FX Daily Strategy: Asia, July 31st

BoJ and FOMC the focus

We see BoJ standing pat suggesting knee jerk JPY decline, but downside limited

FOMC will need to be dovish to justify market pricing, so USD risks on the upside

CAD may benefit most if Fed are dovish given positioning

BoJ and FOMC the focus

We see BoJ standing pat suggesting knee jerk JPY decline, but downside limited

FOMC will need to be dovish to justify market pricing, so USD risks on the upside

CAD may benefit most if Fed are dovish given positioning

The BoJ meeting and the FOMC meeting are the main events for Wednesday, with the BoJ meeting having more potential to surprise. The market is pricing around a 55% chance of a 10bp rate hike form the BoJ, but that is at odds with the Reuters survey of economists in which 75% of respondents expected no change this month. However, with the BoJ having tended to surprise the market since Ueda took over, it’s close to a 50-50 call. We favour no change this month with the weakness of Japanese consumer spending likely discouraging the BoJ. They will in any case go ahead with plans to reduce JGB buying, which is expected to be scaled back by JPY1trn.

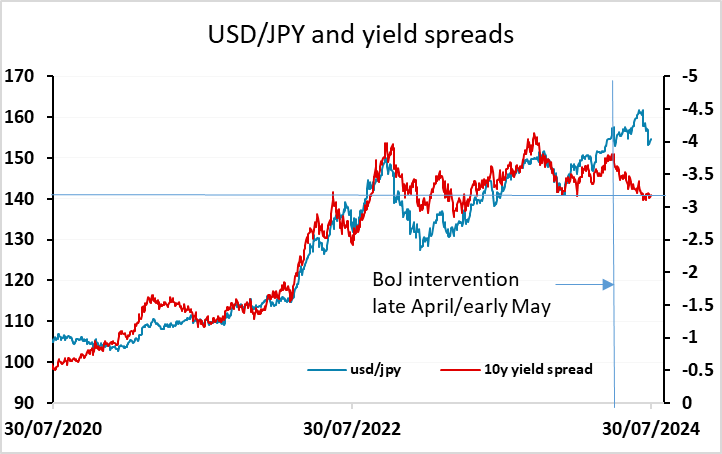

The JPY can be expected to weaken as a knee-jerk reaction to an announcement of unchanged policy, but we see JPY downside as still quite limited from here. Yield spreads already support further JPY gains against a range of currencies, and with the BoJ having demonstrated a willingness to intervene to oppose JPY weakness, with the intervention seemingly effective this month, it’s hard to see a resumption of significant JPY losses, and USD/JPY bounce to the high 155s might well be seen as a JPY buying opportunity. If the BoJ were to raise rates, it would likely have a bigger impact, as a break of the technical support area at 152-153 could trigger some more substantial losses. This is perhaps a reason for the BoJ to hold off, as they would likely prefer to see gradual rather than rapid JPY gains.

The FOMC also meets on July 31 and while a change in rates remains unlikely the FOMC is likely to signal that easing is possible if data before the next meeting on September 18 provides further evidence of falling inflationary pressure. This will see changes to the wording of the statement, but Chairman Jerome Powell will stress that any easing will be data-dependent. This is problematic for the market which is already more than fully pricing in a 25bp rate cut in September, suggesting that a 25bp cut is seen as a near certainty while a 50bp cut is a possibility. The statement will need to be quite dovish to justify this pricing, so the risks may be towards a USD rally on the news.

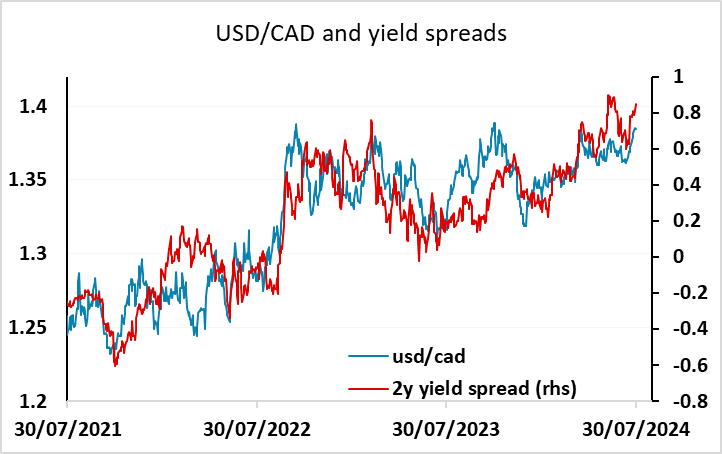

The central bank meetings are the main focus, but there is also plenty of data scheduled. Australian Q2 CPI, Eurozone preliminary CPI for July, the ADP employment report and Canadian May GDP data are all due. However, in practice, it seems unlikely that any of this will have a lot of impact ahead of the FOMC meeting. The CAD may be the currency with the most potential to move, as the CFTC data shows record speculative net short positioning in the futures market. Strong data and a dovish FOMC statement could trigger a sharp CAD recovery.