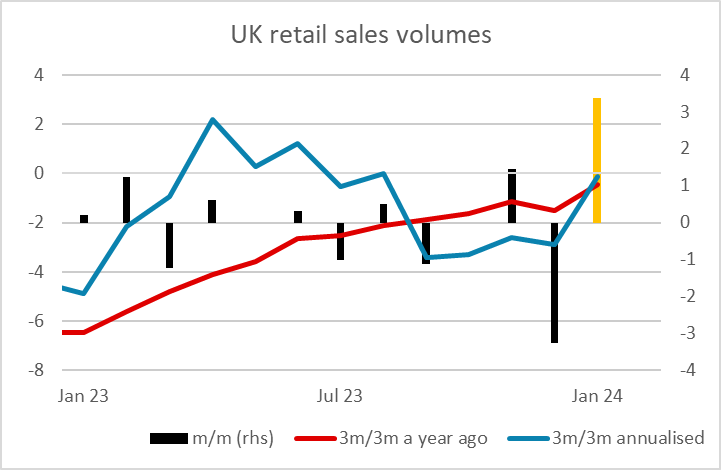

GBP has risen on the back of the larger than expected rise in retail sales in January, but since this only reverses the decline seen in December, it is primarily a seasonal adjustment issue rather than any indication of fundamental strength or weakness. The trend looks to be improving, but a flat number next month would see the 3m/3m trend dip lower once again, so it looks too early to judge, and we wouldn’t put a lot of faith in the data. The weakness of the Q4 GDP data yesterday, the softer CPI data this week, and the flattening of the trend in average earnings all suggests there is likely to be scope for UK rate cuts before the August date that he market currently has for the first cut. Nevertheless, today’s numbers are stronger than expected, and with EUR/GBP up in the last two days, some correction today is likely. The 0.85 level still looks likely to be strong support, and is unlikely to be tested, and a break back up above 0.8550 looks more likely.