Argentina: Tentative Shock Plan Announced

Argentina's Economic Minister, Luis Caputo, reveals pivotal economic reforms to tackle the nation's fiscal deficit. Key measures include currency devaluation, subsidy cuts, and ministry reduction. While aiming for a zero deficit, skepticism lingers, especially with unaddressed pension issues. The plan's short-term impact is contractionary, yet vital for Argentina's twin deficits. The government's relationship with Congress adds uncertainty to its execution. A 1.5-2.0% deficit reduction is anticipated, with keen interest in Milei's financing strategy.

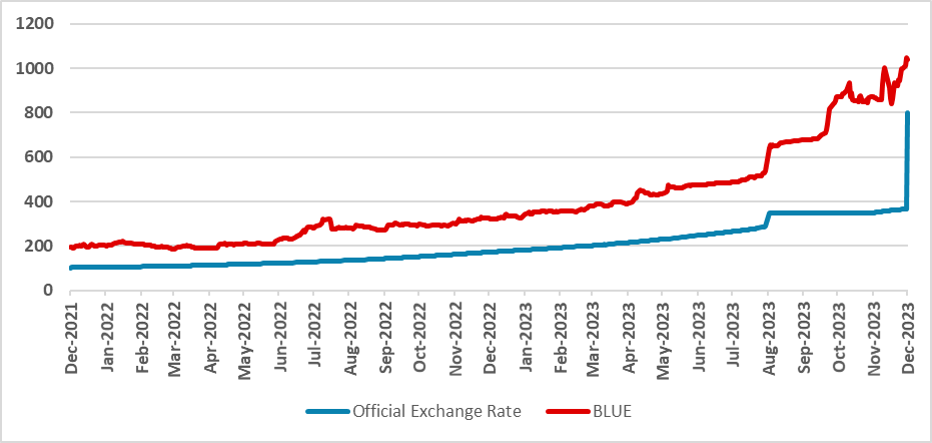

Figure 1: Argentina Exchange Rate (ARS/USD)

Source: Refinitiv and MEF

Argentina's new Economic Minister, Luis Caputo, has unveiled the initial economic measures under Javier Milei's administration, focusing on addressing the root cause of Argentina's economic woes—the fiscal deficit. In a 16-minute video, Caputo outlined the following measures:

- Devalue the official exchange rate to 800 ARS/USD from 366 ARS/USD.

- Suspend the commencement of public construction projects for which contracts have not yet been finalized.

- Reduce public subsidies for energy and transport.

- Do not renew contracts for public employees with a duration of less than 1 year.

- Reduce federal transfers to provinces.

- Cut down the number of Ministries from 18 to 9.

- Increase export and import tariffs.

- Raise targeted social benefits by 50%.

With these changes, the government aims to decrease government expenditures by 2.9% and increase government revenues by 2.2%, collectively achieving a zero fiscal deficit. However, we remain skeptical that these measures will be sufficient to eliminate the deficit entirely. It's worth noting that the plan did not address reducing pensions, a significant component of Argentina's federal budget.

Solving the root of Argentina's macro imbalance involves reducing the fiscal deficit to zero, preventing the Central Bank from issuing new Pesos to finance it. The devaluation of the Pesos aims to unify the official exchange rate with the current black market rate (BLUE) of 990 ARS/USD. Despite this, the multiple exchange rates system and taxes for citizens to access US dollars will persist, and certain restrictions will be necessary due to the Central Bank's lack of dollars constraining further flexibility.

The short-term impact of the plan is expected to be contractionary and inflationary. However, reducing the fiscal deficit and adjusting the official exchange rate are deemed essential to address Argentina's twin deficits. The unpopular reduction of subsidies to transport and energy, particularly affecting the poorest, is strategically timed at the beginning of the government when the President's popularity is high.

The government's relationship with Congress remains uncertain. While some measures can be implemented through executive orders, others will require congressional approval. We anticipate the fiscal deficit will likely be reduced to around 1.5-2.0%, and it will be intriguing to observe how the Milei administration plans to finance this adjustment.