USD, JPY, AUD flows: USD firmer overnight, JPY dips on Ueda, AUD soft

USD firmer in Asia with commodity currencies weaker. JPY dips on Ueda but net impact modest. Rangy trading to persist

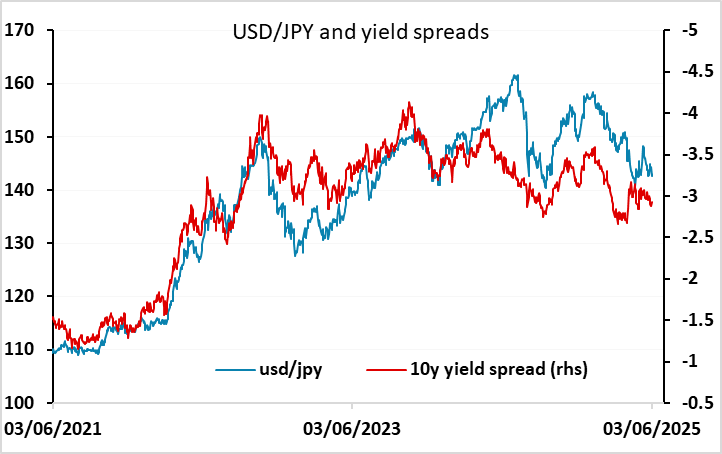

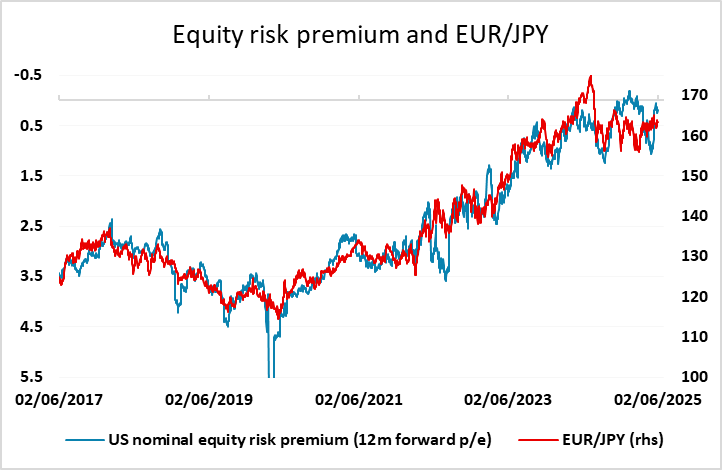

The overnight session has seen mildly risk negative trading, with the commodity currencies falling back against the USD, and the USD also made general gains in Asia, reversing the losses seen in the US session. Then main overnight news was the Ueda comments which suggested no imminent easing from the BoJ and led to some initial JPY weakness. But the JPY was net not much changed from European closing levels, having gained ground in US trading. In practice, BoJ policy is unlikely to be of much FX significance unless we see a generally more risk positive market tone. In any case, the market wasn’t pricing in much BoJ tightening this year before the Ueda comments, so there hasn’t been much impact on front end JPY yields, with the market still pricing 17bps of tightening this year. The major determinant of moves in the JPY is still likely to be the risk tone in the market, with the JPY likely to see substantial gains if risk premia rise. Given the current low level of risk premia, and the concerns about US and global slowdown due to US tariffs (and other factors), the JPY risks still look heavily weighted to the upside.

For today, the data focus in Europe will be on the Eurozone CPI numbers, but we doubt there will be much market impact from these, with the preliminary national numbers already released. Developments on tariffs are still likely to be then main market driver, but in the absence of news on those, trading looks likely to be quite rangy. The JPY may see some mild weakness in response to the overnight Ueda comments, but we doubt this will go far. Softness in the commodity currencies against the USD shouldn’t extend significantly, with 0.64 on AUD/USD still looking like a strong buying area.