USD, JPY, CHF, NOK flows: Risk recovers on stronger US GDP data

USD rises against JPY and CHF as US Q2 GDP comes in above expectations

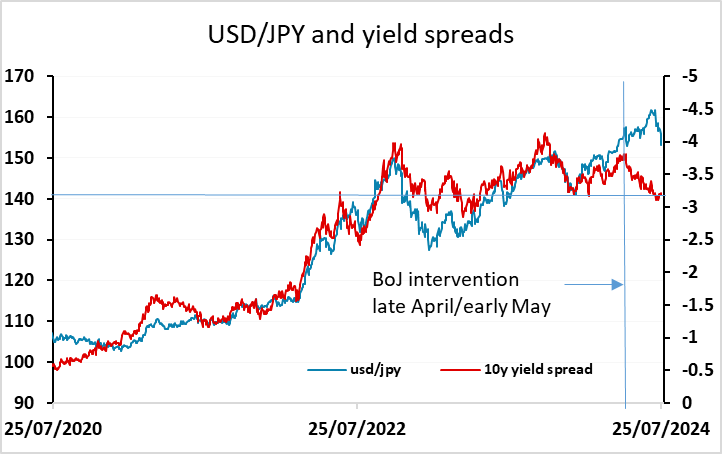

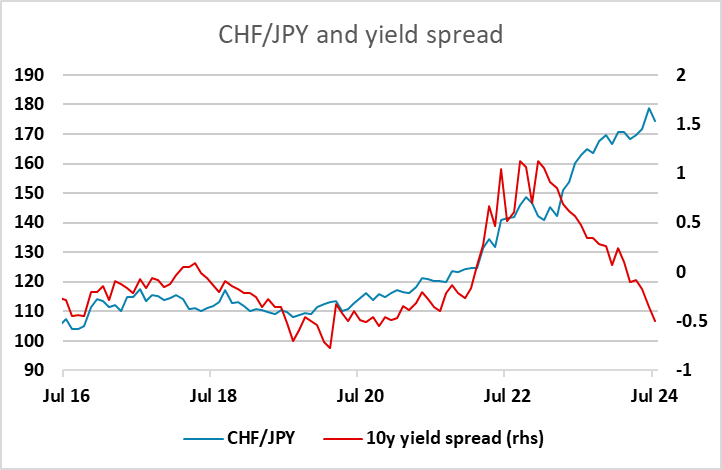

US Q2 GDP was generally stronger than expected, with real GDP rising 2.8% annualised against a consensus of 2.0%, and the core PCE deflator up 2.9% against a consensus of 2.7%. The data has given the USD a boost against the JPY in particular, and to a lesser extent the CHF, but with much milder gains elsewhere. AUD/USD is actually higher and USD/NOK lower as the commodity currencies rally on the stronger than expected data. Other data was mixed, with core durable goods stronger than expected but headline a lot weaker, while initial and continuing claims were both a little lower than expected.

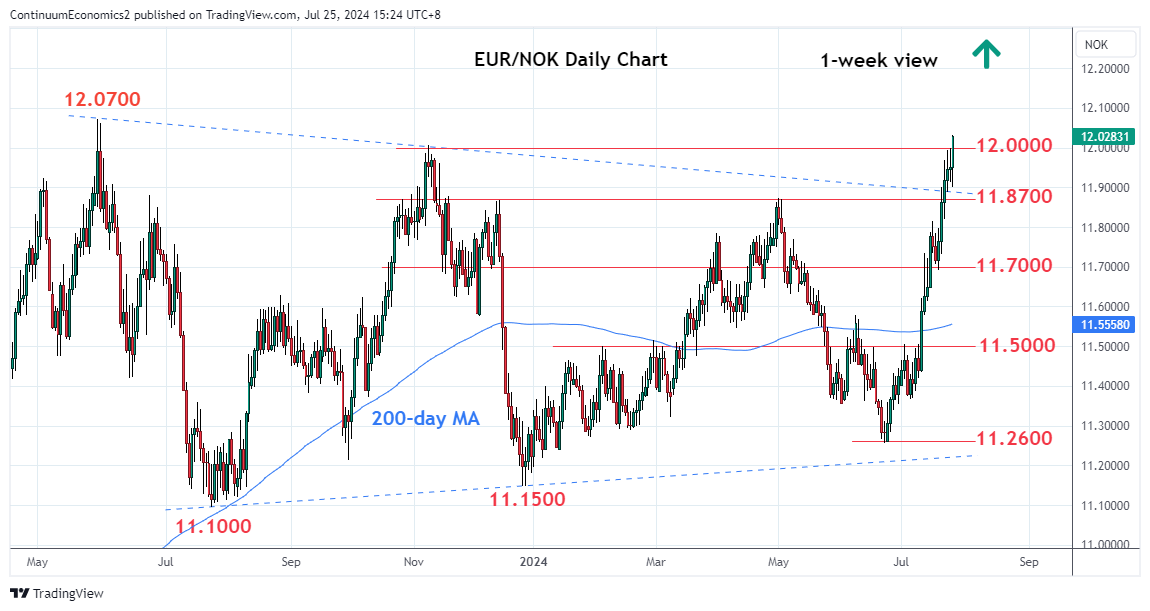

At the moment, US yields are still lower on the day, reflecting the risk off tone in markets overnight, but the risks may now be for a risk recovery following the data which might allow a more extended USD rally against the riskier currencies. We still see the JPY as hugely undervalued and see scope for much more substantial JPY gains over the rest of the year, but the CHF may be vulnerable after recent gains, and there is scope for a big NOK recovery from all time lows against the EUR (pandemic excluded) seen this morning.